Stop settling for less! Download the Made 4 More app for listings you can actually trust.

The core of the housing market is driven by private lenders, agents, and local title companies, all of whom keep working. The delays pop up where federal agencies touch the transaction. When the government partially shuts down, some federal offices scale back or furlough staff, creating immediate bottlenecks in specific areas of the closing process.

The Three Main Points of Friction

When it comes to real estate, the pain is concentrated in a few predictable spots:

- Government-Backed Loans Slow Down (or Stop): Loans from the FHA, VA, and USDA account for about one-quarter of all mortgage applications.

- FHA & VA: They typically continue to process and guarantee loans, but with severely reduced staffing. This means slower case number assignments, slower underwriting reviews, and longer processing times. It's like trying to get through the security checkpoint with only one lane open.

- USDA Loans: These are often the hardest hit, as the USDA often halts the issuance of new direct and guaranteed home loans entirely during a shutdown, forcing those closings to pause indefinitely.

- Verification Bottlenecks: Most loans, including conventional ones, rely on federal agencies for final verification. For instance, lenders often need the IRS to process tax transcripts (Form 4506-T) to verify a borrower's income. If the IRS is closed, that key piece of paperwork can stop a final loan approval cold.

- Flood Insurance Approval Pauses: If a property is in a flood zone, the lender requires flood insurance. A lapse in funding can affect the National Flood Insurance Program (NFIP), halting the issuance of new policies and policy renewals. Without this mandatory insurance, the lender cannot legally close the loan, stalling thousands of deals, especially in coastal or rural flood-prone regions.

The Historical Rebound: Why Delays Are Just a Blip

This isn't our first time at the shutdown rodeo, and history gives us a solid blueprint for what to expect.

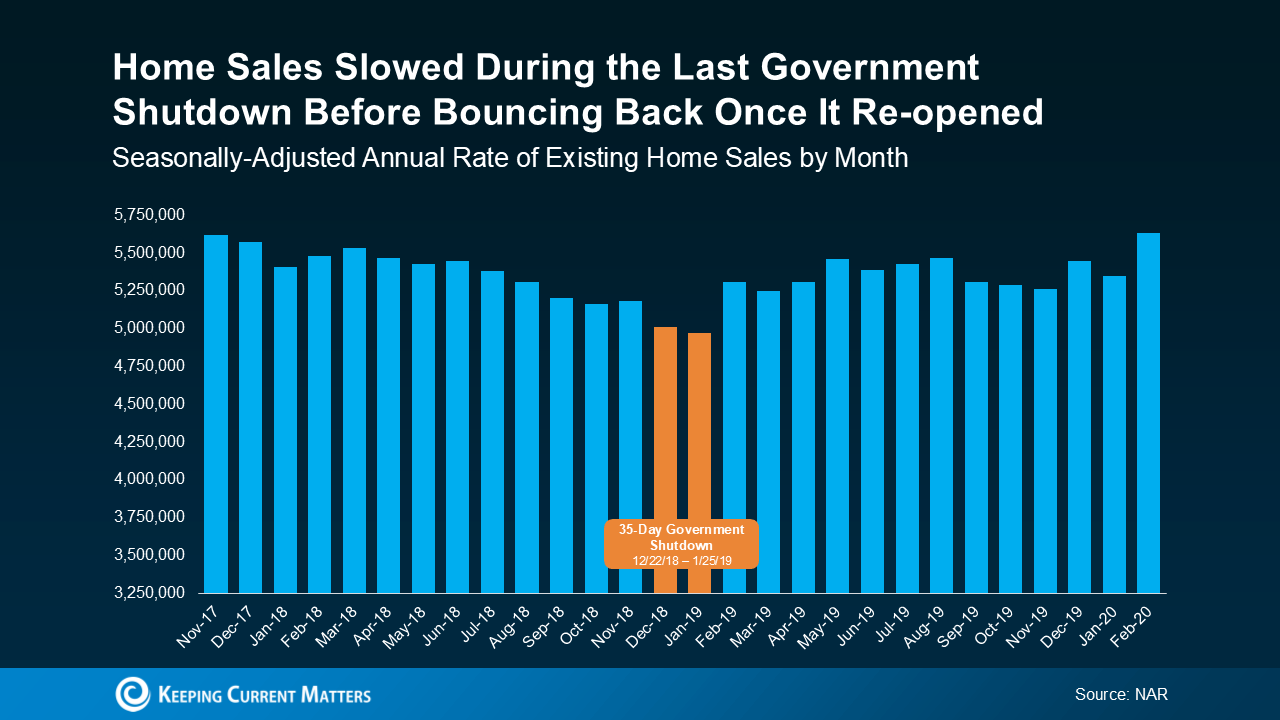

If you look back at past government shutdowns—like the one that lasted 35 days near the end of 2018—sales activity did dip. But here’s the crucial takeaway: it was a short-term dip, followed by a swift rebound. As soon as the government reopened and furloughed staff returned, the built-up backlog of delayed closings rushed through the system, and sales numbers quickly shot back up.

As Jeff Ostrowski, a Housing Market Analyst at Bankrate, explains, "I think for most people, it’s probably going to be a blip more than a real deal killer." The market hits a temporary pause, but it doesn't break.

Turning Uncertainty into Your Opportunity

While a potential delay is stressful if you're under contract, a period of government uncertainty can actually work in your favor if you're just starting your journey:

- For the Buyer: Some buyers become nervous, hit the pause button, or struggle with the loan delays mentioned above. This temporary caution reduces market competition. A well-prepared buyer (especially one using a conventional loan) may suddenly find a small window of opportunity to negotiate a better deal or face fewer bidding wars than they would have otherwise.

- For the Seller: If you are ready to list, an agent who understands how to mitigate these risks can position your home as the "sure thing." Sellers who can offer to use a conventional loan buyer or who are ready to negotiate minor repairs will have a significant advantage over those who are unprepared and panic.

The key is not to panic and wait, but to be the most prepared player in the market.

Bottom Line: Don't Let Fear Cause Paralysis

A government shutdown will not derail the housing market, but it will create short-term hurdles for deals that rely heavily on federal processes. The last time this happened, sales rebounded almost immediately when the government reopened.

The moral of the story? Be prepared, stay informed, and make sure your agent has a "shutdown contingency" plan for every part of your deal. Don't let political uncertainty sideline your personal goals.