Download the Made 4 More app for the most accurate listings—your info stays private. Shop smarter, find the best deals, and start your home journey with confidence today!

If you’ve been hoping for mortgage rates to take a breather, good news—your wish might be coming true. 🏡✨ Rates have already started easing up, and experts say the trend could continue into next year. But what’s behind the shift, and how low could they really go? Let’s break it down in plain English.

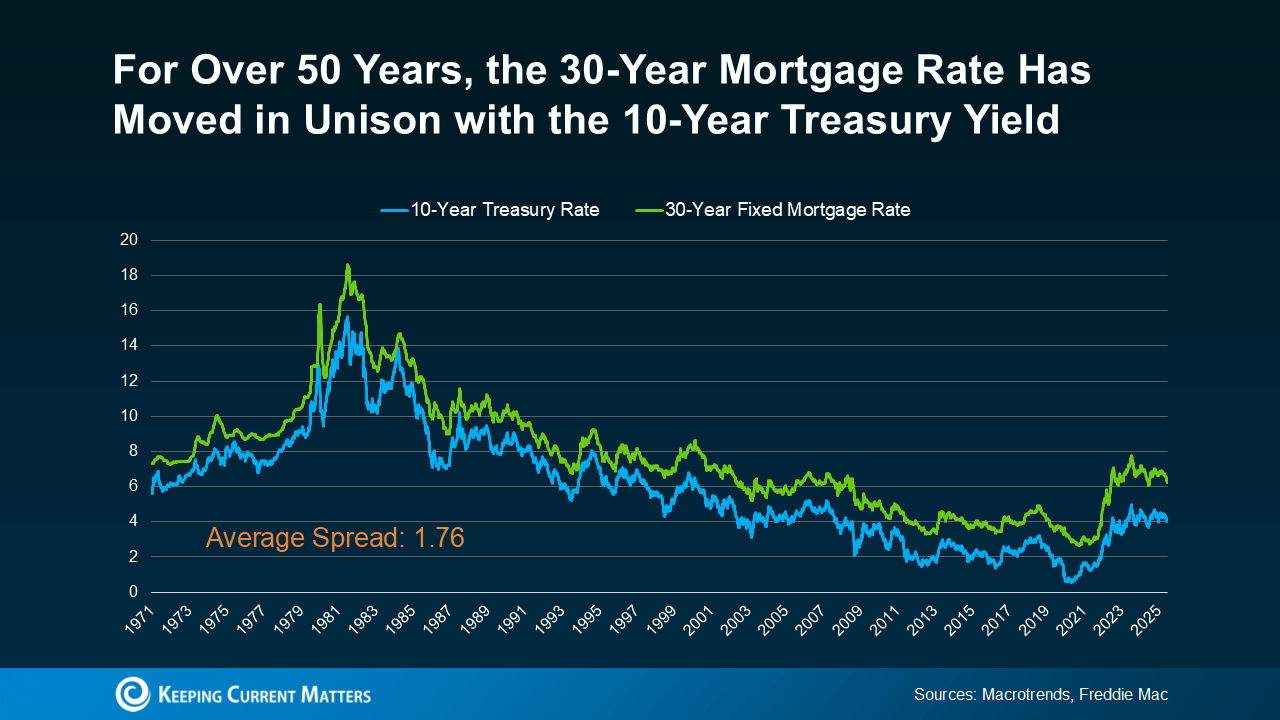

The Secret Link Between Mortgage Rates and the 10-Year Treasury Yield

Here’s the deal: for over 50 years, mortgage rates have moved almost in sync with the 10-year Treasury yield—a key benchmark that reflects investor confidence in the economy. When the yield rises, mortgage rates tend to follow suit. When it falls, so do mortgage rates.

That connection is so consistent that experts even track the spread between them—basically, the difference in percentage points. Historically, that spread sits around 1.76%, give or take.

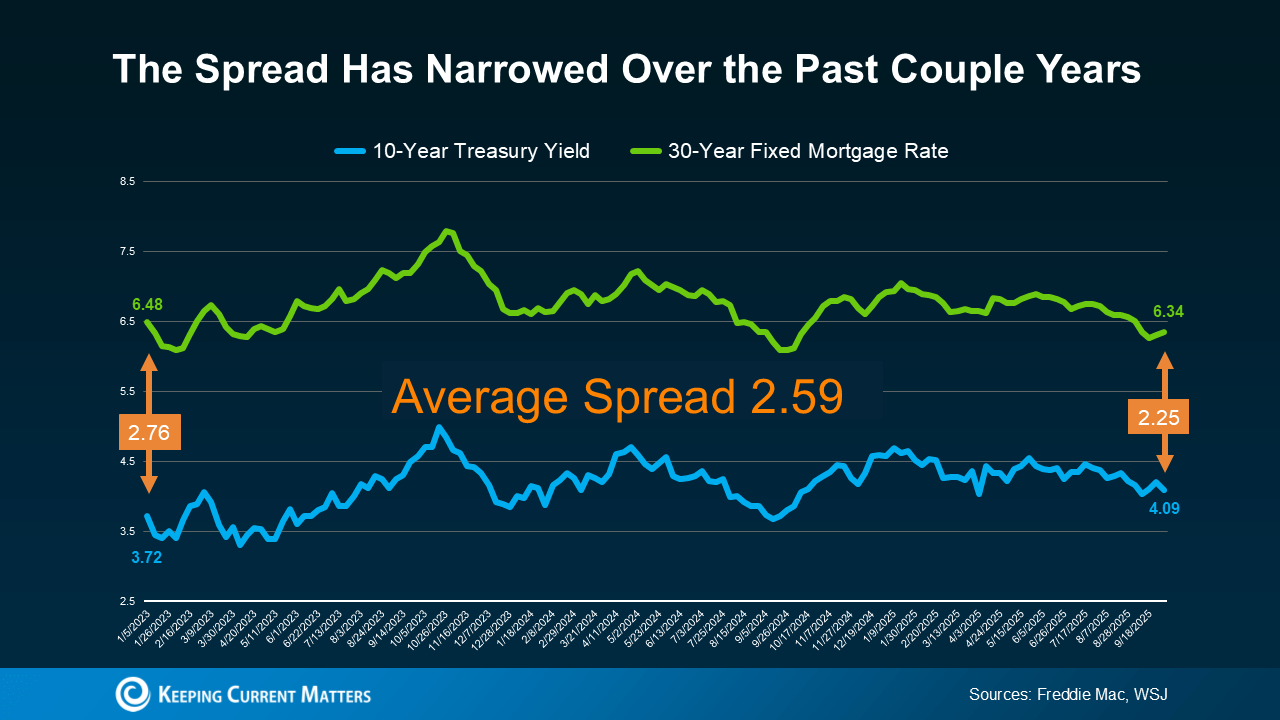

The Spread Is Finally Shrinking (And That’s a Good Thing)

Over the past couple of years, that gap ballooned beyond normal levels. Why? Uncertainty. Think of the spread like a “fear gauge” for the market—when investors are uneasy about the economy, they demand higher returns, pushing mortgage rates up.

But here’s the exciting part: as confidence improves, the spread starts to shrink. 📉 That’s exactly what’s happening right now. Experts say as this fear factor eases, mortgage rates have room to move even lower.

As Redfin recently put it:

“A lower mortgage spread equals lower mortgage rates. If the spread continues to decline, mortgage rates could fall more than they already have.”

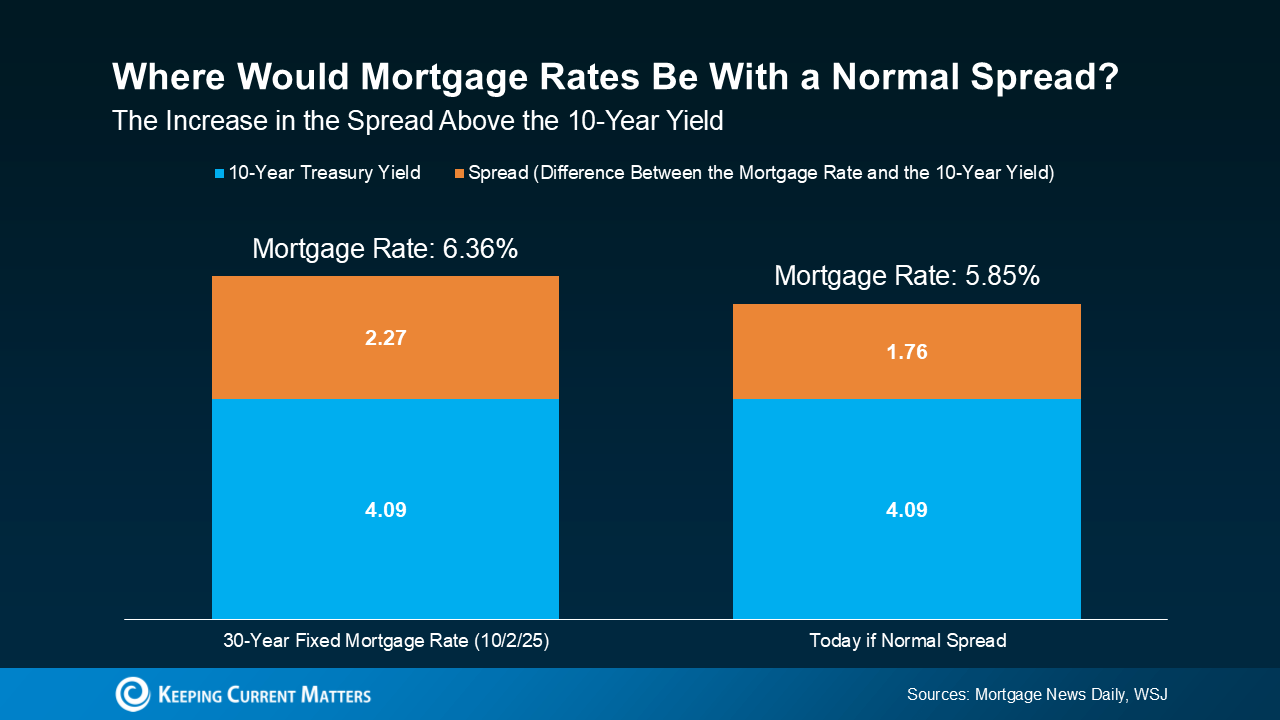

The 10-Year Treasury Yield Is Expected To Drop Too

It’s not just the spread that’s shifting—the 10-year Treasury yield itself is expected to decline in the months ahead. When you combine both trends (a narrowing spread and a falling yield), you get a powerful recipe for lower mortgage rates.

At the time of writing, the 10-year yield sits around 4.09%. Add the normal spread of 1.76%, and you’re looking at mortgage rates around 5.85%—which would be a game-changer for buyers and sellers alike. 🙌

Of course, the economy, job market, and inflation will all play their part—but the big picture shows encouraging signs of easing rates heading into 2026.

What This Means for You

If you’ve been holding off buying or selling because of high mortgage rates, now’s the time to pay attention. As the market stabilizes, those who act early will have the upper hand—whether it’s locking in a lower rate, finding the right property, or getting top dollar for your home before competition heats up again.

Bottom Line

Mortgage rates are finally moving in the right direction, and all signs point to a continued cooldown. But the market moves fast—and staying informed is key. That’s where working with an experienced real estate pro makes all the difference.

📞 Call or text us at 855-935-MORE to connect with a Made 4 More Realty agent who can help you make your next move with confidence.