Your dream home shouldn't come with hidden fees or sold data. Download the Made 4 More app!

If you’ve seen the headlines about home prices dipping, you might be wondering — “What does that mean for the value of my home?” Don’t stress. Even with a little market cooling, most homeowners are still sitting in a very strong position. Why? Because of the incredible home equity you’ve built over the last few years.

Your Equity Still Works in Your Favor

Home equity tends to move hand-in-hand with home prices. When prices soar, equity grows fast. When prices settle down, equity growth slows — but doesn’t disappear.

Think back to 2020 and 2021 when housing inventory hit record lows. Bidding wars were everywhere, and prices skyrocketed. That wave of appreciation massively boosted homeowner equity across the country.

Now, as more homes have hit the market, price growth has cooled slightly. But that doesn’t mean you’ve lost ground — it just means the market’s catching its breath.

You’re Still Way Ahead of the Game

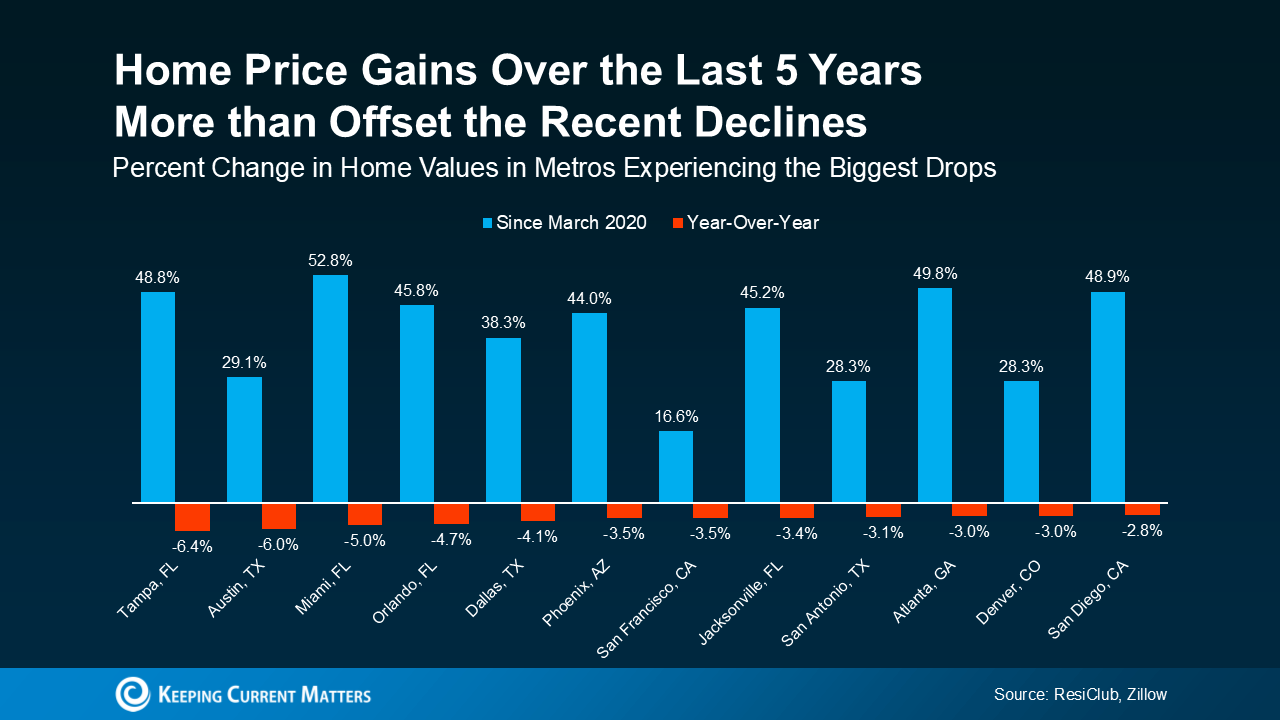

Let’s put this into perspective. According to Zillow, home prices nationwide have climbed over 45% since March 2020. Even if your area saw a small dip — say 3% or 4% — your net gain is still enormous.

In plain terms: a minor price drop isn’t wiping out years of growth. Homeowners who’ve owned for even a few years are still way ahead, with thousands in equity gains that weren’t even possible before the pandemic.

Every single U.S. state has seen price increases over the past five years, according to data from the Federal Housing Finance Agency (FHFA). That means your investment is still working hard for you — whether you’re thinking about upsizing, downsizing, or just staying put and building wealth.

No, the Sky Isn’t Falling

Worried that prices could crash and take your equity with them? Experts say that’s highly unlikely. As Jake Krimmel, Senior Economist at Realtor.com, explains:

“The slight recent declines in aggregate value and total home equity are not cause for concern… Large price declines nationally are extremely unlikely in the near term.”

Translation: this is a market correction, not a collapse. The market’s balancing after years of unsustainable growth, and that’s a healthy thing.

Bottom Line

Even with today’s moderation, homeowners are still sitting on near record equity levels — and that’s real financial power. You’ve worked hard to build it, so make it work for you!