📲 Don’t let outdated info or hidden fees keep you stuck renting! Download the Made 4 More app for the most accurate, hassle-free home listings—no data selling, just real deals. Start your path to ownership with confidence today!

Let’s be real: with mortgage rates still sky-high and home prices refusing to budge, you might be asking yourself, “Is now even the right time to buy?”

Totally fair question. Renting can feel like the safer, simpler choice right now—heck, it might even be the only choice you feel you have. But before you resign yourself to another year of rent hikes and landlord drama, let’s talk about what renting really costs you.

Spoiler alert: It’s not just the rent check.

Rent Feels Easier Now… But Hurts Later

Renting seems like the low-stress option—no maintenance headaches, no 30-year commitment, maybe even lower monthly payments than buying in your area. But there’s a catch.

You’re building nothing.

Every rent check you write? That money’s gone. No equity. No return. You’re literally helping your landlord build their wealth—while you’re stuck at square one.

That’s why 70% of would-be buyers say they’re stressed about what renting means for their future, according to a Bank of America survey. And they’re not wrong to worry.

Owning a Home = Building Real Wealth

Here’s the truth: homeownership is one of the most powerful wealth-building tools out there.

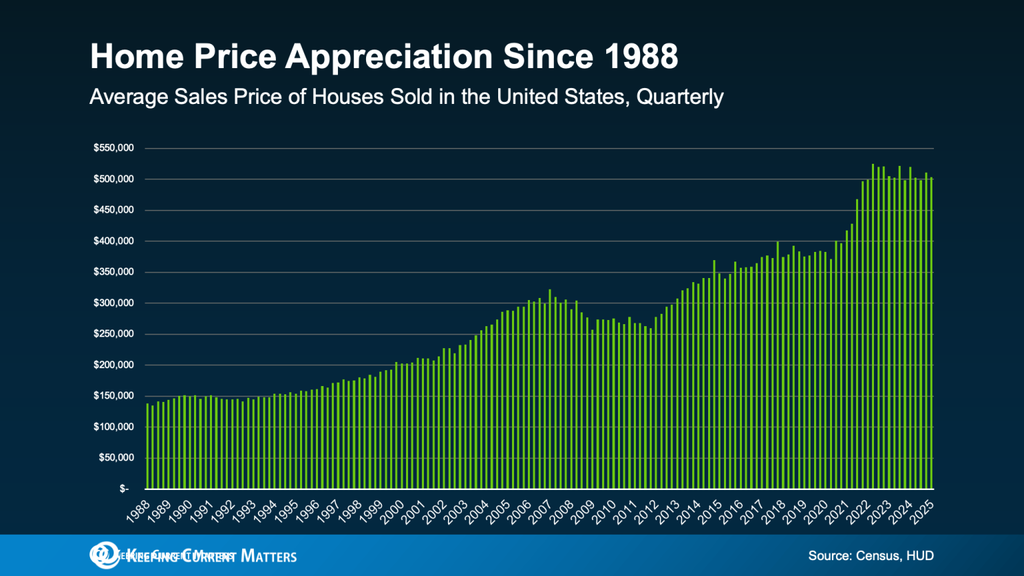

Why? Because home values generally go up over time. So the longer you wait, the more you’ll likely pay when you’re finally ready to buy.

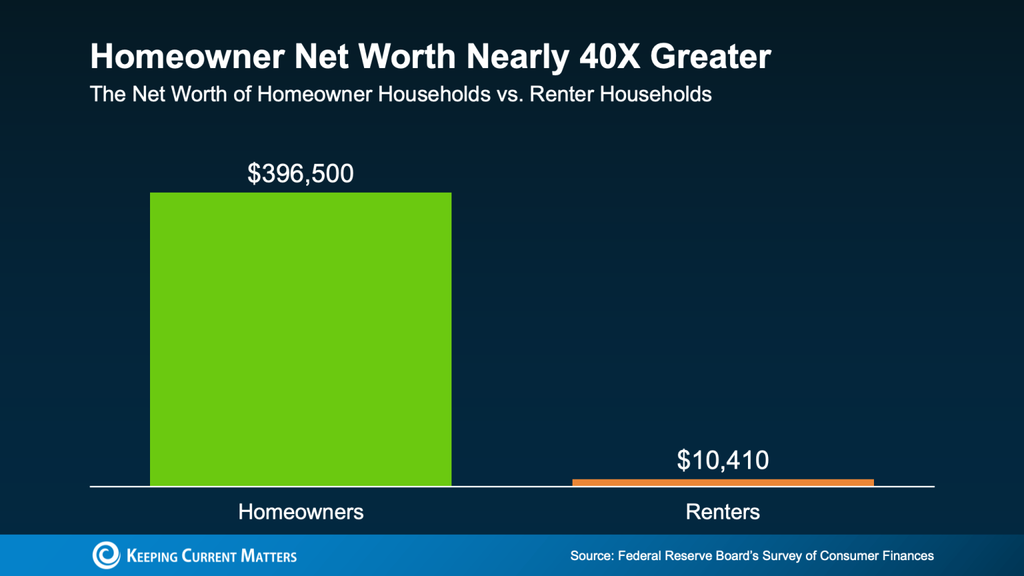

And while you’re waiting and renting, homeowners are quietly stacking equity every time they make a mortgage payment. That equity becomes part of their net worth. In fact, the average homeowner’s net worth is nearly 40 times higher than that of a renter. That’s not just a gap—that’s a canyon.

Rent Prices Are Going One Direction: Up

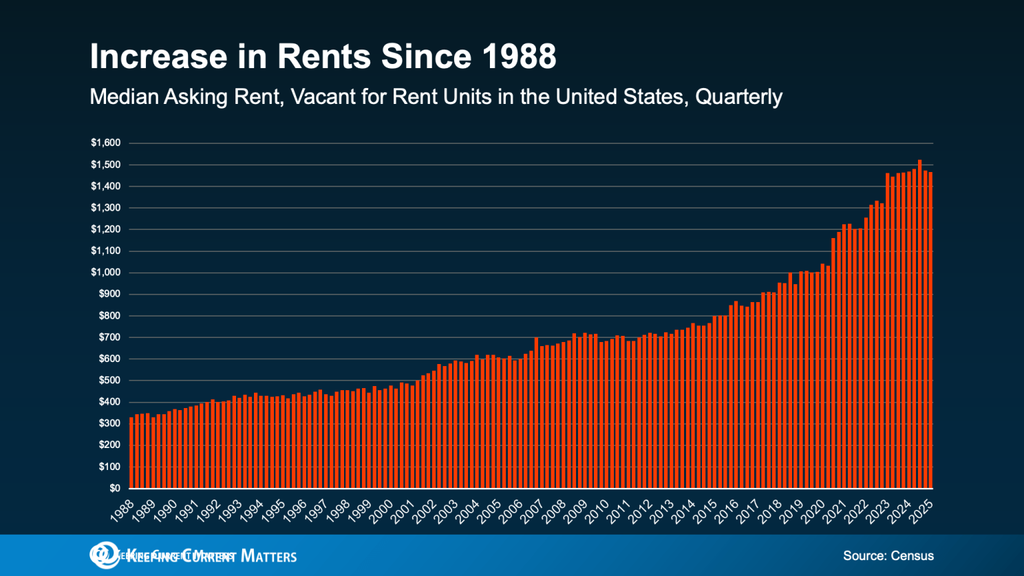

Sure, rent might feel steady now. But zoom out, and you’ll see a clear trend: rent has climbed consistently for decades. And guess what? It’s not slowing down.

Meanwhile, renters are scrambling to save while their monthly costs rise. That financial pressure is real. According to that same Bank of America survey, 72% of renters worry that rising rents will seriously impact their long-term finances.

Let’s face it—when your rent keeps climbing, saving for a home gets even harder.

Let’s face it—when your rent keeps climbing, saving for a home gets even harder.

Rent or Own… You’re Still Paying a Mortgage

This one might sting a little: whether you rent or buy, you’re paying a mortgage. The only difference is whose.

So ask yourself: Are you paying your landlord’s mortgage… or your own?

Renting Feels Safer Now. Buying Sets You Up for the Future.

We’re not saying buying is easy. It takes planning, patience, and a solid financial foundation. But what you get in return? Long-term security, growing equity, and a place that’s truly yours.

Renting might feel like floating on a raft—you’re drifting along just fine… until the tide pulls you under. Buying a home? That’s like building your own ship. Sure, it takes effort. But once you set sail, you’re in control of your destination.

As Joel Berner from Realtor.com puts it:

“Renting might be easier short-term, but only buying helps you build equity and generational wealth in the long run.”

Make a Plan—Don’t Stay Stuck

If homeownership feels out of reach today, you’re not alone. But the best way to break the renting cycle? Start with a plan. A clear path. And the right support to get you there.

Call or text us at 855-935-MORE and let’s talk about your goals. Whether you’re buying in 6 months or 2 years, we’ll help you map it out—step by step.