Download the Made 4 More app for the most accurate, up-to-date listings—without your personal info being sold. Stay informed, spot real opportunities, and find your next home with confidence. Get started today!

If you’ve scrolled through social media lately, you’ve probably seen a lot of people blaming “big investors” for today’s high home prices. It’s an easy theory to believe — the idea that massive corporations are buying up all the homes, leaving regular buyers priced out. But here’s the truth: the numbers don’t back that up.

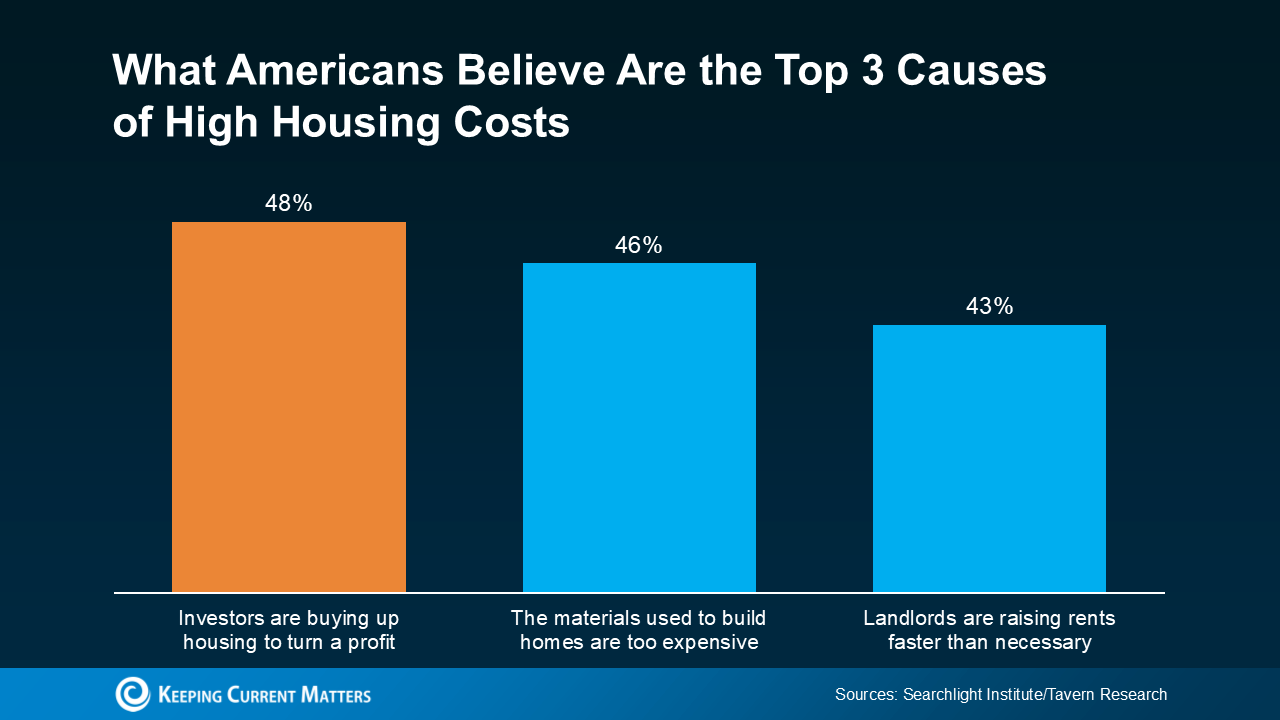

Even though the data proves otherwise, nearly half of Americans (48%) still believe that investors are the main reason homes feel so expensive (see graph below):

The Truth About Investors (It’s Not What You Think)

Yes, investors play a role in real estate — especially in some cities — but they’re not controlling the entire market. According to Realtor.com, only 2.8% of all home purchases last year were made by large investors (those owning more than 50 properties). That means a whopping 97% of homes were bought by regular people — families, first-time buyers, and everyday homeowners.

As Danielle Hale, Chief Economist at Realtor.com, puts it:

“Investors do own significant shares of the housing stock in some neighborhoods, but nationwide, the share of investor-owned housing is not a major concern.”

So if it’s not investors driving up prices… what is?

The Real Reason Homes Cost So Much

The short answer? There just aren’t enough homes to go around.

Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), says it best:

“The fundamental driver of housing costs is the shortage itself—it’s driven by the fact that there’s a mismatch between the number of households and the actual size of the housing stock.”

Think of it like supply and demand 101: too many buyers and not enough homes means prices rise. Builders have been playing catch-up for years, and while new construction is finally ramping up, we’re still far from balanced.

What This Means for Buyers and Sellers

If you’re a buyer, the good news is more homes are slowly hitting the market — which could mean a little less competition down the road.

If you’re a seller, you’re still in a great position. With limited inventory, a well-prepped home priced right can grab attention and sell quickly.

Either way, knowledge is your advantage. Knowing what’s really happening behind the headlines helps you make confident, informed moves — not emotional ones.

Bottom Line

It’s easy to believe investors are to blame for high home prices, but the truth is much simpler: we just need more homes. As new listings and construction continue to increase, the market will start to feel a bit more balanced — and a little less stressful.