Unlock the most accurate home listings with the Made 4 More app—no spam, no selling your info. Shop smart, find the best deals, and start your real estate journey with confidence today!

Let’s be real—homeownership isn’t what it used to be. Prices are up. Rates have bounced around. And for first-time buyers? It can feel like trying to climb Everest in flip-flops.

But if you’re a homeowner, you might be sitting on a secret weapon: your equity. And that equity could be the difference between your kid renting another year… or finally holding the keys to their first home.

Your Home Has Been Working for You—Now Let It Work for Them

If you’ve owned your home for a few years (or more), chances are, you’ve built up a serious chunk of equity—just by living in it. No side hustle. No crypto gamble. Just plain old appreciation.

In fact, according to Cotality (formerly CoreLogic), the average homeowner with a mortgage has over $311,000 in equity. That’s not pocket change—it’s life-changing money.

So, what if a slice of that equity could help your child finally break into the market?

Helping Your Kid Buy a Home Is More Common Than You Think

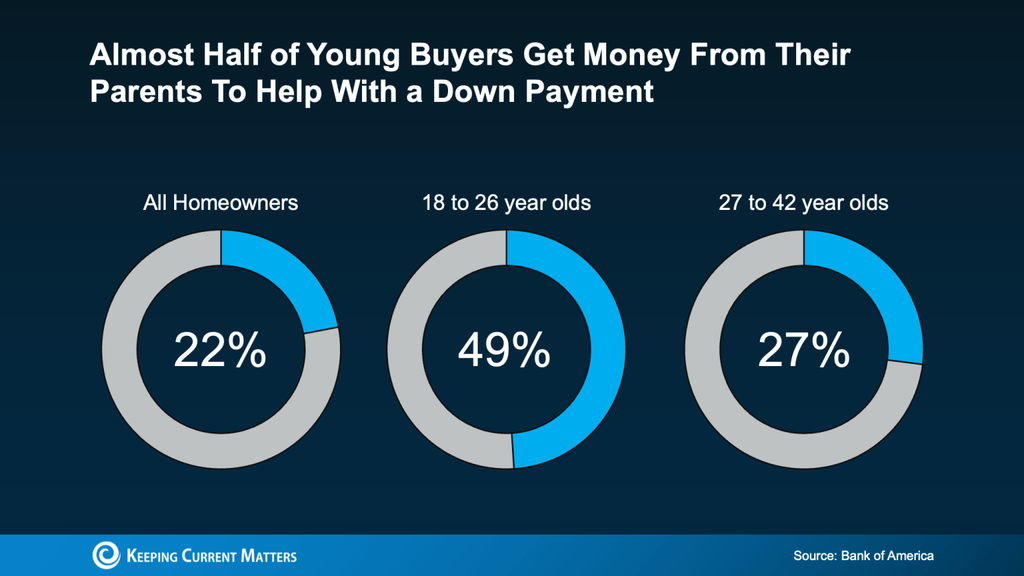

According to Bank of America, 49% of buyers aged 18–26 got help from their parents when making their down payment. That’s nearly half of Gen Z buyers leaning on family to make homeownership happen.

And here’s the kicker—45% of them said they couldn’t have done it without that help. Not wouldn’t. Couldn’t.

We’re not just talking about handing over cash. Many parents are tapping into the wealth tied up in their homes to support their kids. It’s smart, strategic, and deeply meaningful.

Equity Isn’t Just a Number—It’s a Head Start

Using your home equity to support your child’s purchase isn’t just about money. It’s about giving them the foundation to start building wealth early, avoid high-interest loans, and walk into their first home with confidence.

It’s the kind of gift that keeps giving—like passing down a ladder when they’re stuck at the bottom of the wall.

Not sure how to make it happen? That’s where we come in. We help families explore options—from cash-out refinancing to co-signing strategies—based on your comfort level and financial goals.

You Worked Hard for This Equity—Now Use It to Build a Legacy

This isn’t just about “helping out.” It’s about being the reason your kid says, “We got the house.”

It’s about turning years of homeownership into something that lasts beyond you—and gives your children a smoother, smarter path forward.

You don’t need a trust fund or a financial advisor to make it happen. You just need the right plan—and a team who gets it.

Let’s Talk About How You Can Put Your Equity to Work

If you’re curious about how to use your equity to help your child become a homeowner, let’s talk. We’ll walk you through the process, give you real answers (not just bank jargon), and help you map out your next steps.

Call or text us at 855-935-MORE and let’s build something lasting together.