Don’t let missing info or surprise fees stand between you and your VA loan dream home!

Download the Made 4 More app for the most accurate, Veteran-friendly listings—without your personal data being sold. Shop smarter, save more, and find your perfect home with confidence. Get started today!

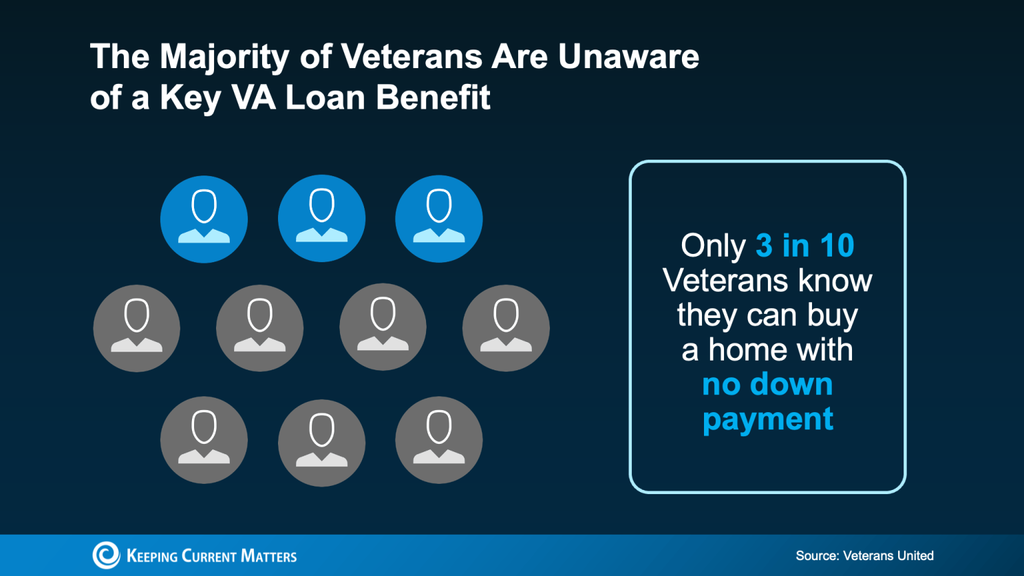

If you’re a Veteran or know someone who served, here’s a fact that might surprise you: most Veterans have no idea they could buy a home with zero down payment. Seriously—7 out of 10 Veterans aren’t aware of one of the most powerful tools they’ve earned through service: the VA home loan.

Let’s break it down—because this benefit isn’t just a “nice to have.” It can be the difference between renting forever and finally owning a place to call home.

Why VA Loans Are a Game-Changer for Veterans

For over 80 years, the VA loan program has helped millions of Veterans, active-duty service members, and their families achieve the dream of homeownership. But here’s what too many don’t realize: you don’t need a massive down payment—or even perfect credit—to make it happen.

According to Veterans United, VA loans offer:

- $0 down payment

- No private mortgage insurance (PMI)

- More flexible credit guidelines

- The lowest average fixed rates in the industry

That’s not just helpful—it’s life-changing. Especially in a housing market where saving tens of thousands for a down payment can feel impossible.

No Down Payment? Yep, Really.

The no-down-payment option is the crown jewel of the VA loan. While most buyers are scraping together 3–20% for a down payment, VA buyers can step right in without dropping a dime upfront. That’s more money in your pocket now, and more buying power when it counts.

Closing Costs? You’ll Pay Less

VA loans cap closing costs, so you’re not shelling out extra for unnecessary fees. Plus, sellers are even allowed to cover some of them, making your upfront expenses even lighter. That’s what we call a win-win.

No PMI = Lower Monthly Payments

Most buyers who put down less than 20% get hit with PMI (private mortgage insurance). Not Veterans. With a VA loan, you skip the PMI entirely, saving hundreds a month. That adds up fast—money you can use for furnishing your home, paying off debt, or just living life.

You’ve Earned This—Don’t Miss Out

You served your country. This benefit is part of the thank-you. Whether you’re just starting to think about buying or you’ve been told you “don’t qualify”—you owe it to yourself to look into your VA loan eligibility. The right real estate team and lender can help you every step of the way.

This Isn’t Just a Loan—It’s a Launchpad

If you’re a Veteran, don’t let a lack of information cost you the chance to build wealth through real estate. The VA loan isn’t a “nice perk”—it’s a powerful tool to plant roots, build equity, and finally stop renting.

Want to find out how it applies to you? Call or text us at 855-935-MORE and let’s walk through your options together.