Download the Made 4 More app for the most accurate, reliable listings. Search for your dream home with total confidence, knowing your information is safe and will never be sold. Get started now!

Let’s be honest, you’re watching the mortgage rates like a hawk, aren't you? You see them hovering just above 6% and you’re thinking, "Just wait for the 5s. That's when I'll jump in!" It makes total sense—who wouldn't want the best possible rate?

But here’s the harsh reality: that magic 5.99% rate might not be the golden ticket you think it is. Waiting for a small rate dip is a gamble that could cost you far more than you save. Today's market is quietly handing savvy buyers a major advantage, and you might be letting the biggest savings slip right through your fingers.

Surprise! You’ve Already Saved Hundreds

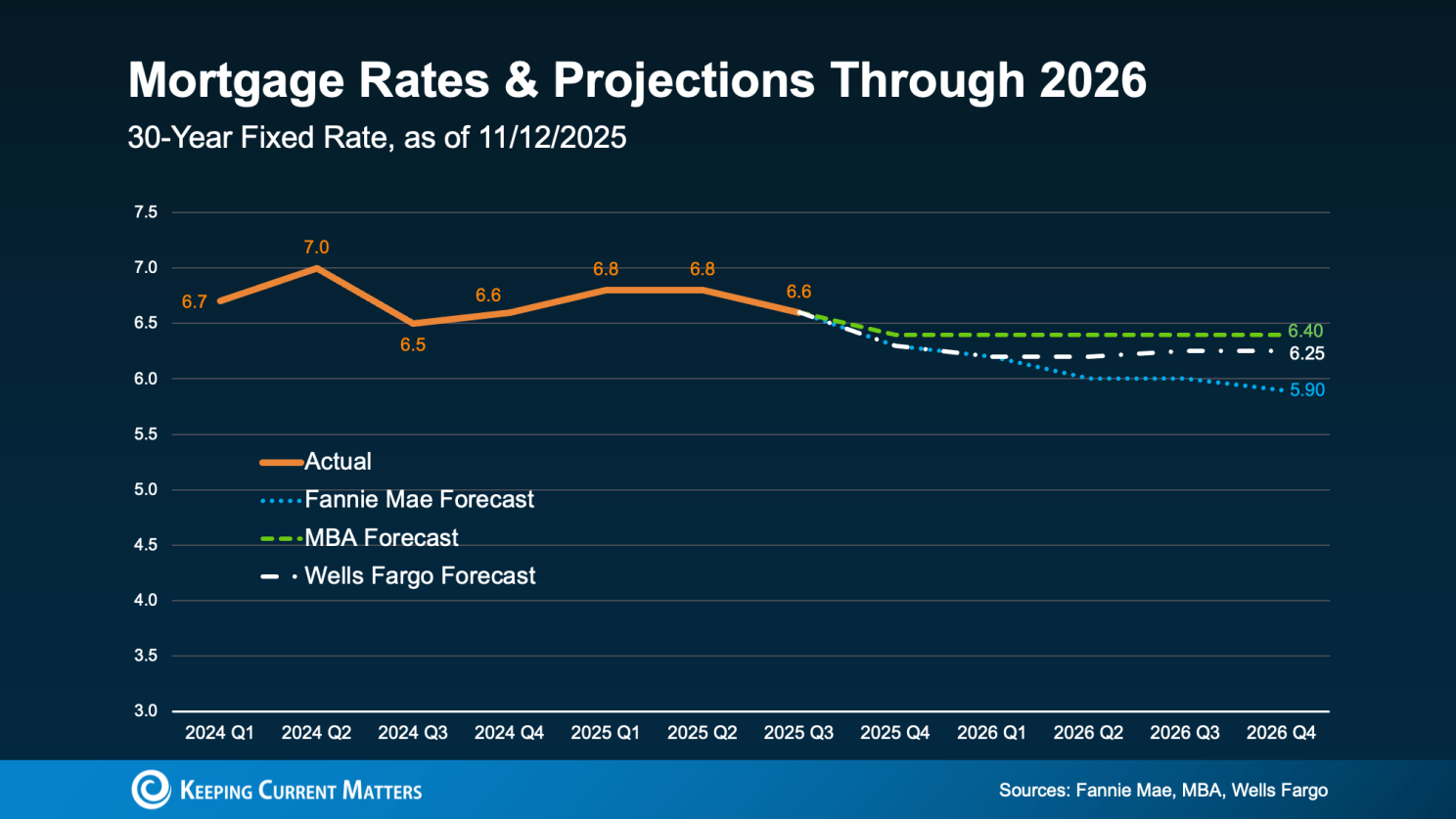

If you paused your home search earlier this year, you’ve already benefited from a huge win, even if you didn't realize it. Back in the spring, rates peaked above 7%. Since then, they've been easing down into the low 6s. That difference might sound small, but it translates into serious cash flow right now.

According to Redfin data, the typical monthly payment on a $400,000 home is already down almost $400 compared to those peak rates in May.

Think about that! If you buy today, you’re instantly saving hundreds of dollars every month compared to where the market was just a few months ago. That is real, tangible money that changes the affordability game for a lot of people. Now, should you hold out for even more? Let’s look at the numbers.

The Real Math Behind That Magic 5.99% Rate

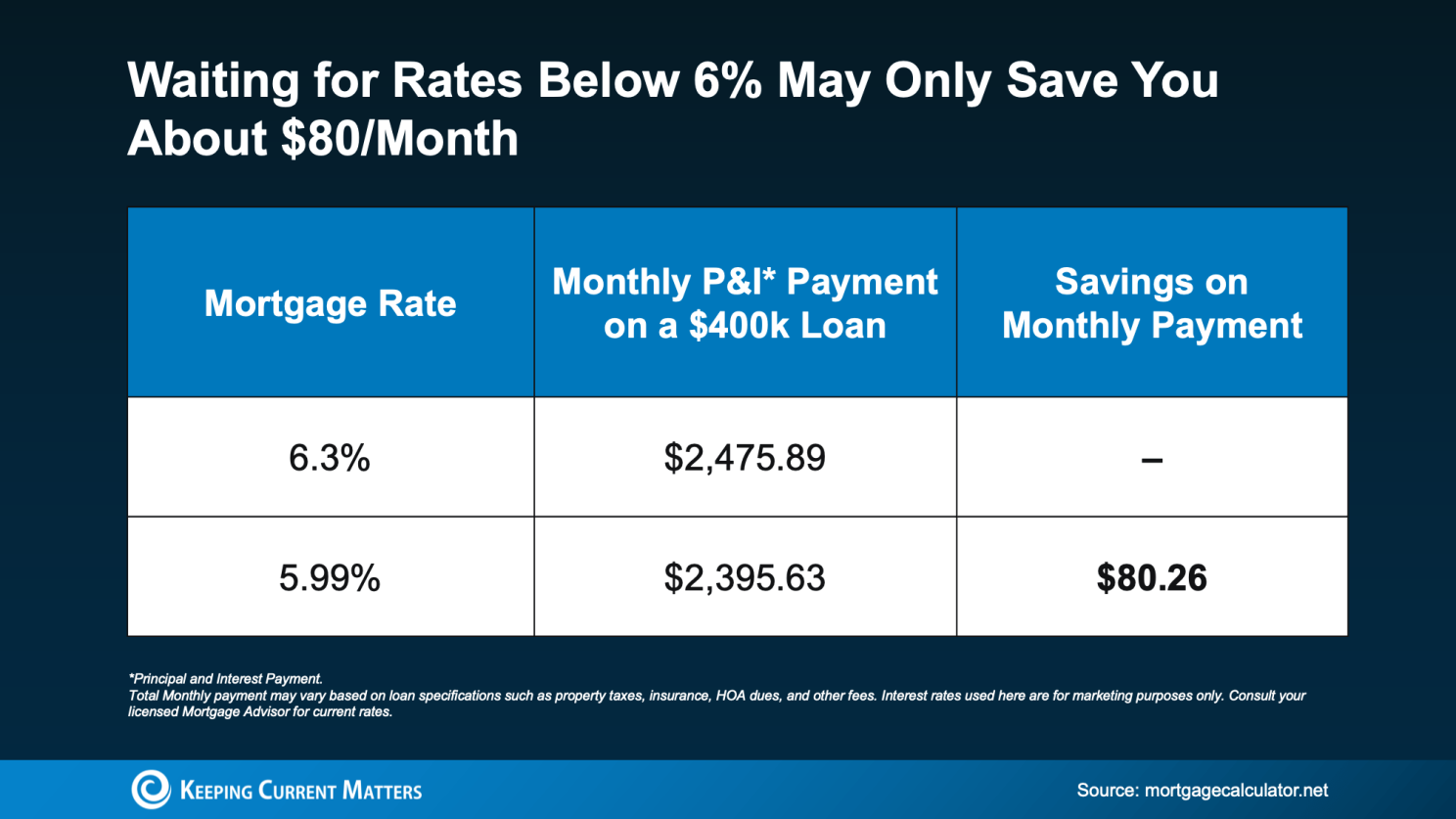

Most major experts are predicting that mortgage rates will remain right around where they are today throughout 2026. There's simply no guarantee that a significant drop is coming soon. But let's indulge the idea and say rates drop from the low 6s to that psychological tipping point of 5.99%.

How much extra cash are you actually holding out for?

The difference between where rates sit now and that 5.99% goal is only about $80 a month on an average-priced home.

Eighty dollars. That's one dinner out. That's a week of fancy coffees. Is that small, relatively minor savings—which might not even materialize—worth missing out on the biggest opportunity the market has offered this year? Probably not, because while you’re waiting for a few extra dollars, you're giving up your biggest advantage: leverage.

When Rates Fall, Competition Explodes

This is the central truth that should get every buyer moving right now: Your competition is watching the same rates you are.

Right now, you have fewer buyers to compete with. You have more homes to choose from. And most importantly, you have sellers ready to negotiate to get a deal done, whether that means price drops or concessions.

The moment rates sustainably drop below 6%, the game changes entirely. The National Association of Realtors (NAR) estimates that if rates hit 6%, roughly 5.5 million more households will be able to afford the median-priced home.

Even if only a small fraction of those people re-enter the market, you will see a massive influx of demand. That intense competition will erase your current negotiating leverage, drive prices higher, and potentially push the final sale price up enough to completely cancel out the $80 a month you waited for. You could win the battle on rate but lose the war on price!

Bottom Line: Don't Let $80 Hold You Back

You don’t have to wait for 5.99% to start saving money; the market has already delivered a nearly $400 monthly saving compared to the spring.

The smart move is to seize the current advantages—low competition and motivated sellers—and secure your home now. Ask yourself this fundamental question: Is an extra $80 a month worth gambling away your leverage, your current price, and your dream home?