Don’t let bad data or hidden fees cost you your dream home! Download the Made 4 More app for the most accurate listings—without your info being sold. Find the best deals with confidence. Get started today!

Buying a home is exciting. It’s also one of the biggest financial decisions you’ll ever make. And while most buyers focus on price, rate, and monthly payment, there’s one line item quietly creeping up that can throw off your budget if you’re not prepared: homeowner’s insurance.

Think of home insurance like the seatbelt for your biggest investment. You hope you never need it — but when you do, you’ll be glad it’s there. The catch? That protection is costing more than it used to.

Let’s break down what’s happening, why it matters to you, and how smart buyers are planning around it.

What Home Insurance Really Protects (And Why It Matters)

Home insurance isn’t just another bill — it’s your financial safety net. A solid policy can:

- Cover repairs or a full rebuild after fire, storms, or other covered disasters

- Protect your belongings like furniture, electronics, and personal items

- Provide liability coverage if someone gets hurt on your property

In short, it’s the shield around your home and your finances. Skimping here is like driving a Ferrari with bicycle brakes. Not a great idea.

Why Home Insurance Costs Are Rising

Here’s the simple truth: insurance companies are paying out more claims — and those claims cost more to fix.

What’s driving it?

- More frequent severe weather and natural disasters

- Higher construction and labor costs

- More expensive materials to rebuild or repair homes

When insurers pay more, premiums rise. It’s that simple.

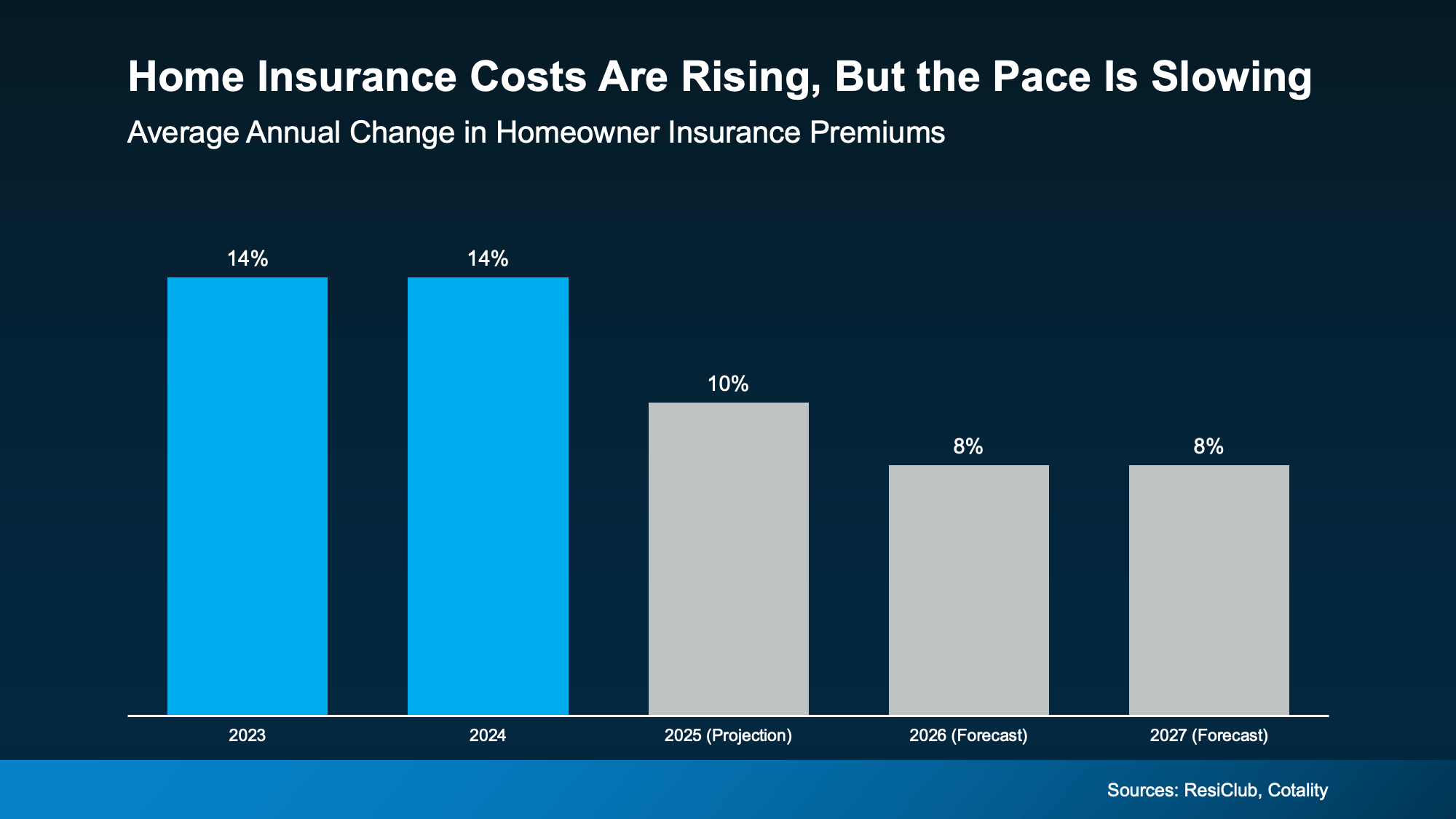

The good news? The pace of increases is starting to slow:

- 2023–2024: ~14% annual increases

- 2025: ~10%

- 2026–2027 (projected): ~8%

Still rising? Yes. But not as aggressively. That gives buyers more room to plan strategically.

Good News: Lower Mortgage Rates Can Help Offset Insurance Costs

Here’s where smart planning comes in.

As insurance and taxes rise, mortgage rates have been trending lower. That can help balance out higher insurance premiums. A better rate can free up monthly cash flow, helping absorb those added costs.

It’s not about one cost canceling another — it’s about layering the right strategies so your overall payment still works.

This is where having the right team matters.

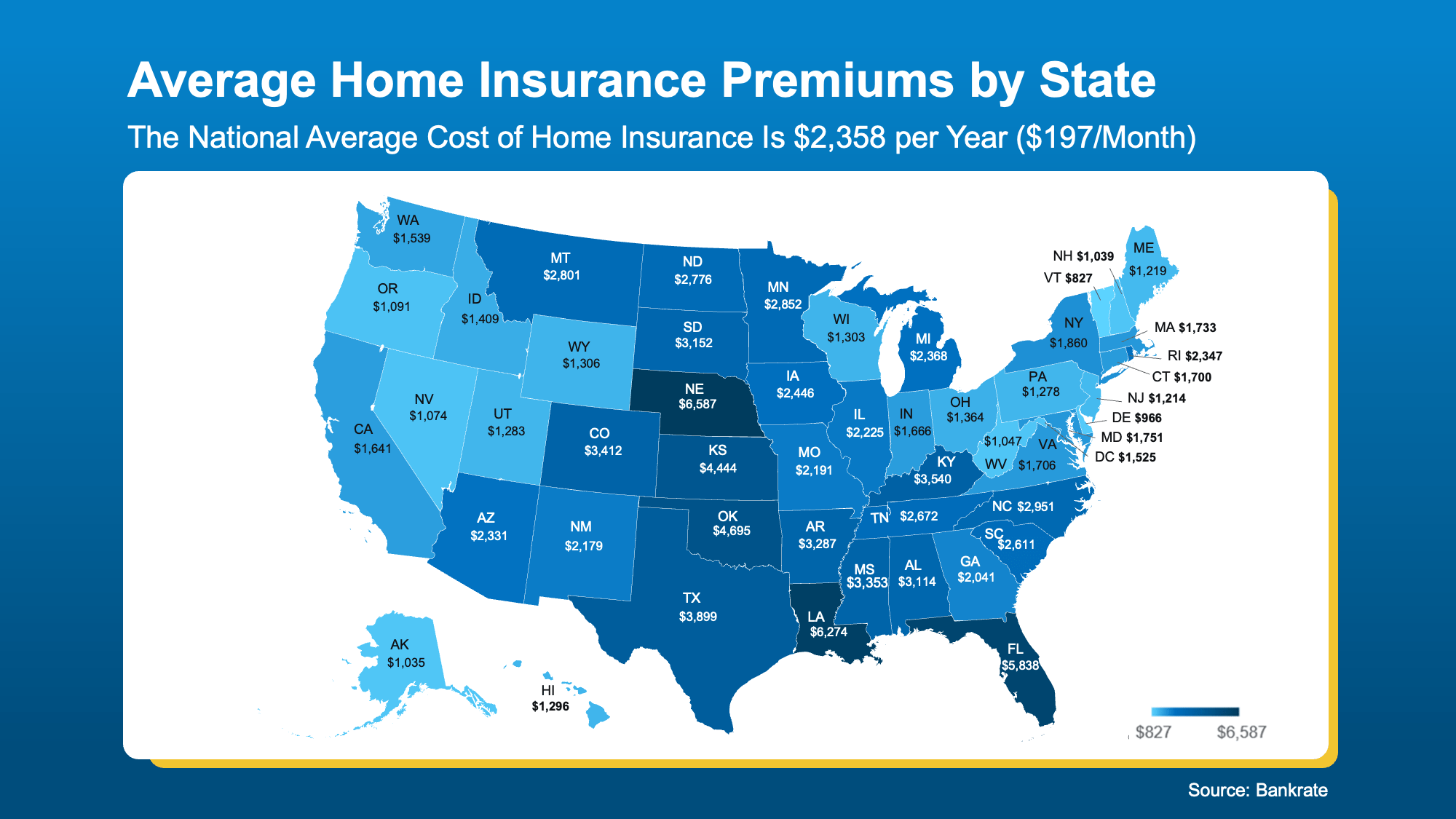

Insurance Costs Vary Big-Time by Location

Your premium isn’t just about your house — it’s about where you buy.

Factors that impact your rate:

- Local weather risks

- Fire and flood zones

- Home value and rebuild costs

- Regional labor and material pricing

Two similar homes in different cities can have very different insurance bills. That’s why local expertise is critical when you’re budgeting.

How Buyers Can Lower Their Home Insurance Costs

You can’t control the weather — but you can control how you shop for insurance. Smart buyers use these strategies:

- Shop around (don’t just accept the first quote)

- Bundle policies (home + auto = discounts)

- Ask about discounts you may qualify for

- Highlight upgrades like a new roof or storm windows

- Improve your credit for better rates

Small moves here can mean hundreds (or thousands) saved over time.

What This Means for Buyers Right Now

Home insurance is becoming a bigger piece of the affordability puzzle. The buyers who win aren’t the ones ignoring it — they’re the ones planning for it.

When you understand insurance costs upfront, you avoid surprises, protect your budget, and make smarter long-term decisions.

That’s how confident buyers stay in control — even in a changing market.

Bottom Line

Home insurance costs are rising — but they don’t have to derail your homeownership goals.

With smart planning, the right loan strategy, and a team that knows how to navigate today’s market, you can still move forward with confidence and clarity.

📞 Call or text us at 855-935-MORE to run the numbers, explore your options, and build a smarter home buying plan.