Don’t let bad data or hidden fees cost you your dream home! Download the Made 4 More app for the most accurate listings—without your info being sold. Find the best deals with confidence. Get started today!

For the first time in a long time, buyers finally have something they haven’t had much of lately: momentum.

If you’ve felt priced out, stuck on the sidelines, or just tired of running numbers that never quite worked, here’s some good news — buying a home is becoming more affordable. Not overnight. Not magically. But meaningfully.

Monthly payments are easing, pressure is loosening, and the math is finally starting to make sense again for more buyers.

Let’s break down what’s changing and why this could be your opening.

Buying a Home Is Becoming More Within Reach

For years, buying a home felt like trying to run uphill in sand. Prices climbed, rates spiked, and affordability stretched past what most households could comfortably handle.

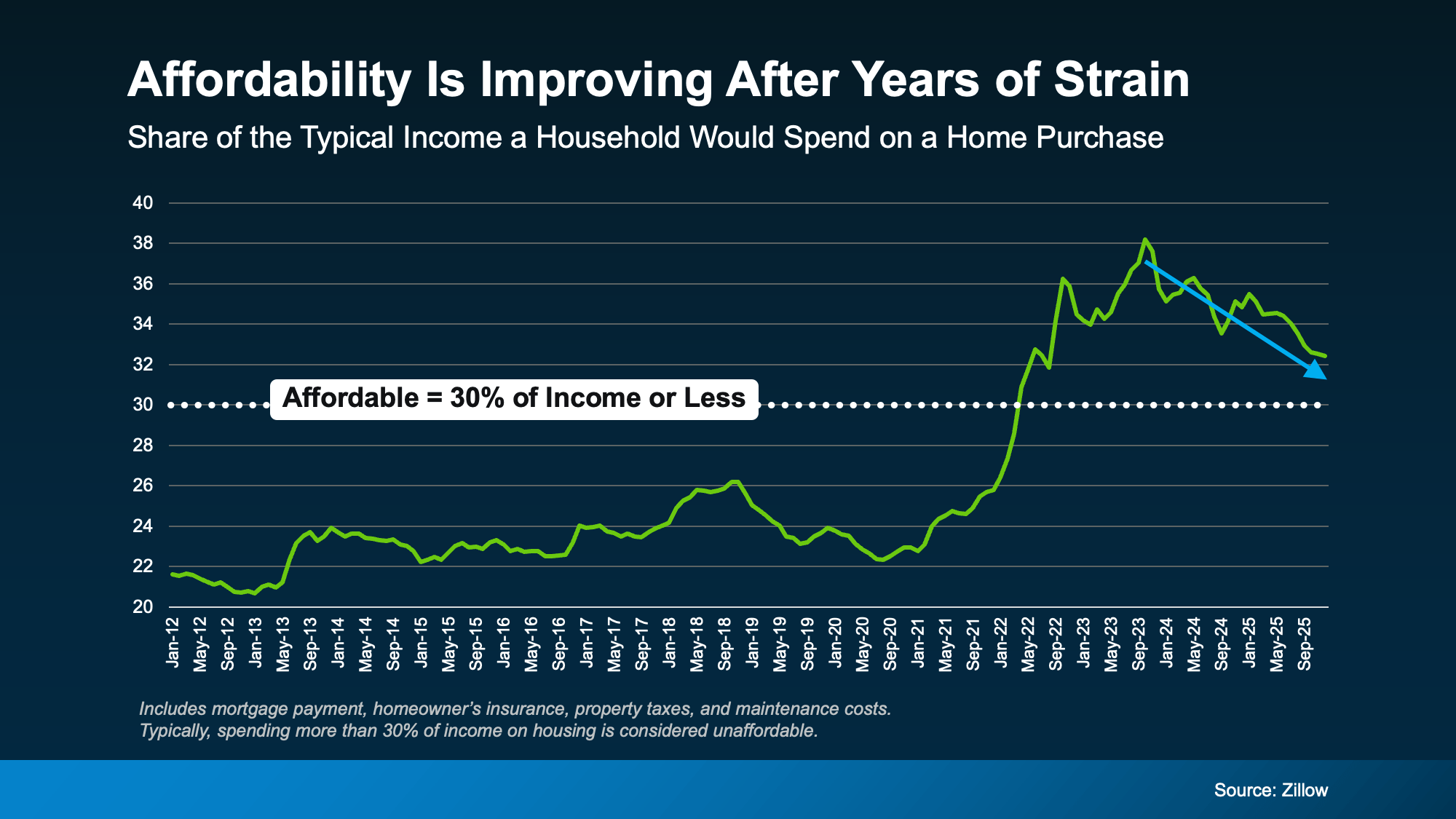

Housing is generally considered affordable when your total costs (mortgage, taxes, insurance, and basic upkeep) stay around 30% of your income. For a while, many buyers were way over that line.

Now? That gap is starting to shrink.

The share of income needed to buy a home is slowly coming down. We’re not fully back to “comfortable,” but we are officially back to “possible.” And after the last few years, that’s a big deal.

What’s Actually Making Homes More Affordable

This shift didn’t happen by accident. Three major forces are finally working in buyers’ favor:

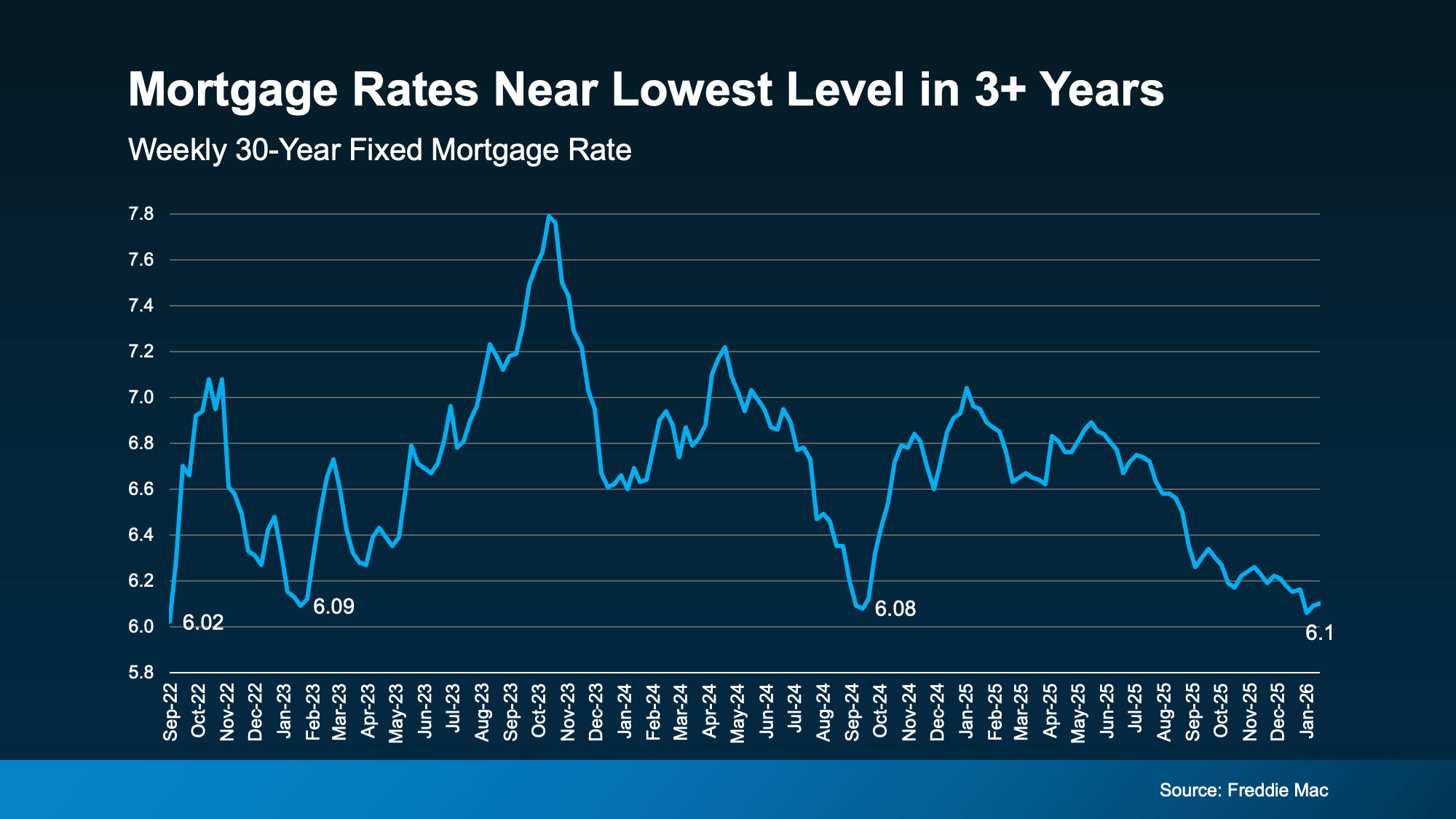

1. Mortgage Rates Have Come Down

Rates are sitting near their lowest levels in more than three years. Even small drops can make a big difference in your monthly payment — and your buying power.

Lower rates = more breathing room.

2. Home Price Growth Has Cooled

Home prices aren’t crashing nationally — but the rocket fuel is gone.

Instead of sharp, unpredictable jumps, prices are rising more slowly. That makes it easier to plan, budget, and buy without feeling like the house you wanted yesterday is suddenly $50K more today.

Stability is back in the conversation.

3. Wages Are Growing Faster Than Home Prices

This one is huge.

When income grows faster than home prices, buyers regain ground. Even if rates don’t fall dramatically, stronger wages help restore purchasing power.

Translation? Your paycheck is finally catching up to the market.

Why 2026 Could Be a Turning Point for Buyers

These trends are lining up like a steady tailwind. Not a sudden boost — but a consistent push in the right direction.

Affordability won’t snap back overnight. But compared to the last few years, buyers finally have momentum instead of resistance.

Think of it like rowing against a current that’s finally slowed down. You’re still working — but now you’re actually moving forward.

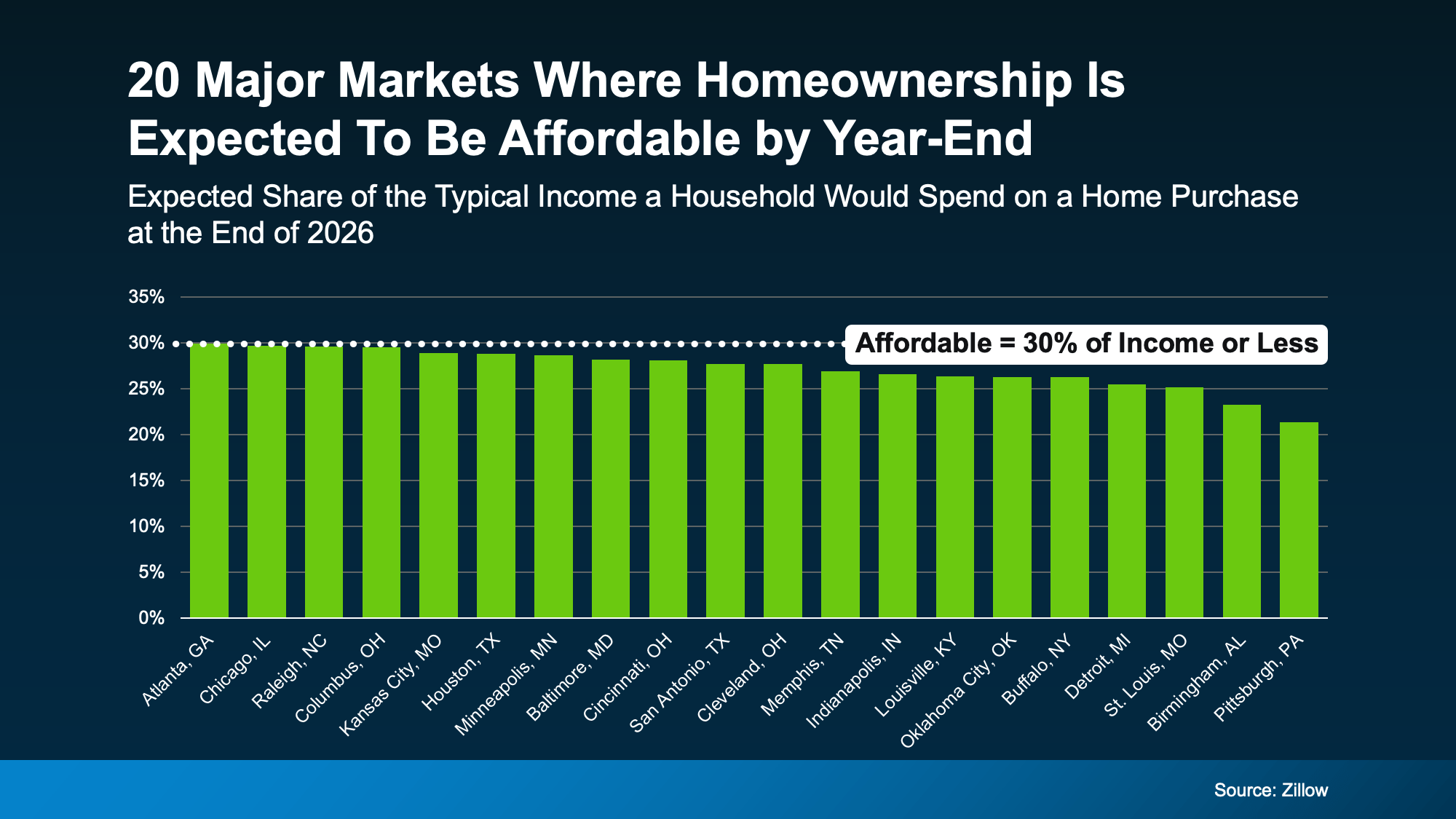

Where Affordability Is Improving First

Some markets are improving faster than others. In certain areas, housing costs are already dropping closer to that 30% affordability benchmark.

But here’s the key: you don’t have to wait or move states to benefit.

Local market shifts can create pockets of opportunity — even when national headlines say otherwise. That’s why having a local expert matters. What’s true nationally isn’t always true on your street.

What Smart Buyers Are Doing Right Now

Savvy buyers aren’t waiting for “perfect.” They’re:

- Locking in improved rates

- Taking advantage of slower price growth

- Using income gains to expand buying power

- Watching for motivated sellers and off-market opportunities

They’re positioning themselves before competition heats up again.

Bottom Line

Buying a home is finally getting more affordable — and that’s not just a headline. It’s a real shift.

The forces that crushed affordability are easing. The math is improving. And for many buyers, what felt impossible last year may now be within reach.

If you want to see how these trends affect your buying power in our local market, let’s run the numbers together.