📲 Don’t let scary foreclosure headlines or bad data cloud your decisions.

Download the Made 4 More app for the most accurate listings—without your info being sold. See real opportunities, avoid the noise, and move with confidence. Get started today!

If you’ve seen headlines screaming that foreclosure activity has been rising for months, you’re not alone if your mind immediately jumps to 2008. It’s a reflex. Back then, foreclosures were the canary in the coal mine.

But here’s the truth most headlines skip: today’s foreclosure numbers aren’t flashing red—they’re settling into normal. And that distinction matters.

Let’s break this down without the fear-mongering.

Foreclosures Are Up—But Context Changes Everything

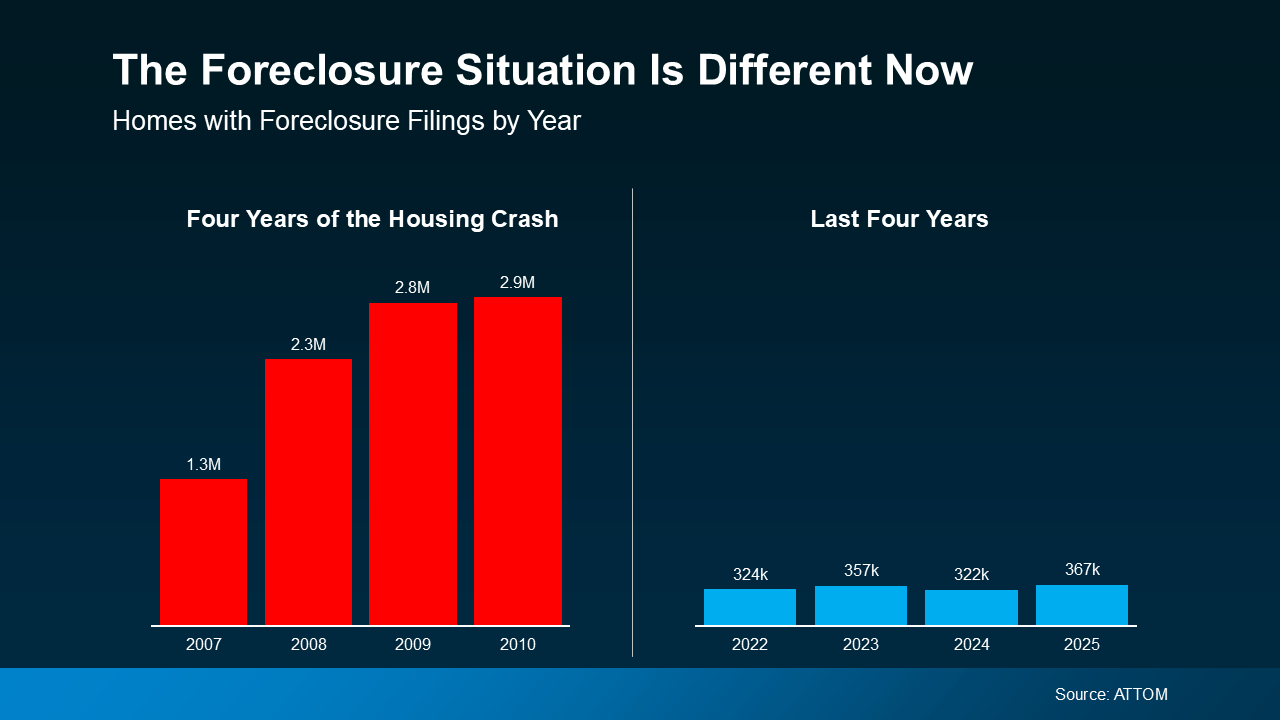

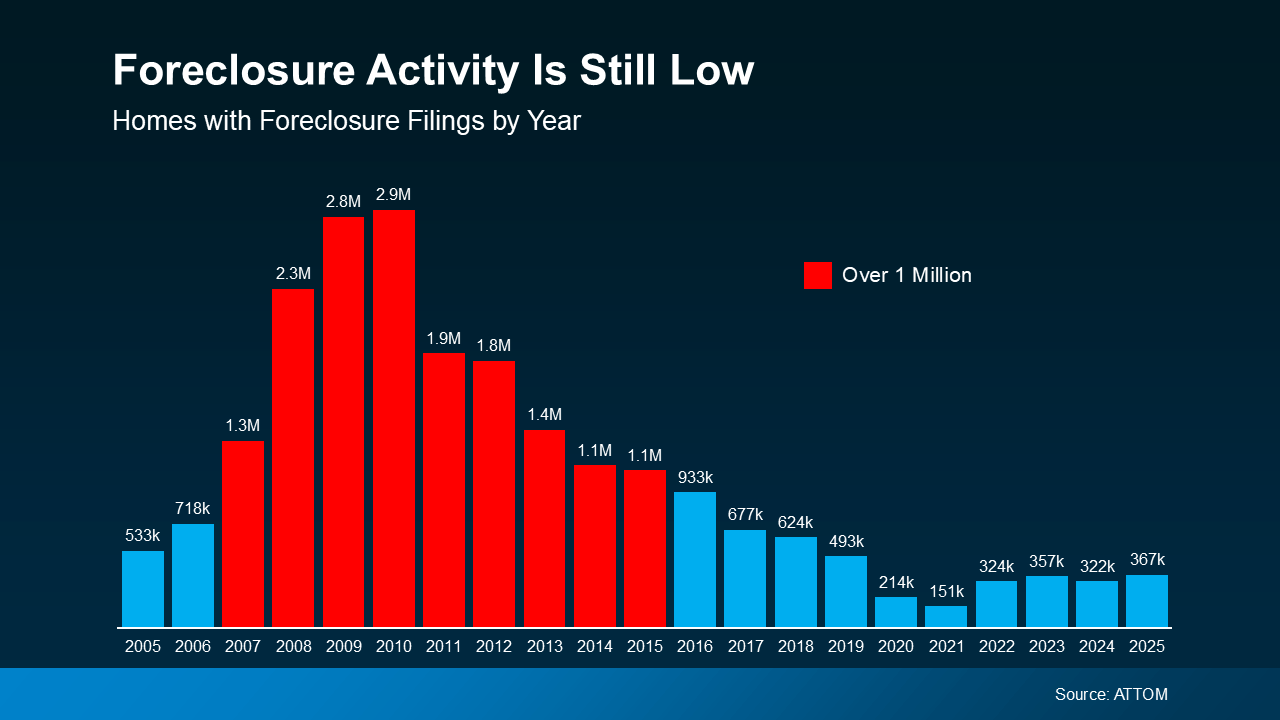

Yes, foreclosure filings are up about 32% year-over-year. That sounds dramatic… until you zoom out.

For the last several years, foreclosure activity was abnormally low thanks to pandemic-era protections and historically strong homeowner equity. What we’re seeing now isn’t a spike into danger—it’s a recalibration back to typical market levels.

Think of it like traffic after a holiday weekend. The roads feel busier, but that doesn’t mean there’s an accident ahead. It just means things are returning to normal flow.

Even with the recent increase, foreclosure activity today is nowhere near the levels seen during the housing crash. Not even close.

Why This Market Is Nothing Like 2008

The fear comes from memory. The data tells a different story.

Here’s what’s fundamentally different today:

- Stronger lending standards

- More qualified buyers

- Significantly higher homeowner equity

That last one is the real game-changer.

Over the past five years, home values surged. Most homeowners now have a sizable equity cushion. That means if financial stress hits, many owners can sell their home and walk away with cash, instead of being forced into foreclosure.

In 2008, millions of homeowners were underwater—owing more than their homes were worth. Today? That scenario is the exception, not the rule.

This Is Normalization—Not a Meltdown

According to ATTOM, today’s increase in foreclosure activity reflects a return to pre-pandemic norms, not widespread homeowner distress.

In plain English:

- This is not a flood of distressed properties

- This is not the start of a housing crash

- This is the market finding its balance again

The word to remember here is normalization. Not collapse. Not crisis.

Why Headlines Feel Scarier Than Reality

Fear travels faster than facts—especially on social media.

Big, bold headlines get clicks. Context doesn’t. But context is exactly what buyers, sellers, and homeowners need right now.

That’s why having a trusted real estate professional in your corner matters more than ever. Someone who can help you separate signal from noise.

Bottom Line

Rising foreclosure headlines aren’t a red flag—they’re a reminder to look deeper. Today’s housing market is supported by strong equity, disciplined lending, and healthier fundamentals than we’ve seen in decades.

If something you’re reading online has you worried, don’t guess. Let’s talk it through.

📞 Call or text us at 855-935-MORE—sometimes one honest conversation cuts through all the chaos.