🏡 Don’t let high prices or confusing loan options keep you from your first home! Download the Made 4 More app for accurate listings, zero hidden fees, and total privacy—so you can shop smart and buy with confidence. Get started today!

Let’s be real—buying your first home can feel overwhelming. Between rising home prices, climbing interest rates, and the mountain of cash it feels like you need for a down payment, it’s no wonder so many first-time buyers are wondering, “How the heck do people afford this?”

But don’t panic. There’s a not-so-secret weapon many first-time buyers are using to beat the odds and score their first home: the FHA loan.

FHA Loans: The Shortcut Past the Financial Hurdles

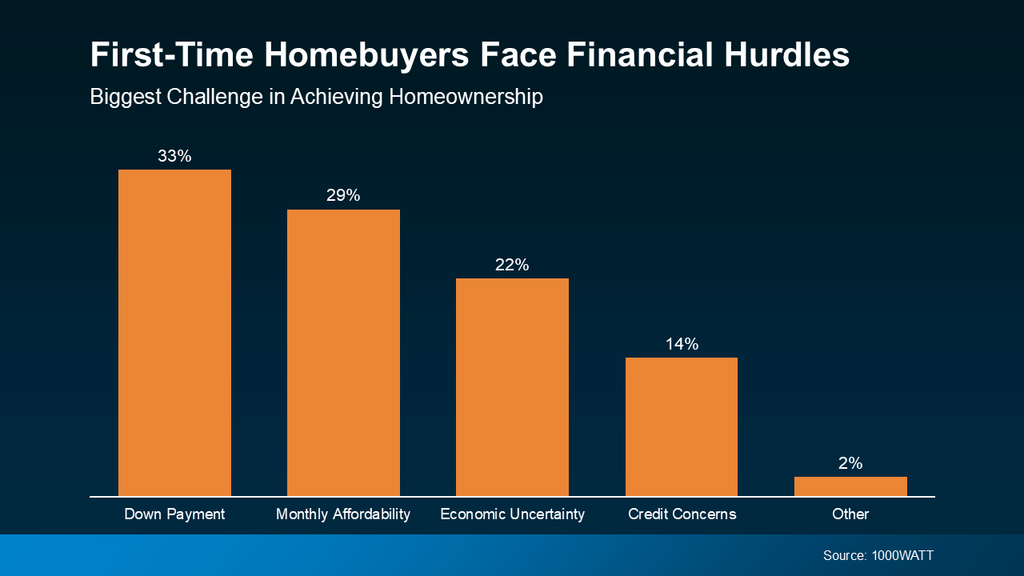

If you’ve been saving every spare dime for your down payment and still feel like you’re falling short, you’re not alone. A recent 1000WATT survey shows that saving up for a down payment and affording monthly mortgage payments are the top two roadblocks for first-time buyers.

That’s where FHA loans step in like a financial lifeline. Backed by the Federal Housing Administration, FHA loans were built for buyers just like you—people who are ready for homeownership but don’t have a six-figure savings account.

Less Money Down, More House Sooner

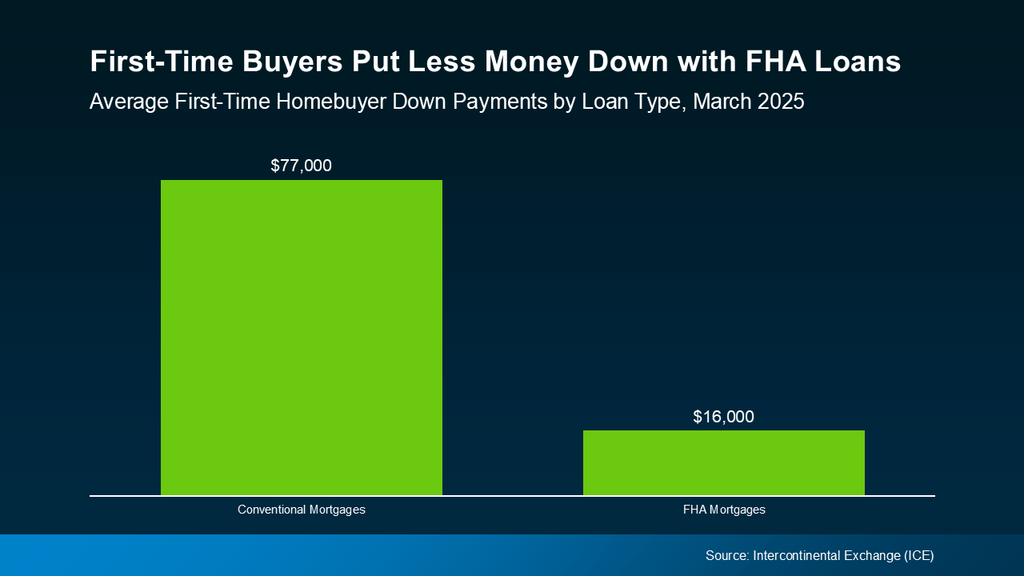

Let’s talk numbers. According to Intercontinental Exchange (ICE), the average FHA loan buyer puts down just $16,000—compared to the whopping $77,000 down payment typically needed for a conventional loan. That’s over $60,000 you could keep in your pocket or use for moving costs, furniture, or that dream kitchen reno.

Lower Upfront Costs = Sooner Move-In Dates

The magic of FHA loans doesn’t stop at the down payment. They often come with lower interest rates compared to conventional mortgages. Yep, that means more affordable monthly payments—so your budget breathes a little easier.

Bankrate puts it like this:

“FHA loan rates are competitive with, and often slightly lower than, rates for conventional loans.”

Translation? You could get more house for less money every month. That’s a win.

Is an FHA Loan Right for You?

If you’re dreaming about ditching rent, planting roots, or simply having a home that’s yours, an FHA loan might just be your golden ticket. But don’t go it alone. The smartest move? Talk to a trusted lender who can walk you through the fine print, compare options, and help you figure out what fits your financial puzzle.

Buying your first home doesn’t have to feel impossible. With the right loan (hello, FHA!) and the right team on your side, you can kick the door open to homeownership way sooner than you think.

Call or text us today at 855-935-MORE and let’s figure out your next move together.