💡 Exploring adjustable-rate mortgages? Make sure you’re also getting the best deal on your next home. Download the Made 4 More app for accurate, up-to-date listings—no hidden fees, no data selling. Shop smart, buy confidently. Get started today!

Let’s be real: mortgage rates have been kind of brutal lately. Between higher prices and climbing interest rates, a lot of buyers are getting creative just to make homeownership doable. And one buzzword you’ve probably heard floating around lately? Adjustable-Rate Mortgages, or ARMs.

If the term makes you uneasy (cue flashbacks to 2008), you’re not alone. But hold up—today’s ARMs are not the risky monsters of the past. Let’s break it down so you know exactly what you’re getting into—without the stress or confusion.

What Even Is an Adjustable-Rate Mortgage?

Think of it like this: A fixed-rate mortgage is your steady, reliable friend—it never changes, no surprises. But an ARM? That’s your cool, flexible buddy who starts off easy but might switch things up later.

Here’s the gist: you get a lower interest rate for the first few years (which means lower monthly payments—nice, right?). After that, your rate adjusts based on market conditions. If rates drop? You win. If they rise? Not so much.

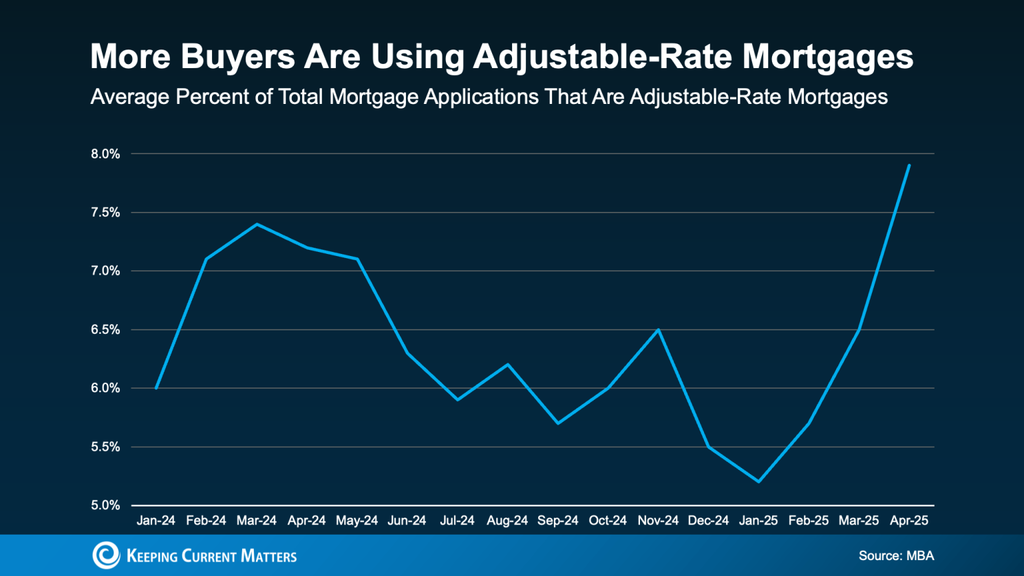

Why Are ARMs Making a Comeback?

Simple. Affordability is tight, and buyers are looking for breathing room. With an ARM’s lower starting rate, you might:

- Qualify for a bigger house

- Pay less each month (at least at first)

- Have more flexibility if you plan to move or refinance before your rate adjusts

So yeah, they can be a powerful tool—if you know how to use them right.

Pros of an ARM (Why Buyers Are Eyeing Them)

- Lower Initial Rates: This one’s big. Lower rates upfront = lower payments.

- More Buying Power: You might qualify for a home that seemed out of reach with a fixed-rate loan.

- Great for Short-Term Plans: If you’re not planning to stay put long-term, you might sell before that rate adjusts.

But Wait… The Catch?

Here’s where the risk comes in: once the initial period ends (typically 5, 7, or 10 years), your rate could go up. And with it? Your monthly payments. That could be a gut punch if you’re not prepared.

If you’re still in the house and rates have climbed? You’ll be shelling out more each month. If rates have dropped? Sweet—you might actually save. But honestly, no one has a crystal ball.

Should You Consider an ARM? Ask Yourself This:

- Are you planning to move or refinance before the rate adjusts?

- Can you comfortably afford a possible payment hike in the future?

- Do you have a solid emergency fund to buffer surprises?

If you answered yes to those, an ARM might make sense. But this isn’t a solo decision—you need to talk to a lender you trust to walk through the numbers.

Bottom Line: Be Smart, Not Sorry

Adjustable-Rate Mortgages can be a smart move—but only if you understand how they work and how they fit into your financial plan. Don’t just chase the lower rate without thinking it through. Talk to a knowledgeable lender and your financial advisor to figure out if this flexible loan is a fit—or a flop—for your future.

Got questions about what mortgage is right for you? Call or text us at 855-935-MORE. We’ll break it down, no pressure.