Don’t let outdated estimates or hidden fees cost you thousands in home equity! Download the Made 4 More app for the most accurate home values and listings—without your info being sold. Make confident decisions about selling, upgrading, or reinvesting your equity. Get started today!

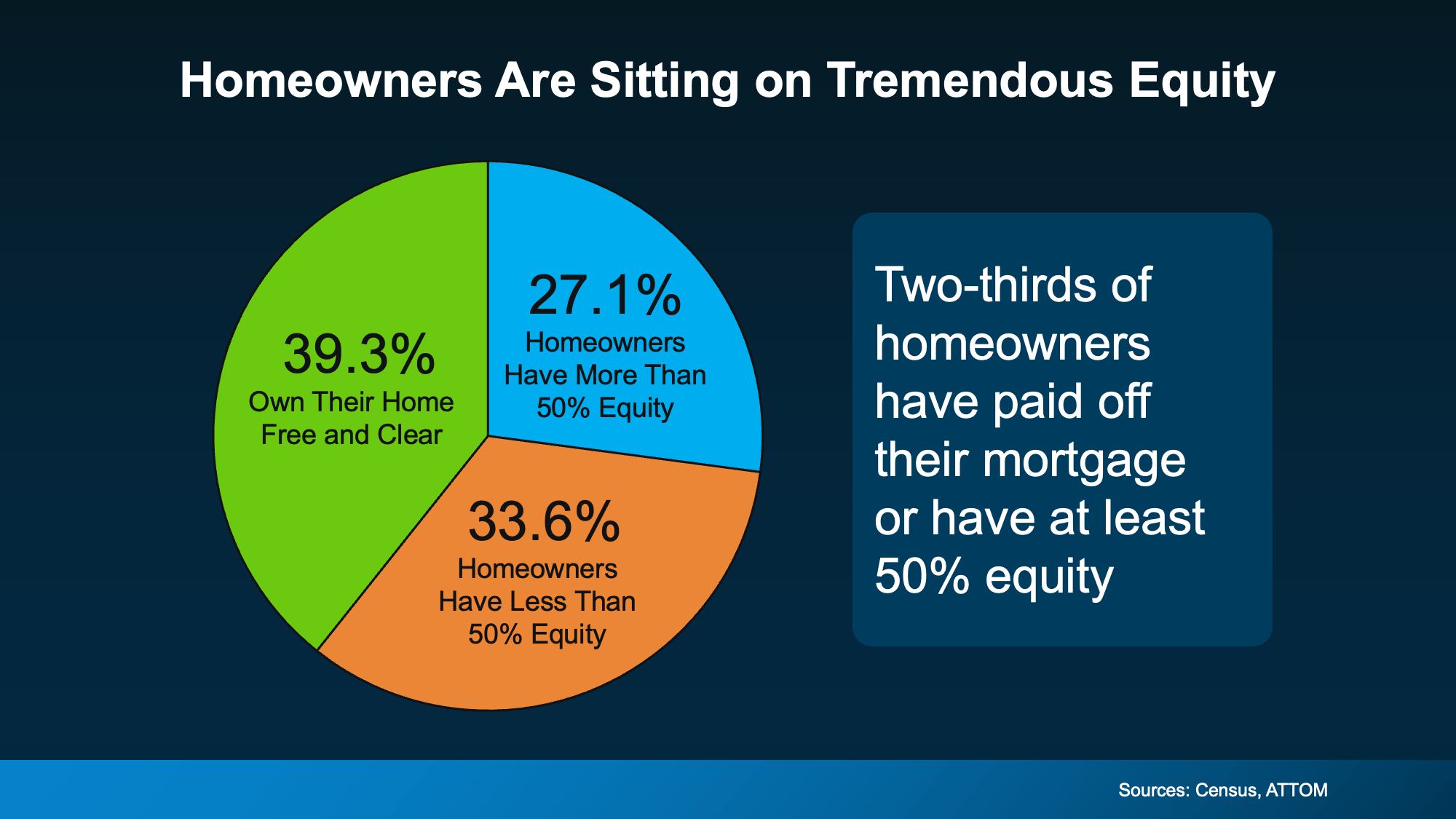

You’ve probably heard it: Homeowners today are sitting on serious equity.

But what does that actually mean for you?

It means you may be living in one of your biggest financial assets—and not even using it to its full potential.

Equity isn’t just a number on paper. It’s stored wealth. It’s leverage. It’s opportunity knocking at your front door.

Let’s break it down.

How Much Equity Do Homeowners Really Have?

Here’s the simple version.

As you pay down your mortgage and home values rise, the portion of your home that you own free and clear grows. That’s your equity.

And right now? It’s substantial.

- 39% of homeowners own their homes outright.

- Another 27% have at least 50% equity.

- The average homeowner has nearly $300,000 in equity.

That’s not pocket change. That’s life-changing money.

So the real question is…

What are you going to do with it?

1. Upgrade Your Lifestyle (Without Draining Your Savings)

Feeling cramped?

Or maybe you’re rattling around in too much space now that the kids are gone?

Your equity can become the down payment on your next chapter.

Move up. Downsize. Relocate. Buy closer to work. Buy closer to the beach.

In some cases, homeowners even have enough equity to purchase their next home in cash. That’s power.

2. Remodel Smart and Build Even More Value

Not ready to move? No problem.

Your home can evolve with you.

Kitchen upgrades. Bathroom refreshes. Adding functional space. The right improvements don’t just make life better—they can increase your future resale value.

Pro tip? Always talk to a local real estate expert before renovating. Not all upgrades are created equal. Some are gold. Some are glitter.

3. Fund a Big Goal Without Starting From Zero

Starting a business?

Helping your kids with college—or a down payment?

Boosting retirement savings?

Your home equity can act like a financial springboard.

Think of it as your silent partner. It’s been growing in the background while you’ve been living your life.

Now it might be time to let it work for you.

4. Protect Yourself in Tough Times

Life happens. Job changes. Health issues. Unexpected setbacks.

If you ever hit financial turbulence, equity can be a safety net.

Many homeowners today can sell, pay off their mortgage, and walk away with money in their pocket—avoiding foreclosure altogether.

That’s a very different story than what we saw in 2008.

And it’s because today’s homeowners have stronger equity positions.

Your Next Steps (Don’t Skip This)

If you’re even thinking about using your equity, here’s your game plan:

Step 1: Get a personalized equity assessment from a local agent.

Step 2: Talk to a financial advisor about the smartest way to use it.

You’ll want to maintain at least 20% equity as a cushion. That loan-to-value ratio matters. Strategy beats impulse every time.

Why This Matters for Real Estate Agents (Recruitment Insight)

Here’s the bigger picture.

Home equity conversations are driving today’s market.

Sellers are moving because they can. Buyers are competing for homes owned by equity-rich homeowners. Investors are repositioning wealth.

Agents who understand equity positioning win more listings. Period.

At Made 4 More Realty, we train our agents to lead with data, strategy, and opportunity—not just show homes.

If you’re an agent who wants to:

- Master equity conversations

- Win more listing appointments

- Provide higher-level financial guidance

- Build long-term wealth for your clients

You might be in the right room.

Bottom Line

Your home equity could be the key to your next move—literally and financially.

Move up. Remodel. Invest. Protect yourself.

But don’t guess. Get clarity.