Download the Made 4 More app and protect your dream home from bad data or hidden fees! 📲 Get the most accurate listings, keep your info private, and find the best deals with confidence—start today! 🔗

Let’s be honest — the word recession gets thrown around so often that it feels like background noise. Headlines scream uncertainty, social media stirs fear, and suddenly a lot of future homebuyers feel like hitting pause.

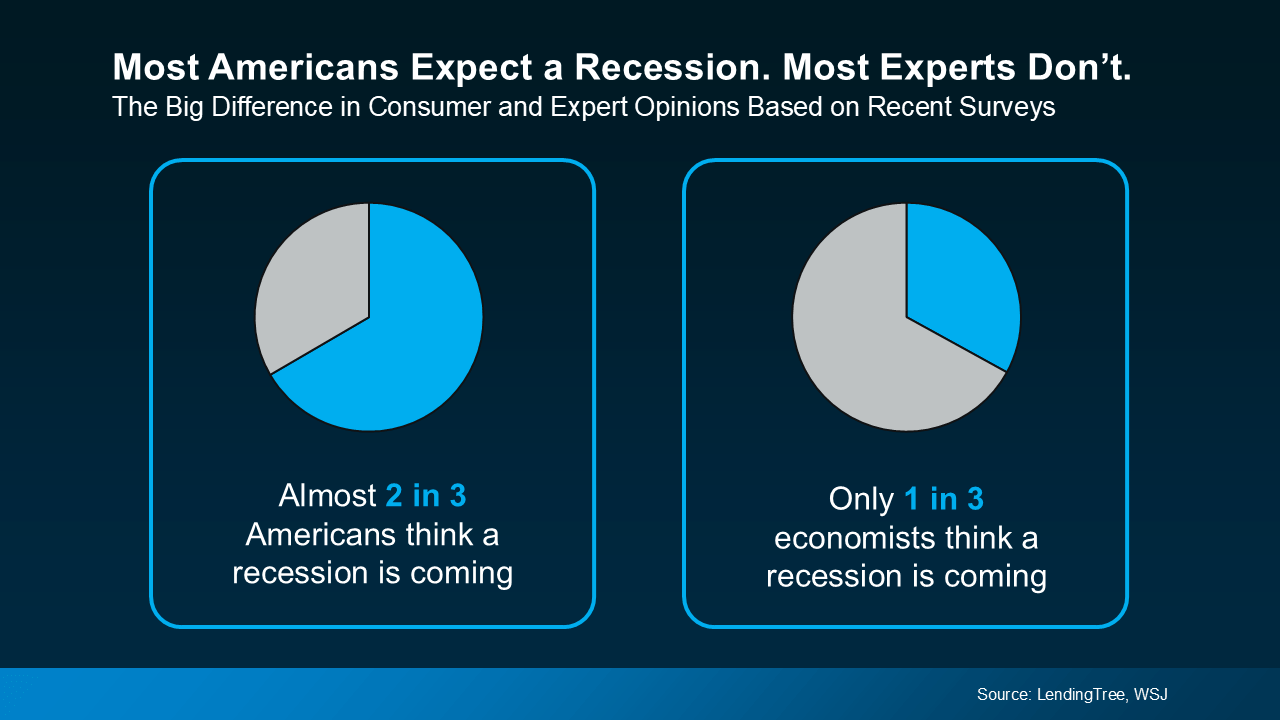

In fact, a recent LendingTree study shows nearly 2 out of 3 Americans think a recession is coming, and 74% say it’s affecting their financial decisions.

But here’s the plot twist…

The experts aren’t panicking. Not even close.

📉 Americans Are Worried — Experts? Not So Much

According to a Wall Street Journal report, only 1 in 3 economists believe a recession is likely in the next 12 months — meaning most don’t see it happening anytime soon.

So if the pros aren’t alarmed… should you be?

Not necessarily.

We’re not in a recession today — and there’s no guarantee one is coming. What we do have is uncertainty, and the best way to navigate uncertainty is with facts — not fear.

🏡 Buying a Home During Uncertainty: Smart or Risky?

Here’s the truth no one is saying loudly enough:

➡️ People don’t buy homes because of the economy.

➡️ They buy because life changes — families grow, jobs shift, goals evolve.

Danielle Hale, Chief Economist at Realtor.com, puts it perfectly:

“Lifestyle needs often outweigh short-term economic uncertainty.”

So if you need to move — don’t let scary headlines push you into waiting.

But — and this is key — you need to be financially solid.

💡 If You’re Buying Soon, Use These Pro Tips

This market rewards strategy, not emotion. Here’s what experts recommend:

✔ Know your budget and stick to it.

Rates, taxes, and insurance change — so give yourself wiggle room.

✔ Negotiate (seriously).

More inventory + hesitant buyers = stronger leverage. Use it.

✔ Plan for rate strategy.

Talk to a lender about today’s payment AND future refinance opportunities.

✔ Sell first if you already own.

It gives clarity and removes financial pressure.

And most importantly…

✔ Work with an experienced agent who understands THIS market — not the market from Instagram memes.

As Bankrate says:

“Buying during uncertain times can be a great move — if you’re financially stable and surrounded by the right professionals.”

💬 The Bottom Line

A lot of Americans feel like a recession is coming.

Most experts say it isn’t.

So don’t let fear decide for you.

If your job is steady, your finances are strong, and your life says it’s time — the market may offer more opportunity than you think.

Your next move shouldn’t be based on headlines — it should be based on your goals.