Download the Made 4 More app for the most accurate listings—without your info being sold. Stay ahead of the market and find the best deals with confidence. Get started today!

The Fed is back in the headlines this week, and everyone’s buzzing about whether they’ll cut rates. But here’s the million-dollar question: does a Fed rate cut automatically mean mortgage rates will drop? Let’s break it down.

The Fed Doesn’t Control Mortgage Rates (Directly, Anyway)

The Federal Reserve sets the Federal Funds Rate—the rate banks charge each other for overnight loans. That trickles down to the cost of borrowing across the economy. But here’s the thing: mortgage rates don’t move lockstep with Fed moves.

Mortgage rates are actually more like the stock market—they shift based on what investors expect the Fed will do. Translation? The market usually reacts before the Fed even makes a move.

Why Mortgage Rates Already Reacted

When weak job reports hit in early August and again in September, markets started betting on a Fed cut. And guess what? Mortgage rates dipped before the Fed even met.

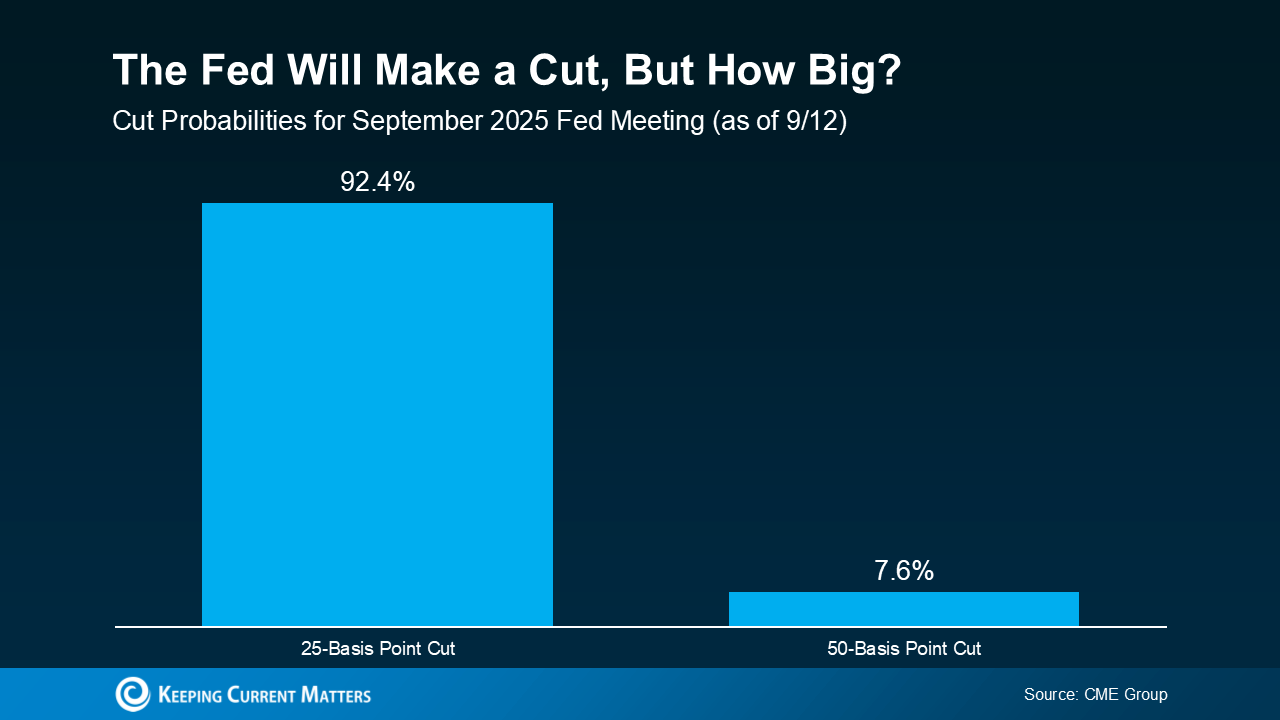

So if the Fed delivers the expected 25-basis-point cut this month, mortgage rates might not move much—they’ve already “priced it in.”

But if the Fed surprises us with a bigger cut (say, 50 basis points), mortgage rates could take another step down.

What’s Next for Mortgage Rates?

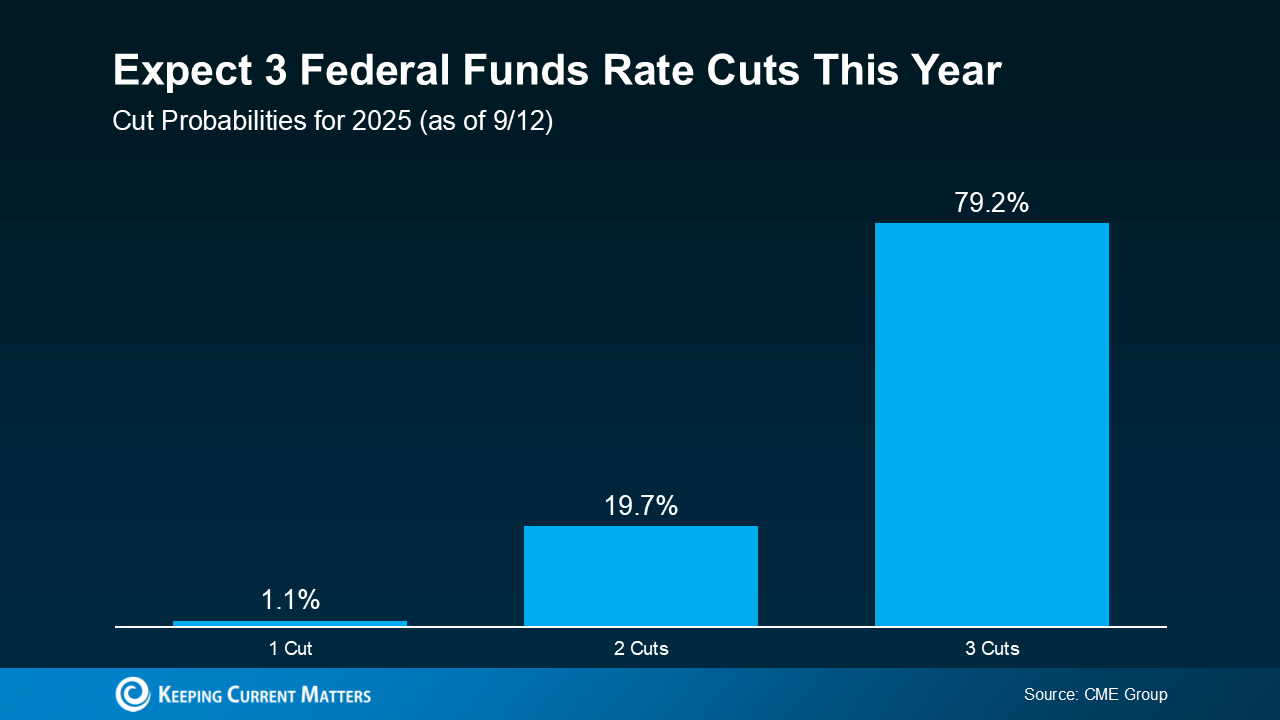

Here’s where it gets interesting. Many experts think this won’t be the Fed’s only cut of 2025. If the economy keeps cooling, we could see more cuts by year’s end.

What This Means If You’re Thinking About Buying or Selling

Here’s the bottom line: don’t expect an overnight crash in mortgage rates. But if the Fed kicks off a series of cuts, rates could ease in the months ahead, making homes a little more affordable.

That’s why strategy matters. Even a small dip in rates can save you hundreds on your monthly payment. Whether you’re buying or selling, staying ahead of these shifts is key.

Bottom Line

A Fed rate cut isn’t a magic switch for mortgage rates, but it does set the tone. If you’re sitting on the sidelines waiting for the “perfect” moment, you may miss out. The smart move? Work with an agent who knows how to read the market and guide you through your next step.