Download the Made 4 More app for the most reliable listings, with your privacy protected. Secure the best deals and start your search today!

If you’ve been waiting for mortgage rates to finally give you a break, here’s some news you’ll love: they just dropped in the biggest one-day decline in over a year. 🙌

Last Friday, September 5th, the average 30-year fixed mortgage rate slid to its lowest point since October 2024. For buyers who’ve been feeling squeezed, this is the shift you’ve been waiting for.

Why Did Rates Drop?

The drop came right after the August jobs report showed weaker-than-expected numbers for the second month in a row. That sent a ripple through financial markets, and mortgage rates responded by falling.

In plain English? The economy is showing signs of cooling off. And historically, when that happens, rates usually dip.

Why This Drop Is a Big Deal for Buyers

This isn’t just about one headline—it’s about real savings for you.

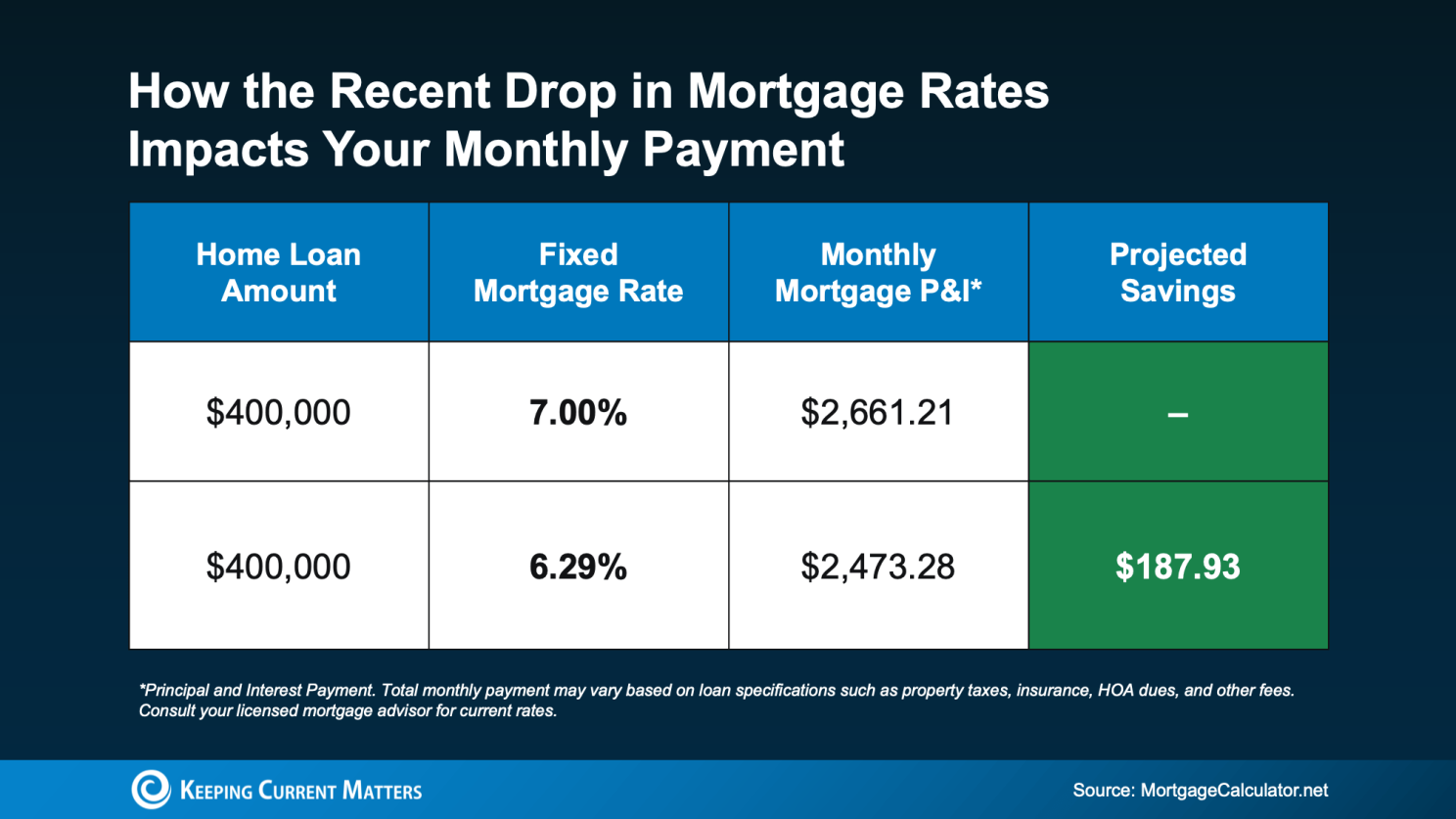

At the start of summer, mortgage rates hovered near 7%. Now, they’ve slid lower. That difference could save you nearly $200 a month on your payment—or about $2,400 a year. That’s a vacation fund, a new car payment, or a serious chunk of extra cash back in your pocket.

How Long Will It Last?

That depends on the bigger economic picture—things like inflation, jobs, and the Fed’s next moves. Rates could dip further, or they could tick back up.

Here’s what you can do: stay connected with a savvy real estate agent and a trusted lender. They’ll watch the numbers for you and help you lock in the best deal when the timing’s right.

The Bottom Line

Mortgage rates just saw their sharpest drop in a year, and that could finally make the home you’ve been dreaming of affordable again. If you’ve been sitting on the sidelines, now’s your chance to jump back in before the market shifts again.