Don’t let hidden fees or outdated data stand between you and your dream home!

Download the Made 4 More app to access the most accurate listings, with your privacy protected.

Find the best deals confidently. Start your search today!

If you’ve been sitting on the fence about buying a home because getting approved for a mortgage felt like climbing Mount Everest… good news—it’s getting a bit easier to qualify. But before you jump in headfirst, let’s talk about what’s really going on behind the scenes.

🔓 Lending Standards Are Loosening (Just a Little)

Lenders are beginning to open the door wider for qualified buyers. Translation? If you’ve got decent credit and a steady job, you may be in a better position to get a mortgage than you were just a few months ago.

This shift is meant to breathe life into a sluggish market—not trigger another crash. Think of it like adjusting the thermostat, not cranking up the furnace.

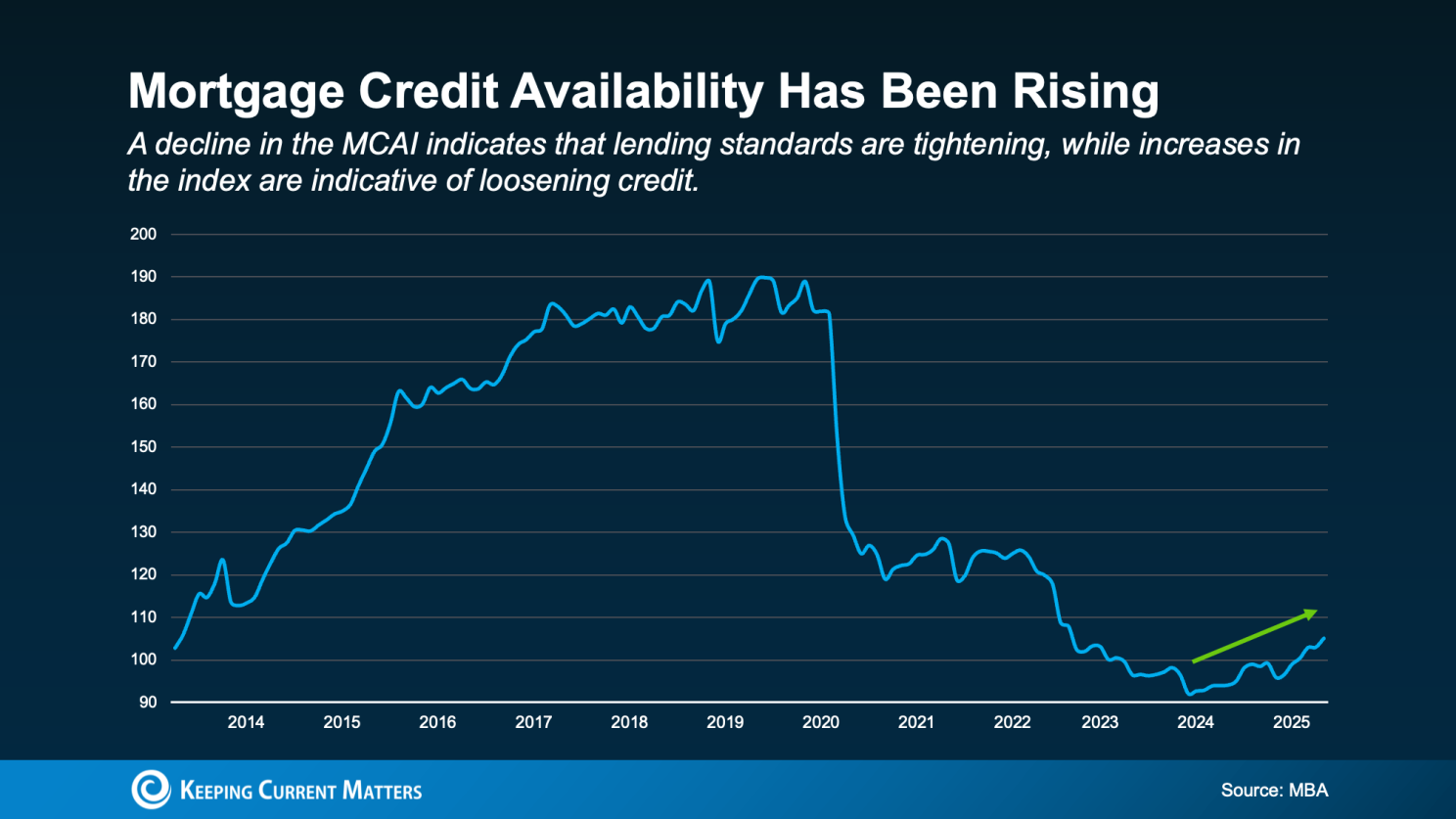

According to the Mortgage Bankers Association, mortgage credit availability (that’s industry-speak for how easy it is to get a loan) is now at its highest level in nearly three years. More banks are willing to lend, which means more buyers are finally getting that long-awaited green light.

📉 This Is NOT 2008 All Over Again

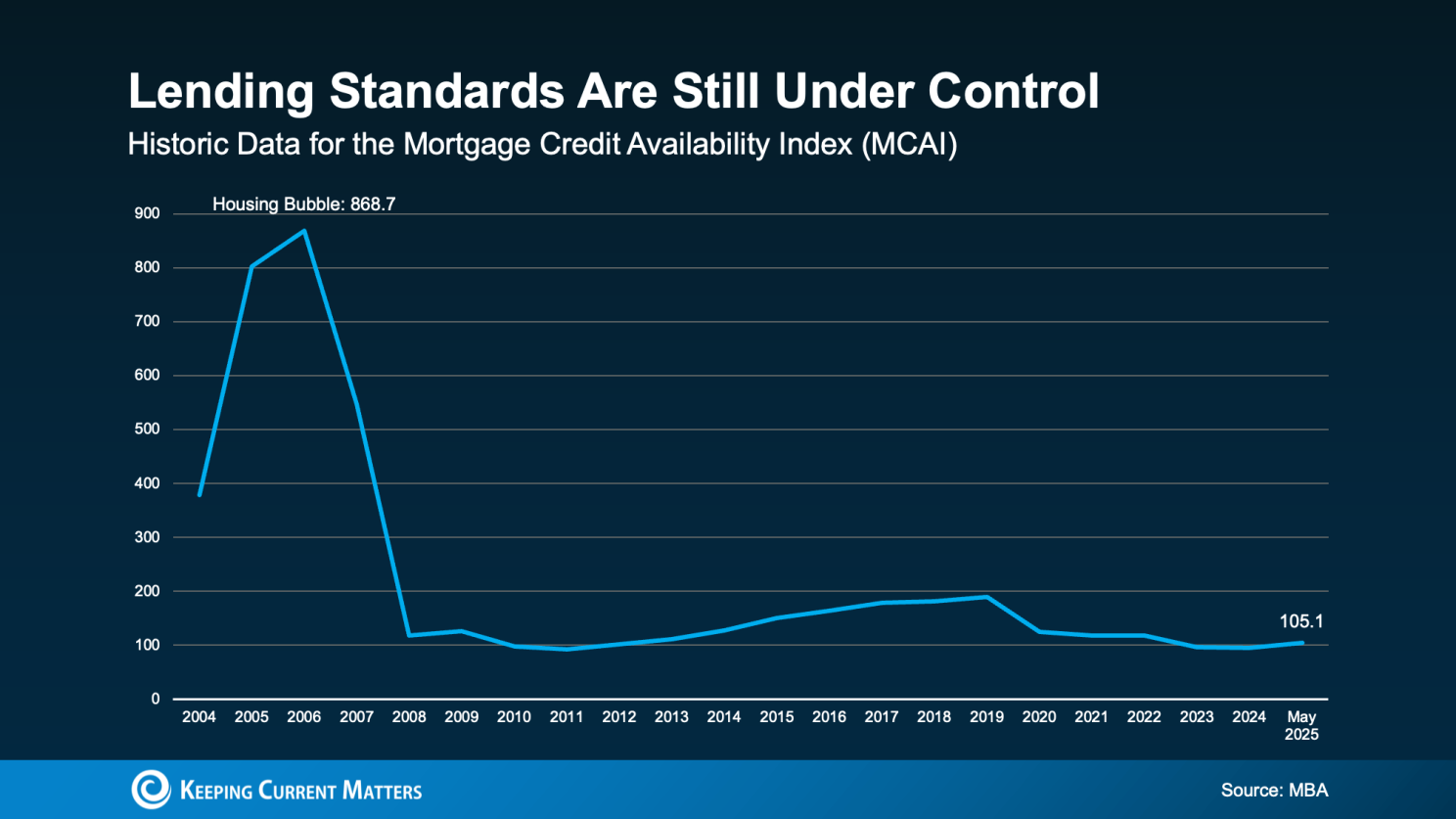

You’re smart to ask: “Didn’t this kind of thing lead to the housing crash?” Short answer: Not this time.

Back then, standards were so loose they were practically non-existent. People were getting loans without income verification. Today? Lenders are still being careful.

Yes, credit is more available—but underwriting standards are still solid. So while there’s more flexibility, banks aren’t handing out keys like candy.

📈 What This Means for You as a Buyer

If you were turned down before or thought you couldn’t qualify, now’s the time to take another look. Even if you don’t have a perfect score or 20% down, there could be a mortgage option out there for you.

Think of this as a second chance—or maybe even your first real shot—to lock in a home loan while lenders are in a more open-minded mood.

💡 The Bottom Line

Getting a mortgage isn’t as impossible as it might’ve felt last year. The landscape is shifting, and you might be more mortgage-ready than you think.

So here’s your move: talk to a trusted lender. Have the conversation. Ask questions. See what’s changed. You might be closer to homeownership than you realize.