🎯 Ready to shop smarter?

Don’t let bad data or hidden fees cost you your dream home!

Download the Made 4 More app for the most accurate listings—without your info being sold. Find the best deals with confidence. Get started today!

If you’ve got student loans, you’re not alone—and you’re definitely not stuck.

Let’s be real. When you’re staring down a chunk of student debt, the idea of buying a home might feel like a pipe dream. In fact, 72% of people with student loans believe that debt is delaying their shot at homeownership.

But here’s the truth: student loans don’t automatically slam the door on buying your first home. You might be closer to owning than you think.

Can You Really Buy a House If You Still Have Student Loans?

Short answer? Yes.

Longer answer? It all comes down to how your debt is structured, your income, and what lenders look for when reviewing your application.

Yahoo Finance said it best:

“Student loans don’t have to get in your way when it comes to becoming a homeowner.”

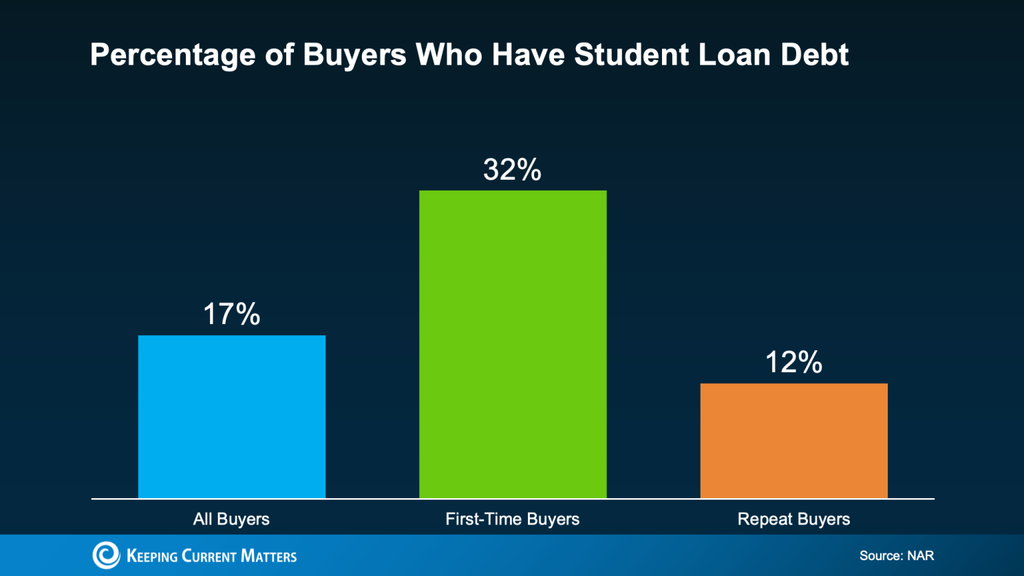

And the numbers back it up. According to the National Association of Realtors, 32% of first-time buyers had student loan debt. That means nearly 1 in 3 first-time homeowners made it happen while still paying off their loans.

So, if you’ve got $20K or even $30K in student debt, you’re not disqualified. In fact, $30,000 is the median student loan balance among buyers—so you’re in good company.

Lenders Don’t Just Look at Debt—They Look at the Full Picture

Think of lenders like personal trainers. They don’t just judge your fitness by your weight—they look at your endurance, diet, and lifestyle. Same goes for your finances.

They look at:

- Your debt-to-income ratio (DTI)

- Your credit score

- How consistent your income is

- Your down payment plan

Student loans are just one line on a bigger financial snapshot. So, if you’ve been managing your payments responsibly and have decent credit, you’re already checking major boxes.

Still Unsure? Talk to a Pro, Not Your Inner Critic

Before you write yourself off, talk to a lender. Seriously. You might be way closer to pre-approval than you think. Even better—many lenders have programs designed for people with student debt.

Getting the facts beats guessing. Every. Single. Time.

Your Student Loans Don’t Own You

Student debt might be part of your story—but it doesn’t have to be the thing that delays your dream of homeownership. Plenty of first-time buyers have been in your shoes and made it happen.

Now it’s your turn.

📲 Call or text us at 855-935-MORE and we’ll connect you with a lender who can walk you through your options—no pressure, just clarity.