Don’t let fear-based headlines or outdated info steer you wrong—get the real story on today’s housing market.

Download the Made 4 More app for the most accurate, up-to-date listings—without hidden fees or your info being sold.

Find the truth and the best deals with confidence. Get started today!

📉 Foreclosure Filings Are Still Low (Like, Really Low)

Yes, foreclosure starts are up 7% so far this year. That might sound scary… until you realize what that number actually means.

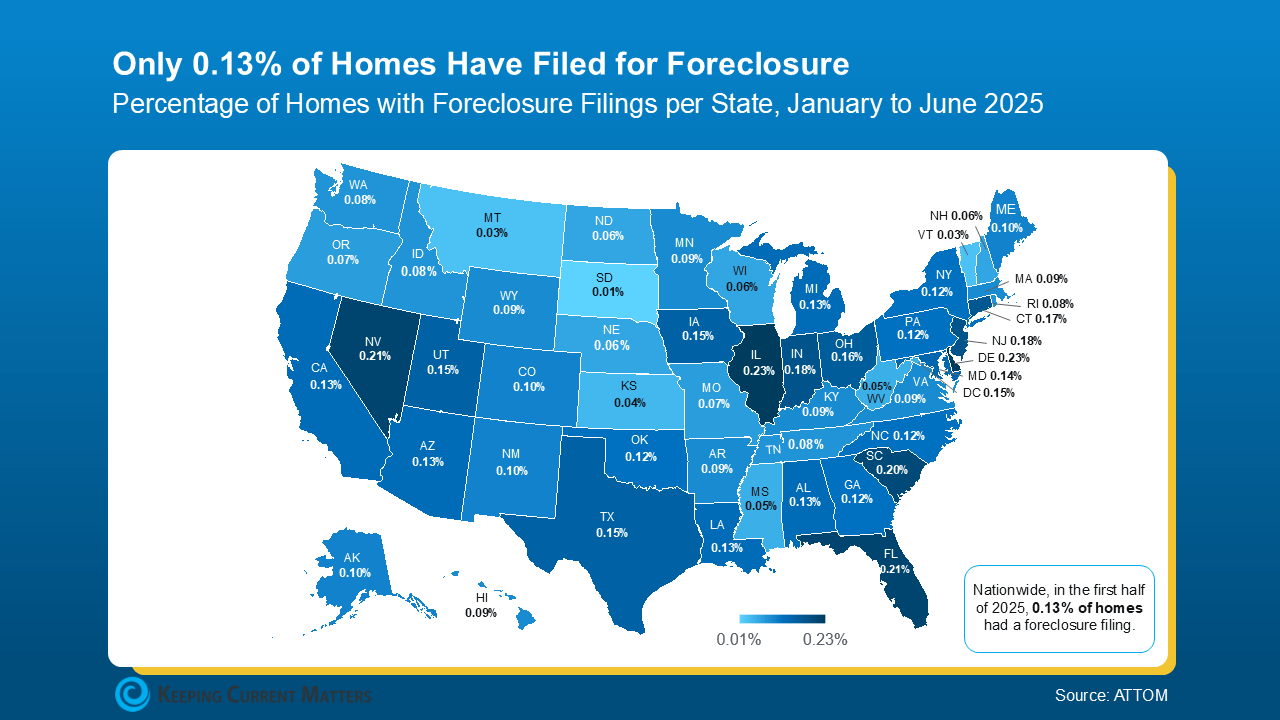

In the first half of 2025, only 0.13% of U.S. homes filed for foreclosure. That’s about 1 in every 758 homes. Compare that to 2010, when it was 1 in every 45.

Big difference, right?

And while headlines love to throw around national stats, real estate is local. Foreclosure activity varies from city to city, and in most areas, the numbers are still comfortably low. Check out the latest U.S. foreclosure heat map from ATTOM if you want to see how your area stacks up.

🏠 Why Today’s Market Is Built on a Stronger Foundation

Remember the chaos of 2008? People were handed loans they couldn’t actually afford, and when the market shifted, they were underwater with no way out.

Fast forward to 2025, and it’s a whole different ballgame:

✅ Lending standards are tighter

✅ Homeowners have record-breaking equity

✅ Most folks who hit financial trouble today can sell and walk away with cash—not a foreclosure notice

As Rick Sharga from CJ Patrick Company put it:

“. . . a significant factor contributing to today’s comparatively low levels of foreclosure activity is that homeowners—including those in foreclosure—possess an unprecedented amount of home equity.”

Bottom line? The safety net is stronger now. And that’s a good thing.

💬 If You’re Facing Financial Trouble, Don’t Wait

Nobody wants to see a homeowner in distress. If you’re struggling to make your mortgage payment, the worst thing you can do is ignore it.

Reach out to your lender. There are more options than you think—from loan modifications to forbearance, or even selling while you’re still ahead.

Don’t let fear stop you from exploring your options.

📌 The Real Takeaway: It’s Not 2008 Again

The next time someone says, “Foreclosures are up!” ask them to show you the whole picture. Yes, there’s been a slight bump—but we’re still way below anything resembling a crisis.

This isn’t a bubble. This isn’t 2010. This is a more stable, equity-rich market.

If you’re curious about what this means for your home value, buying power, or next move—talk to a pro who knows what’s really happening behind the headlines.