Don’t let pricing mistakes or poor advice cost you thousands when selling your home!

Download the Made 4 More app to connect with trusted agents, see accurate market data, and avoid costly missteps.

Get the insights you need to sell smarter—without your info being sold.

Find the best deals with confidence. Get started today!

If you’ve been holding out for mortgage rates to take a nosedive… you might be waiting a while. While we’d all love to see 3% rates again, the reality is, experts say rates are likely to stay right around the mid–6% range through 2025—and that’s not necessarily a bad thing.

So let’s break it down: what’s actually going on with rates, and what does it mean for your next move?

📈 Mortgage Rates Are Settling In the 6s—And That’s OK

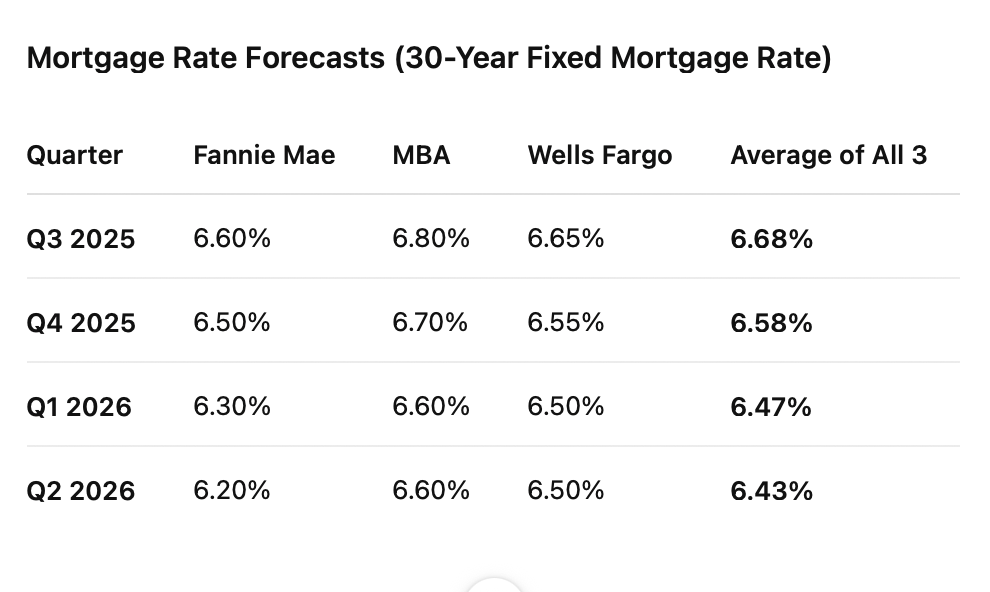

According to projections from Fannie Mae, MBA, and Wells Fargo, the average 30-year fixed mortgage rate is expected to hover between 6.4% and 6.7% through mid-2026. Here’s what that looks like:

🤔 Should You Wait for Rates to Drop Lower?

That depends. If you’re hoping for a “big crash” or another 2020-level dip, experts say: don’t hold your breath.

“If you’re looking for a substantial interest rate drop in 2025, you’ll likely be left waiting.” – Yahoo Finance

And here’s the truth: While you’re waiting for something that may never happen, someone else could be locking in a home they love—with monthly payments that still fit their budget.

💡 Here’s the Smart Play

If you find the right home at the right price in the right neighborhood—don’t let today’s rate stop you.

Why?

Because refinancing later is always an option. But missing out on the home that checks every box? That could sting.

📲 Want to Stay Ahead of the Market? We’ve Got You

Whether you’re buying, selling, or still on the fence, one thing’s for sure: having a knowledgeable, responsive real estate agent makes a world of difference. Especially in a market where small changes in rates can mean big shifts in affordability.

Call or text us today at 855-935-MORE. We’re ready to help you make the smart move.