Ready to make your move while rates are steady? Download the Made 4 More app to explore accurate, up-to-the-minute listings—no hidden fees, no selling your data.

Start planning your purchase with peace of mind today!

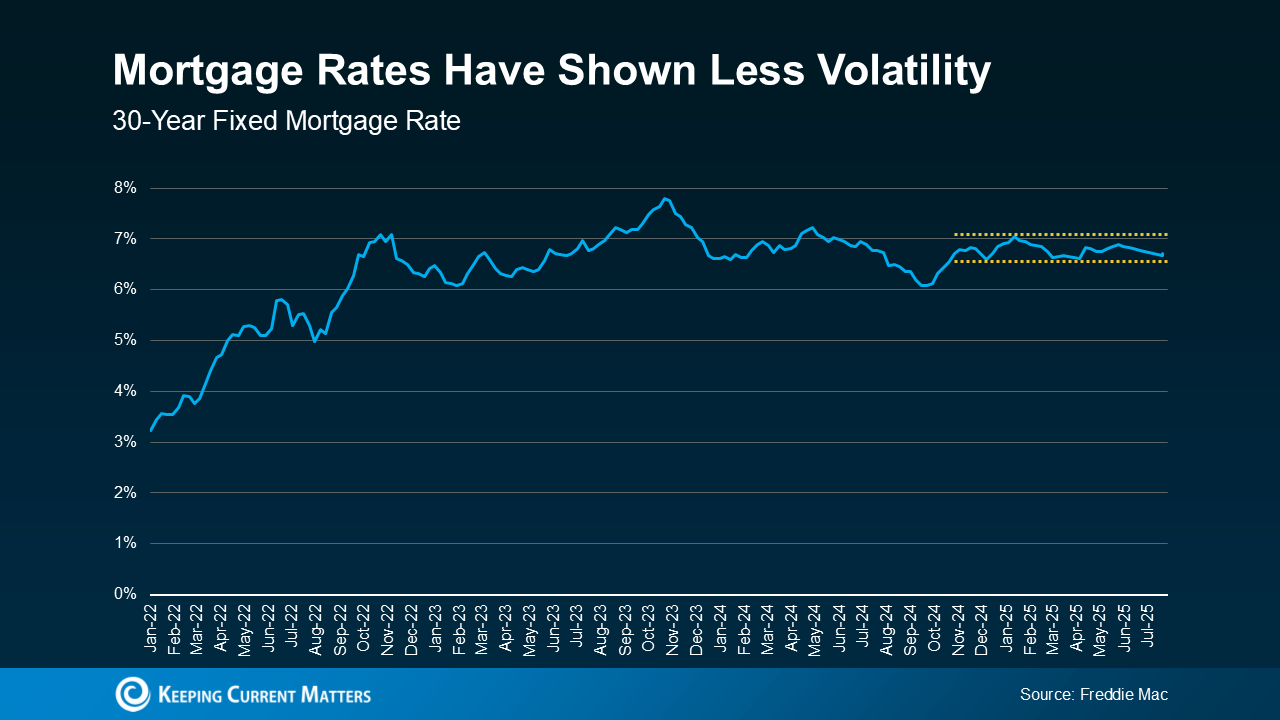

Let’s be real—buying a home in the last few years has felt a little like trying to hit a moving target. Prices were skyrocketing. Rates were jumping all over the place. And if you were trying to budget, it probably felt impossible to pin down what your monthly payment would actually be.

But something encouraging is happening: mortgage rates have finally calmed down. And that stability could be just what you need to stop waiting and start planning your next move.

📈 Mortgage Rates Have Found Their Groove (At Least for Now)

Over the past year, mortgage rates were like a roller coaster—up one week, down the next. That unpredictability made a lot of buyers hit pause out of pure frustration. But lately? Rates have been hanging out in a pretty narrow range.

Experts are even calling this one of the calmest periods for mortgage rates in recent memory. Translation: you can finally make a plan without worrying that the ground will shift out from under you by next Tuesday.

✅ Why This Is a Big Deal for You

When rates jump around, it feels risky to make an offer or lock in a payment. Nobody wants to wake up and realize their budget just got torched overnight. But with this steadiness, you get a clearer picture of what you’ll actually be paying every month—and that makes moving feel way more doable.

Imagine shopping for a car if the price tag changed by thousands of dollars every few days. That’s what mortgage shopping has been like. So even if today’s rates aren’t exactly your dream number, the predictability is a massive win.

🔮 Will Rates Stay Calm?

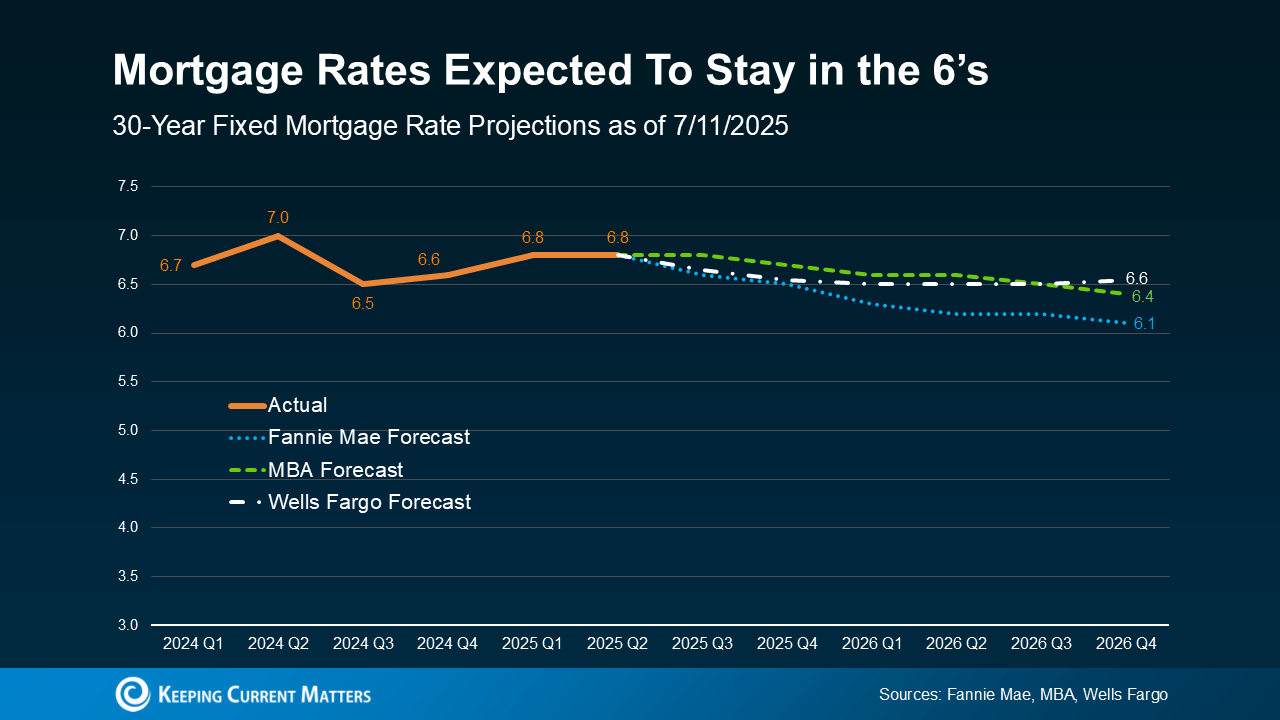

Good question—and one a lot of buyers are asking. Most experts think rates could drift down a bit, but not in any dramatic way.

Danielle Hale, Chief Economist at Realtor.com, said it best:

“I expect a generally downward trend for rates this year, but at a slow enough pace that it might not be noticeable in any given month.”

So if you’re holding out for a magical rate drop, you might be waiting a long time. The truth is, trying to time the market is nearly impossible. And the opportunity you have today could look very similar six months from now.

💡 The Bottom Line

If you’ve been feeling paralyzed by uncertainty, you’re not alone. But today’s calmer mortgage rates are giving buyers something rare: a moment to breathe, plan, and move forward with confidence.

Don’t let the idea of the “perfect” moment keep you from getting started. Because while affordability is still tight, predictability is priceless—and right now, you finally have some.

📲 Ready to run the numbers and see what your payment could look like?

Let’s talk. Call or text us anytime at 855-935-MORE to get started.