Don’t let bad data or hidden fees cost you your dream home! Download the Made 4 More app for the most accurate listings—without your info being sold. Find the best deals with confidence. Get started today!

Let’s be honest—everyone’s asking the same question right now:

“Is this really a good time to sell?”

And the answer surprises a lot of people.

For many homeowners, the answer is a confident yes.

Not because the market is “perfect.”

Not because rates are low.

But because of one powerful thing quietly working in your favor: your equity.

If you’ve owned your home for a while, there’s a very real chance you’re sitting on a pile of hidden wealth—and that number could completely change how, when, and if you move next.

The Hidden Wealth Sitting Inside Your Home

Home equity is one of the most underrated wealth-building tools out there.

Here’s how it builds without you even thinking about it:

- Every mortgage payment shrinks your loan balance

- Home values tend to rise over time

- Your ownership stake grows month after month, year after year

Think of it like a savings account you didn’t know you were funding—except this one often grows faster than most investments.

And if you’ve been in your home for a while? That equity can be substantial.

According to Realtor.com, nearly half of homeowners have lived in their homes for 15+ years, and 1 in 4 for more than 25 years. That’s a long time for appreciation and principal paydown to do their thing.

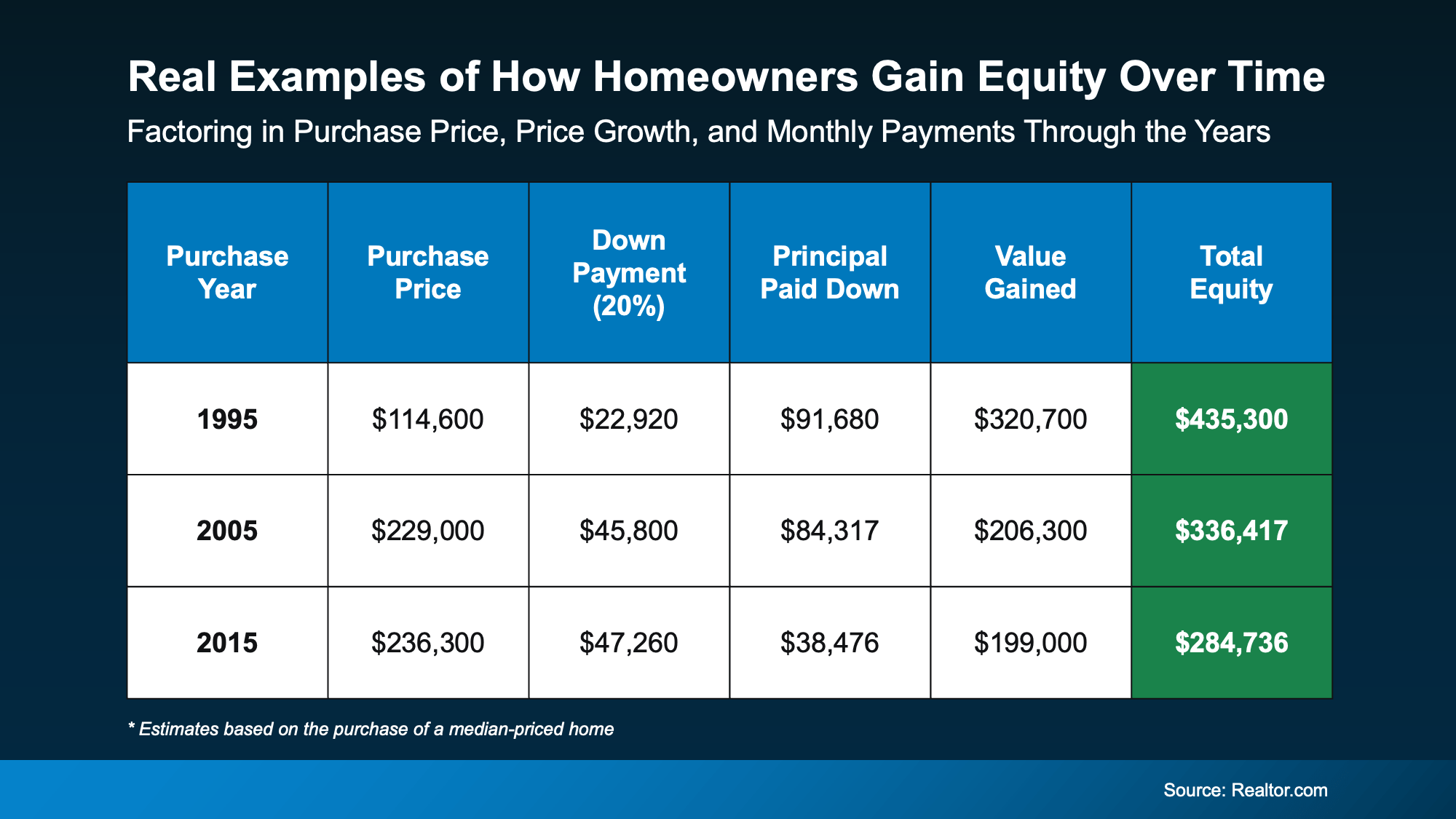

So… What Does That Really Look Like in Dollars?

This is where most homeowners’ jaws drop.

Based on Realtor.com research using median home prices:

- Bought in the mid-1990s? You could be sitting on $400,000+ in equity

- Bought in the early 2000s? Even after the crash, many homeowners have $330,000+

- Bought around 2015? In just about 10 years, equity often reaches $285,000+

And those are averages.

Your number depends on purchase price, improvements, down payment, and location—but the takeaway is simple:

👉 A lot of homeowners are walking around with six figures of equity… and don’t even realize it.

How Your Equity Can Power Your Next Move

This is where equity stops being a number and starts becoming a strategy.

Worried about higher mortgage rates?

👉 Your equity can fund a larger down payment—meaning less money financed and lower monthly payments.

Concerned about competing in today’s market?

👉 Some sellers use their equity to make cash or near-cash offers, which sellers love.

Not sure if moving even makes sense?

👉 Equity gives you options—downsize, relocate, buy first, or invest—on your terms.

Equity doesn’t just help you move.

It helps you move smart.

Bottom Line: Knowledge Is Leverage

You don’t need to sell tomorrow.

But if you haven’t had a professional break down what your home is actually worth—and how much equity you have—you’re making decisions without the full picture.

And that’s like playing poker without looking at your cards.

If you want a clear, pressure-free equity assessment, let’s talk.