Retirement isn’t the end of the road—it’s the start of something amazing. After decades of hard work, you finally get to write your next chapter. Whether that means traveling the world, spending more time with grandkids, or just relaxing without the 9-to-5 grind, one big question can shape your plans: Does your current home still fit your future lifestyle?

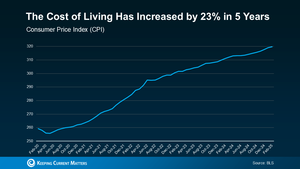

The Cost of Living Has Changed—Has Your Plan?

Here’s the reality: life is more expensive than it was even a few years ago. According to the Bureau of Labor Statistics, the cost of living has jumped a whopping 23% in the last five years. That includes everything from groceries and gas to healthcare and housing. So, if you’re planning to stretch your retirement savings for decades to come, you’ve got to be smart about where your money goes.

Why Moving Could Be a Smart Financial Move

This is where your home comes into play. More retirees are downsizing or relocating—and for good reason. Moving to a more affordable area (or simply into a smaller home) can ease the financial pressure and free up room in your budget. That extra cash could go toward the fun stuff: hobbies, travel, or those spontaneous ice cream trips with the grandkids.

Think about it: why pay for space you no longer need? Downsizing means less to clean, maintain, and spend on. Relocating to a lower-cost area could reduce your taxes, utilities, and other monthly expenses. It’s like giving your retirement plan a raise without needing to lift a finger.

Location Still Matters—Even in Retirement

Now, don’t worry—you don’t have to pack up and move across the country (unless you want to!). Sometimes a move just a few towns over can make a major difference. Whether it’s getting closer to family, escaping big-city costs, or just wanting a fresh start, location is a key piece of the puzzle.

As Go Banking Rates puts it:

“Where you choose to spend your golden years is critical.”

And they’re right. The right location can make or break your budget, your quality of life, and your peace of mind.

You’ve Got Options—Let’s Explore Them Together

If you’re even thinking about whether your current home fits your retirement goals, now’s the perfect time to start the conversation. A real estate professional can help you weigh your options, run the numbers, and make a plan that fits your future.

Want to stay close but go smaller? Thinking of a total lifestyle shift in a new state? Either way, we’ve got your back—and connections nationwide to help you wherever you’re headed.

You’ve worked hard to earn the freedom that retirement brings. If your current home no longer matches the life you want to live, it might be time to make a move. Let’s talk about how to turn your real estate into a powerful tool for the next stage of your life.

📞 Call or text us today at 855-935-MORE and let’s talk about your next best move.

📱 Don’t risk overpaying or chasing outdated listings. Get the Made 4 More app for the most accurate, private home search experience—no hidden fees, no data sold. Start your smarter home search today!