📲 Downsizing Made Simple — Start With Smart Data

Don’t let hidden fees or outdated info derail your next move!

Download the Made 4 More app for the most accurate listings, so you can confidently find the perfect right-sized home without your info being sold. Get started today!

Retirement used to feel like a far-off finish line. Now? For millions of homeowners, it’s right around the corner.

With nearly 12,000 Americans turning 65 every single day, and a huge wave planning to retire in 2026 and 2027, one big question keeps coming up:

👉 Do I really want to keep maintaining this house?

For many, the answer is a confident no—and downsizing is becoming the smartest next move.

Downsizing Isn’t About Less — It’s About Easier

Let’s clear something up: downsizing isn’t about giving up comfort. It’s about upgrading your lifestyle.

Most homeowners aren’t chasing a smaller home because they have to. They’re doing it because they want life to feel:

Easier to manage

Easier to maintain

Easier to enjoy

Think of it like trading in a big, gas-guzzling SUV for a smooth, easy-to-park hybrid. Same freedom—less hassle.

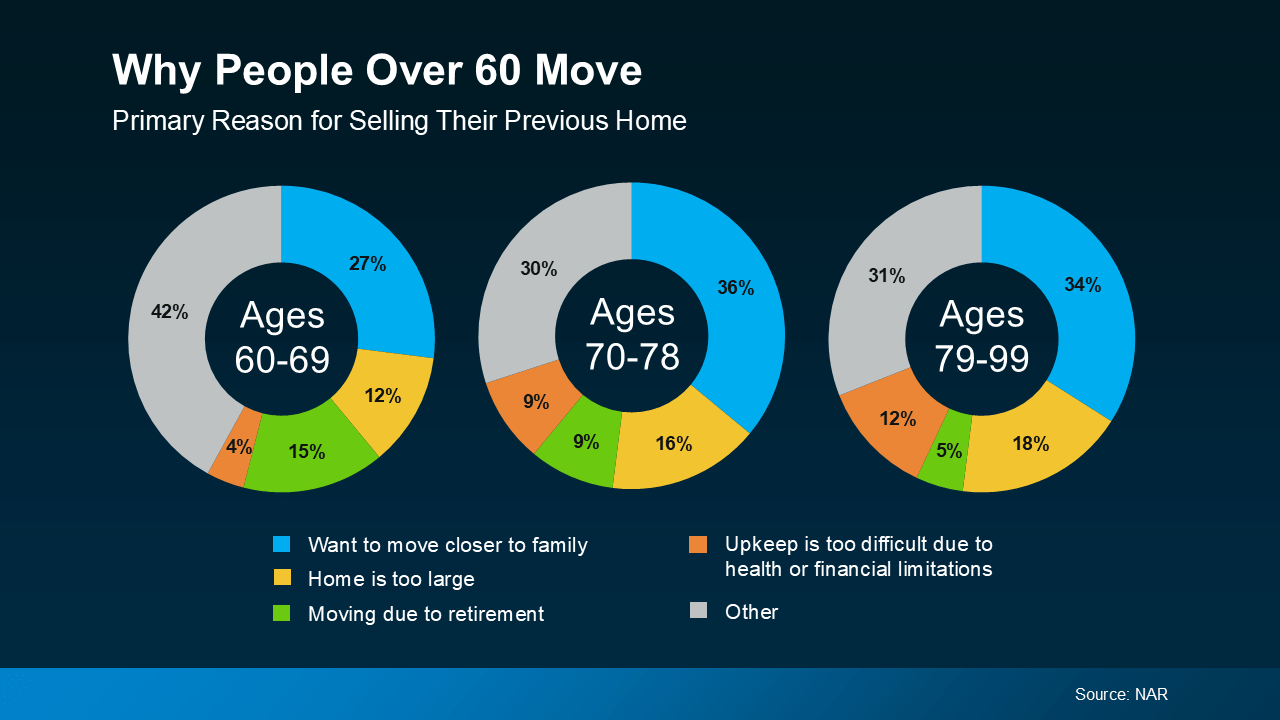

The Real Reasons Homeowners 60+ Are Making the Move

According to the National Association of Realtors, people over 60 aren’t moving because of market hype. They’re moving for life reasons:

To be closer to kids, grandkids, and longtime friends

To get rid of stairs and reduce upkeep

To retire and live where they want, not where work dictates

To lower monthly costs like utilities, insurance, and maintenance

In short? They’re designing a life that fits the years ahead, not the years behind.

The Secret Weapon Making Downsizing Easier: Home Equity

Here’s where it gets interesting.

Thanks to years of appreciation, many longtime homeowners are sitting on more equity than they realize. The average homeowner today has around $299,000 in home equity—and for many retirees, it’s even higher.

Why? Because when you stay in a home for years:

Your home value grows

Your mortgage balance shrinks (or disappears)

That combo creates options. Big ones. It can mean:

Buying a smaller home with less debt

Lowering monthly expenses

Freeing up cash for travel, family, or retirement goals

That’s not downsizing. That’s rightsizing.

Why 2026 Is a Prime Time to Rethink Your Home

With retirement waves coming and housing markets shifting, more homeowners are realizing this is the perfect time to reset, simplify, and cash in on years of smart homeownership.

Yes, it can be emotional to leave a home full of memories. But sometimes closing one chapter is exactly how you open a better one.

Bottom Line: Downsizing = Designing Your Next Chapter

Downsizing isn’t about shrinking your life. It’s about making room for what matters most next.

If retirement is on your radar and you’ve started wondering what your current home and equity could make possible, the smartest first step isn’t selling—it’s getting clarity.