📱 Find Your Dream Home Faster & Smarter!

Don’t let bad data or hidden fees cost you your dream home! Download the Made 4 More app for the most accurate listings—without your info being sold. Find the best deals with confidence. Get started today!

Turn on the news and you’ll hear the word “recession” tossed around like confetti. And if you’re thinking about buying or selling a home, it’s totally normal to wonder: Will my home lose value? Will mortgage rates skyrocket? Should I just sit tight?

Here’s the good news: A slowing economy doesn’t mean the housing market is heading for a crash. In fact, history tells a very different story—one that might actually work in your favor.

Recession ≠ Housing Crash

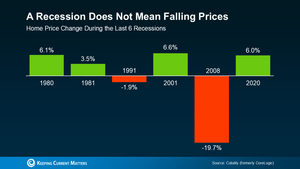

Let’s bust the biggest myth right off the bat: a recession doesn’t automatically tank home prices.

We all remember the 2008 crash—that was the outlier, not the norm. That dip happened because of a housing bubble combined with loose lending and a flood of foreclosures. Today’s market is nothing like that. Inventory is still tight, lending is stricter, and demand is steady.

Here’s the kicker: in four of the last six recessions, home prices actually went up. Yup, up. So if you’re assuming that a recession means homes will lose value, the data says otherwise.

Slower Economy, Lower Rates

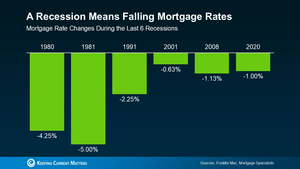

Now here’s something recession talk doesn’t always mention: mortgage rates usually go down during economic slowdowns.

Why? Because the Fed tends to cut rates to encourage borrowing and spending. During each of the last six recessions, mortgage rates dropped—and that can be a game-changer for your buying power.

Now, don’t count on those dreamy 3% rates coming back anytime soon. But even a small drop could make your monthly payment more manageable—or let you afford a little more house than you thought.

The Housing Market Follows Its Own Rules

While the economy takes its turns, housing doesn’t always follow. In most cases, the real estate market keeps moving forward, just at a steadier, more normal pace. If you’re waiting for prices to crash before you buy or sell, you could be waiting a long time—and missing real opportunities in the meantime.

So, What Should You Do?

It all comes down to your personal goals. If you’re buying, a potential rate dip could work in your favor. If you’re selling, low inventory means less competition—and a better shot at holding your price.

And no matter what the market’s doing, having a savvy local real estate expert on your side makes all the difference. They’ll guide you with facts, not fear—and help you move confidently, recession talk or not.

Bottom Line

A recession might sound scary, but history shows the housing market is more resilient than most people think. Whether you’re looking to buy, sell, or just plan your next move, don’t let the headlines decide for you—get the facts and a game plan that fits your goals.

Call or text us at 855-935-MORE to talk about what this market really means for you.