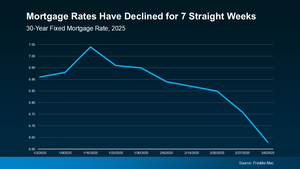

If you’ve been sitting on the sidelines waiting for mortgage rates to drop before buying a home, now might be your moment. After seven straight weeks of decline, mortgage rates have hit their lowest point of the year. And that means one thing—your buying power just got a boost.

Mortgage Rates Are Trending Down—Faster Than Expected

According to Freddie Mac, mortgage rates have steadily dropped from over 7% to the mid-6% range. That’s a bigger shift than experts originally predicted for this time of year. In fact, most forecasts expected us to hit this level around Q3—but here we are already.

While it may not seem like a drastic shift, even a small dip in rates can have a major impact on what you can afford. The result? More breathing room in your budget and lower monthly payments.

Why Are Mortgage Rates Dropping?

The recent dip in rates is tied to economic uncertainty, as noted by Joel Kan, VP and Deputy Chief Economist at the Mortgage Bankers Association (MBA). He explains that concerns about the economy, combined with new tariffs on imported goods, have created a ripple effect leading to lower mortgage rates.

For buyers, this decline couldn’t have come at a better time—right as the spring market heats up. But here’s the catch: mortgage rates are always a moving target. Just because they’re down now doesn’t mean they’ll stay there. If you’ve been waiting for the perfect time to buy, this could be your best shot before rates shift again.

What Lower Rates Mean for Your Buying Power

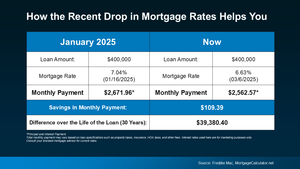

Even a small rate drop can mean serious savings. Let’s break it down with a simple example:

If you took out a $400,000 loan at January’s high of 7.04%, your monthly principal and interest payment would have been significantly higher than if you locked in today’s lower rate. In just a few weeks, that payment has dropped by over $100 per month. That’s real money back in your pocket—money that could go toward home upgrades, savings, or just making your budget a little more comfortable.

Should You Wait for Even Lower Rates?

It’s tempting to hold out, hoping for rates to dip even more. But that’s a risky game. Economic shifts happen fast, and rates could climb just as quickly as they fell. Plus, as rates drop, more buyers jump into the market—meaning more competition for homes.

If you’re serious about buying, now’s the time to run the numbers and see how today’s lower rates impact your homebuying budget.

Bottom Line

Mortgage rates have dropped, making homeownership a little more affordable. If you’ve been waiting for a better deal, this might be your window of opportunity. But remember, rates can be unpredictable, so don’t wait too long.

Would a lower monthly payment make buying a home feel more doable for you? Let’s crunch the numbers together and find out. Call or text us at 855-935-MORE.

Want to make your offer stand out? Download 9 Secrets to Getting Your Offer Accepted! Don’t let a competitive market keep you from landing your dream home.

And before you start your home search, download the Made 4 More app! Don’t let bad data or hidden fees cost you your dream home. Get the most accurate listings—without your info being sold. Find the best deals with confidence. Get started today!