Your dream second home shouldn’t come with surprises.

Get the Made 4 More app to access the most reliable listings—without your personal info being shared.

Smart retirement starts with smarter tools. 🔍🏡

Let’s be real—retirement feels more uncertain than ever.

A whopping 69% of people say today’s financial climate makes it hard to plan for the future, and nearly 7 out of 10 aren’t sure they’ll even be able to retire. That’s not just stressful—it’s a wake-up call.

But here’s a strategy you may not have considered yet: buying a second home.

Why a Second Home Could Be a Smart Retirement Move

Real estate isn’t just about bricks and mortar—it’s about building long-term wealth and stability. If you’ve got the financial wiggle room, a second home might just be your secret weapon. Here’s why:

- It builds wealth over time. As home values climb, your second property appreciates, growing your net worth right along with it.

- It can bring in extra cash. Rent it out and let someone else help pay the mortgage. That rental income? It could beef up your retirement savings faster than you think.

- It gives you options. Sell it later and use the profit to supercharge your retirement funds—or keep it for a paid-off getaway.

- It diversifies your assets. Stocks can be unpredictable. Real estate gives you a tangible backup plan.

Think Second Homes Are Just for Rich Investors? Think Again.

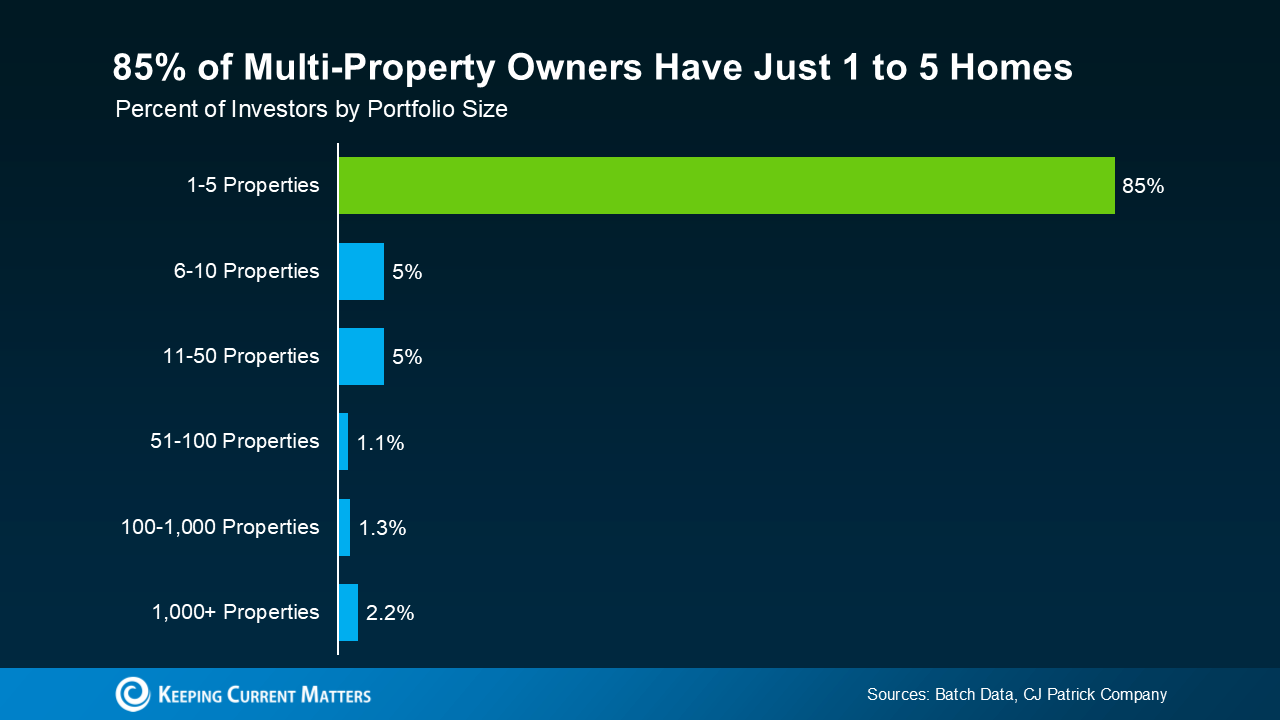

You don’t need to be a real estate mogul to pull this off. In fact, 85% of people who own more than one property only have between 1 and 5 homes. That means folks like your neighbors—maybe even you—are already doing this.

These aren’t mega-landlords. They’re regular people stacking smart financial moves.

Why Now Might Be the Perfect Time to Jump In

Right now, the housing market is shifting in favor of buyers. According to Realtor.com’s Chief Economist, Danielle Hale, buyers have more leverage than they’ve had in years, thanks to:

- More homes hitting the market

- Price cuts

- Slower-moving inventory

If you’re in a market where home prices are expected to rise, buying now could mean big returns later. Whether you rent it out now or sit on it for the long haul, this could be a play that pays off in more ways than one.

You Don’t Need to Go It Alone

If this idea has your wheels turning, your first step is simple: find the right team.

Start with:

- A savvy local real estate agent (🙋♀️ hi, that’s us!)

- A lender who knows the ins and outs of second home financing

These pros can help you dodge mistakes, find hidden gems, and run the numbers to make sure it’s the right move for you.

Ready To Make Your Retirement More Secure?

📞 Call or text us today at 855-935-MORE to get started.