Download the Made 4 More app for the most accurate listings—without your info being sold. Find the best deals with confidence. Get started today!

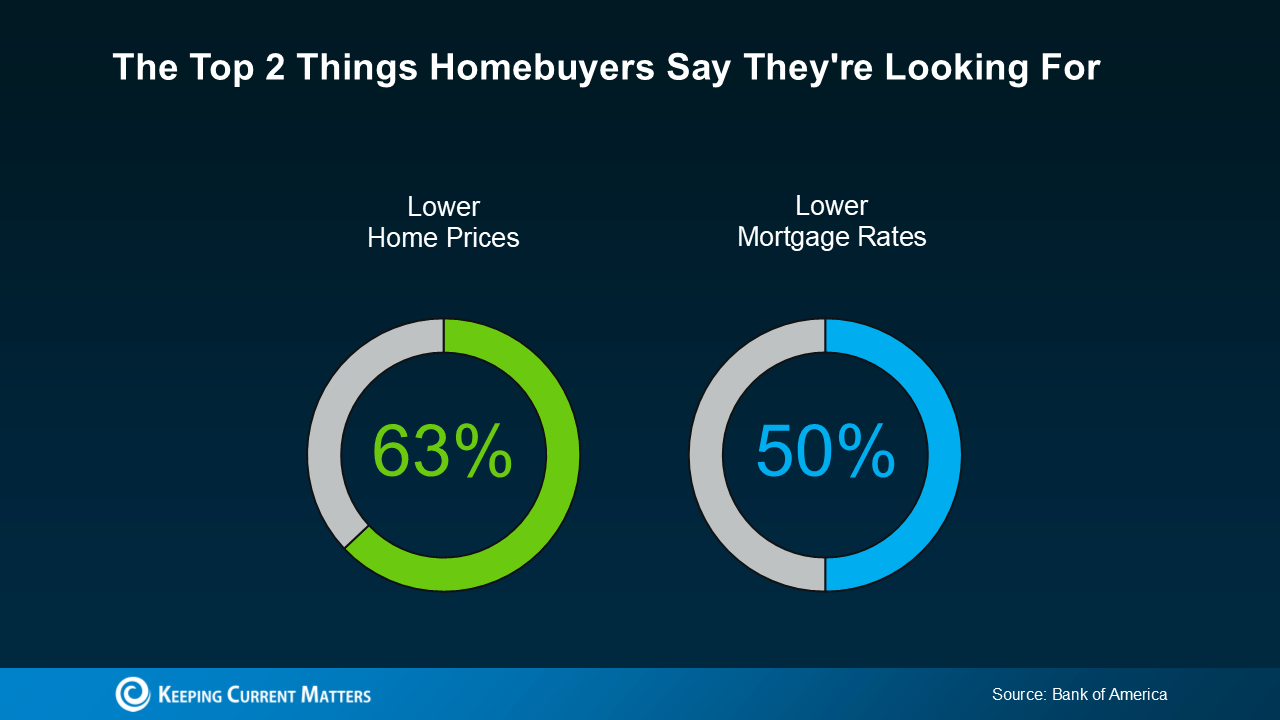

If you’ve been paying attention to what today’s buyers are saying, it all comes down to one thing: affordability. A recent Bank of America survey makes it clear—people want relief when it comes to prices and mortgage rates. And here’s the kicker: the market is actually starting to respond.

Let’s break it down.

Home Prices Are Finally Catching Their Breath

Remember when prices seemed like they were climbing a mountain with no peak in sight? From 2020 to 2021, home values shot up by 20% in just one year. No wonder so many buyers felt priced out!

But here’s the shift: that breakneck pace has slowed down. Experts say we’re looking at single-digit growth this year. That’s way more manageable—and way less intimidating—than the chaos of the last few years.

Now, prices aren’t crashing (so don’t wait around hoping for that), but they’re moderating. Translation? Buyers can actually plan and budget without feeling like they’re chasing a moving target.

Mortgage Rates Are Easing Too

Rates had their moment of making everyone sweat, but lately, they’ve taken a step back. And even a small dip can make a big difference in your monthly payment.

Lisa Sturtevant, Chief Economist at Bright MLS, sums it up perfectly:

“Slower price growth coupled with a slight drop in mortgage rates will improve affordability and create a window for some buyers to get into the market.”

Will rates bounce around a little? Of course. But the big picture is this: rates are expected to stay in the low to mid-6s—and possibly lower if the economy shifts again. That’s a whole lot better than where we were just a few months ago.

Why It All Matters for You

Confidence in the economy may still feel shaky, but when it comes to real estate, the tide is shifting. Prices are moderating. Rates are easing. Both of those changes could be the green light you’ve been waiting for.

If you’ve been on the sidelines, this might be your sign to jump back in before the market makes its next move.