Unlock accurate listings and honest insights with the Made 4 More app—no data selling, just smarter buying. Begin your search with peace of mind now!

If you’re planning to buy a home this year, you’ve probably already thought about your down payment. But here’s the kicker—closing costs can sneak up on buyers like an unexpected dinner bill. Almost everyone knows they’re coming, but not everyone knows what they actually cover, or how much they can swing from state to state. And if you’re an agent, this is exactly the type of conversation that positions you as a trusted guide instead of just a door-opener.

So, What Exactly Are Closing Costs?

Think of closing costs as the “fine print” of homeownership—the extra fees that seal the deal when you finally get the keys. They typically include:

- Loan application and origination fees

- Credit report charges

- Appraisal and inspection costs

- Homeowner’s insurance and title insurance

- Property surveys and attorney fees

In other words, closing costs are the behind-the-scenes crew that makes your home purchase official.

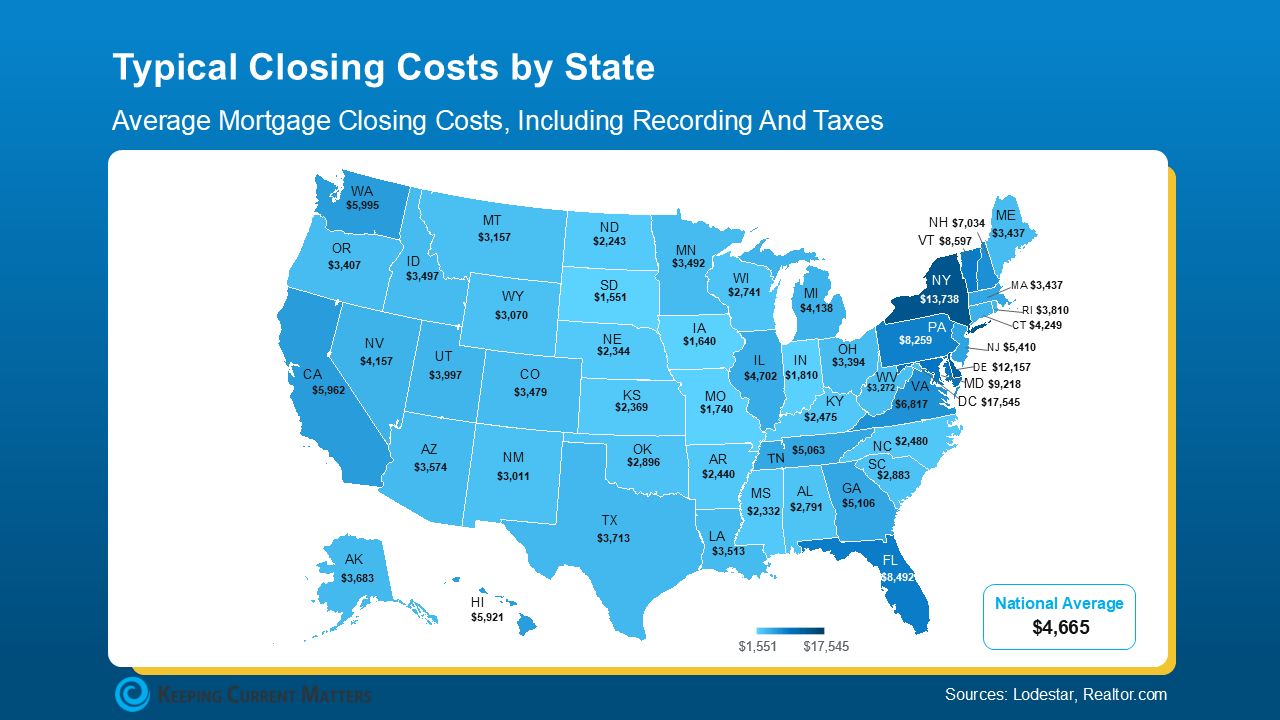

Why Closing Costs Aren’t the Same Everywhere

You’ve probably seen the national average: 2% to 5% of the home’s purchase price. Sounds simple, right? Not so fast. Just like the price of gas or groceries, these costs change depending on where you live. State taxes, transfer fees, local attorney rates, and even the going price of title services can make a big difference.

👉 In some states, you might only shell out $1–3K. In others? You could be staring at $10–15K. That’s not pocket change—and it’s why local expertise matters.

Helping Buyers Take Control

As an agent, this is where you shine. Instead of letting buyers get blindsided, you can guide them through smart strategies, like:

- Negotiating seller credits toward closing costs

- Shopping around for homeowner’s insurance

- Tapping into down payment or assistance programs available in their area

This is how you stop being “just another agent” and start being their go-to advisor. Buyers don’t just want someone who can unlock a house—they want someone who can unlock solutions.

What This Means for Agents

Here’s the real talk: agents who know their stuff about closing costs stand out. While others skim over the details, you can use this knowledge to build trust, win clients, and close more deals. It’s the difference between being replaceable and being unforgettable.

If you’re ready to uplevel your business, help more buyers and sellers, and actually build wealth while you’re at it—why not join a team that equips you with the tools to do just that?

Bottom Line

Closing costs aren’t just numbers on a spreadsheet—they’re an opportunity. An opportunity for buyers to get ahead of the game and for agents to showcase their value. When you know the ins and outs, you don’t just close homes—you close relationships that last a lifetime.