Download the Made 4 More app for accurate, up-to-date listings—without hidden fees or your info being sold. Find the best deals with confidence and start your journey today!

For the last couple of years, buying a home has felt like running a marathon uphill with a backpack full of bricks. Prices soared, mortgage rates jumped, and wages just couldn’t keep up. For many buyers, the dream of homeownership had to be put on hold.

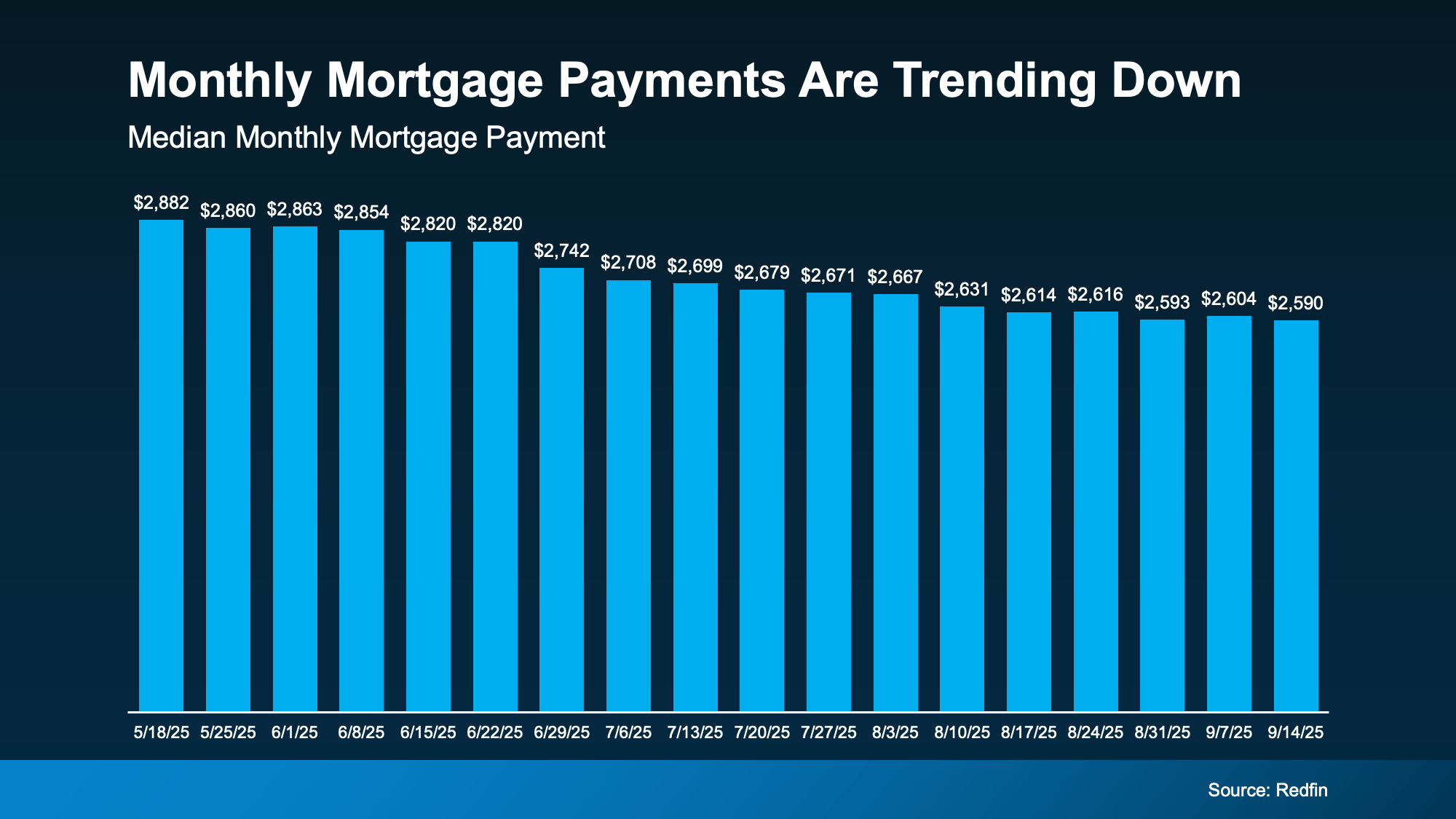

Redfin’s latest numbers reveal that the average monthly mortgage payment has dropped—down roughly $290 compared to just a few months ago.

But here’s the good news: the tide is shifting. If you’ve been waiting on the sidelines, this fall might actually be the window you’ve been hoping for. Let’s break down the three big reasons affordability is finally showing signs of improvement.

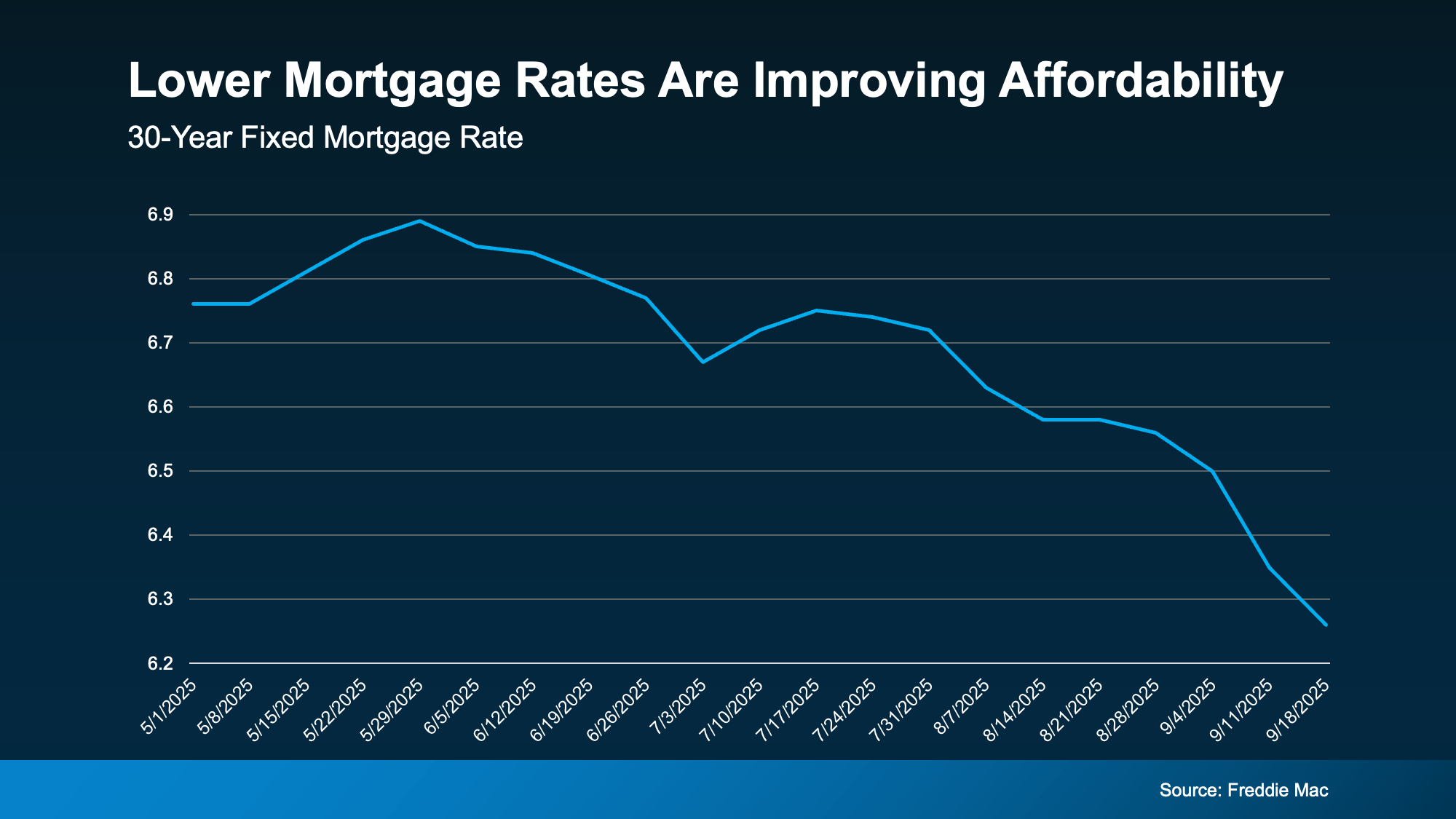

1. Mortgage Rates Are Slipping Downward

Earlier this year, rates were sitting uncomfortably around 7%. Fast-forward to now, and we’re seeing closer to 6.3%. Doesn’t sound like a big deal? Think again. On a $400K mortgage, that small drop could save you around $190 every month. That’s like knocking out your utility bill or gym membership in one swoop.

Even the Mortgage Bankers Association is seeing the ripple effect. Borrower demand has hit the strongest pace since 2022, with purchase applications running more than 20% ahead of last year. Lower rates are helping people get back in the game.

2. Home Price Growth Is Cooling Off

After years of sprinting upward, home prices are finally catching their breath. Instead of double-digit increases, we’re seeing growth in the low single digits—and in some markets, prices are even dipping.

For buyers, this makes budgeting and planning so much easier. You’re not chasing a moving target anymore. Think of it like finally being able to buy those concert tickets without worrying the price will jump $100 while you’re still deciding.

3. Wages Are Rising Faster Than Prices

Here’s a twist: paychecks are growing at about 4% annually, outpacing home price growth. Translation? Your hard work is actually stretching further right now than it did just a year ago.

According to NAR’s Chief Economist, buyers are in a stronger spot because wage growth is outpacing home costs. It’s not a total game-changer, but it gives you just enough edge to make homeownership a little more attainable.

So, What Does This Mean for You?

Combine lower mortgage rates, cooler prices, and rising wages, and suddenly the math doesn’t look quite as scary. Redfin even reports the typical monthly payment is about $290 less than it was earlier this year. That’s real money back in your pocket.

If you’ve been waiting for the right moment, this fall might be the season to turn “someday” into “move-in day.”

Bottom Line

Housing affordability isn’t perfect, but it is improving—and for buyers who’ve been waiting, that shift could be the green light you’ve been hoping for.