Stay ahead with accurate data you can trust—download the Made 4 More app for the most reliable listings without your info being sold.

You’ve probably seen the headlines: “Foreclosures are on the rise!” Sounds scary, right? But before you start thinking we’re headed for another 2008-style crash, let’s hit pause and look at what’s really going on. Spoiler: the sky isn’t falling.

A Quick Look Back vs. Today

During the housing crash (2007–2011), over 9 million homeowners lost their homes in distressed sales. Compare that to just 300,000 last year. Big difference, right? Even though foreclosures have ticked up recently, we’re nowhere near the levels of the crash.

Why Delinquencies Matter

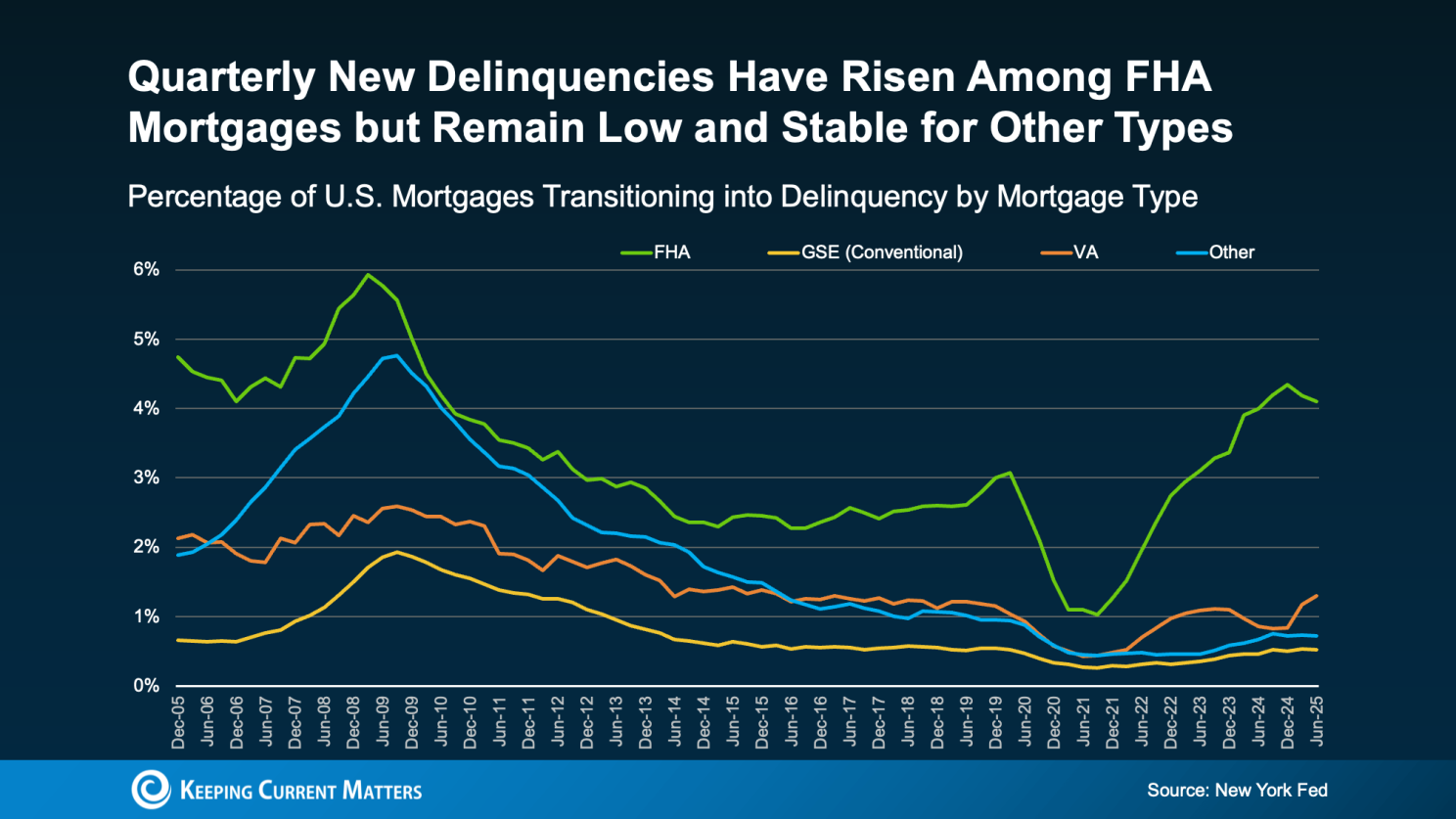

Think of mortgage delinquencies (loans more than 30 days late) as a “check engine” light for the housing market. If they surge, foreclosures might follow. Right now? That warning light is barely flickering.

Industry data shows overall delinquency rates are flat compared to last year. Yes, FHA loans are seeing more missed payments—but the bigger picture is steady and strong. Back in 2008, every type of loan was in trouble. Today, most are solid.

Why FHA Borrowers Feel It More

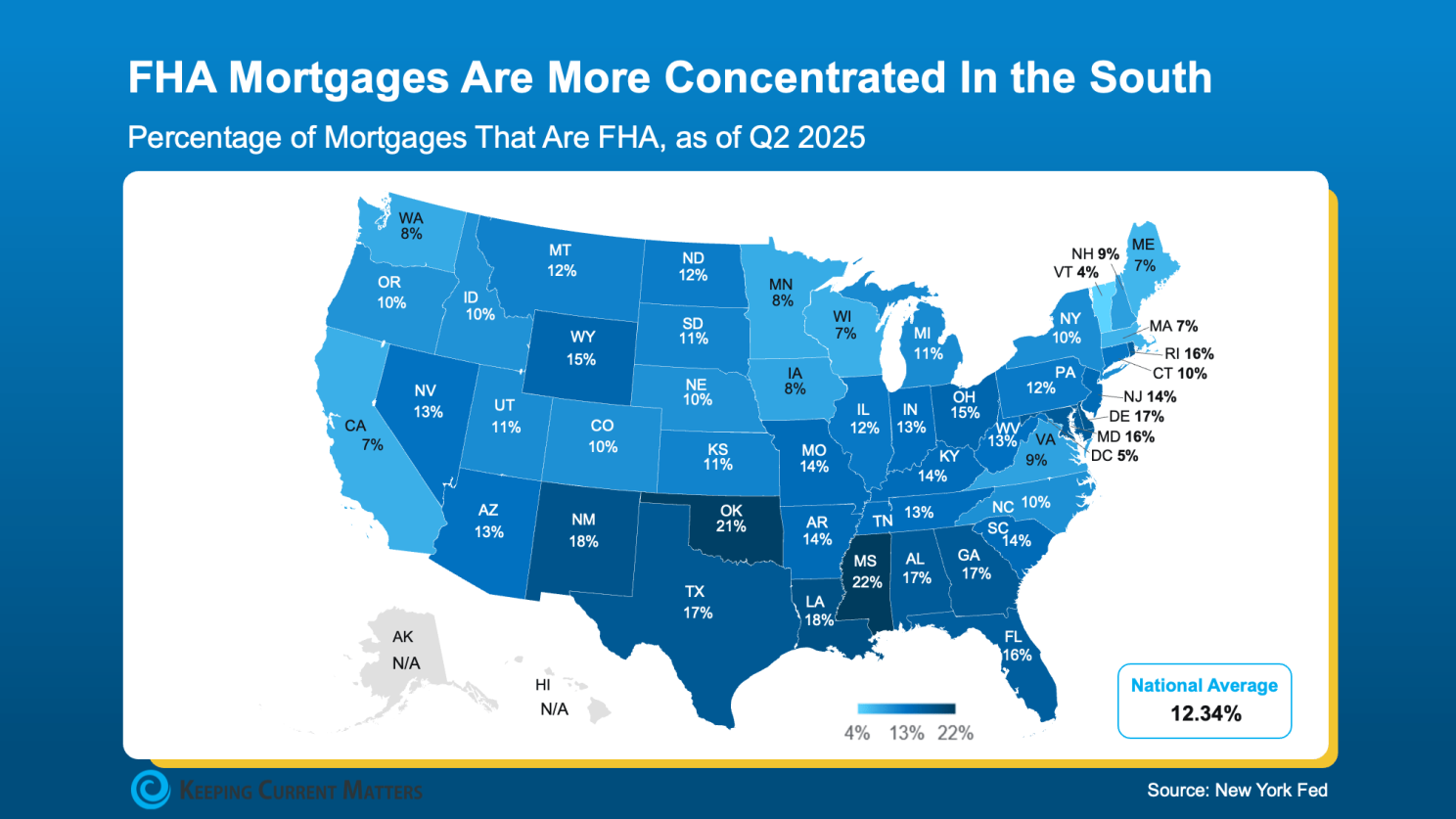

FHA borrowers often have smaller down payments, which means they can feel economic shifts—like inflation or job changes—more sharply. That’s why we’re seeing higher delinquencies there. But here’s the kicker: FHA loans make up only about 12% of mortgages nationwide. And while some regions (like the South) rely on FHA loans more heavily, this still isn’t a red flag for a national crash.

Stronger Foundations Than 2008

Unlike the shaky lending practices before the crash, today’s mortgage market is built on rock, not sand. Borrowers have more equity than ever, and stricter lending standards keep the market healthier. Even if some homeowners struggle, many can sell before foreclosure because they’ve built up serious value in their homes.

If You’re Feeling the Pressure

Behind every headline are real people—and foreclosure is tough. If you’re struggling, the first step is to contact your lender. You may be able to set up a repayment plan, refinance, or explore other options. And remember, with today’s high equity levels, selling before foreclosure is often a smart way to move forward without losing everything.

The Bottom Line

Yes, foreclosures are rising slightly, but this is nothing like 2008. Mortgage delinquencies aren’t flashing red lights—they’re showing us a stable market with a few bumps in the road.

So, no, a foreclosure tsunami isn’t around the corner.