✨ Think a big down payment is the only way in? Think again. Get the facts, skip the stress, and download the Made 4 More app for the most accurate listings!

Buying a home should be exciting, not overwhelming. But the moment "down payment" pops up, that excitement tends to get hijacked by anxiety. You start thinking, "Do I need $50,000 in cash?" or "Is homeownership even possible for me right now?"

If you’ve been feeling that way, you’re not alone. But here's the good news: Most of what you think you know about down payments is probably wrong. Let’s bust some myths and show you why buying your first (or next) home might be closer than you think.

Myth #1: You Need a 10% (or More) Down Payment to Buy a Home

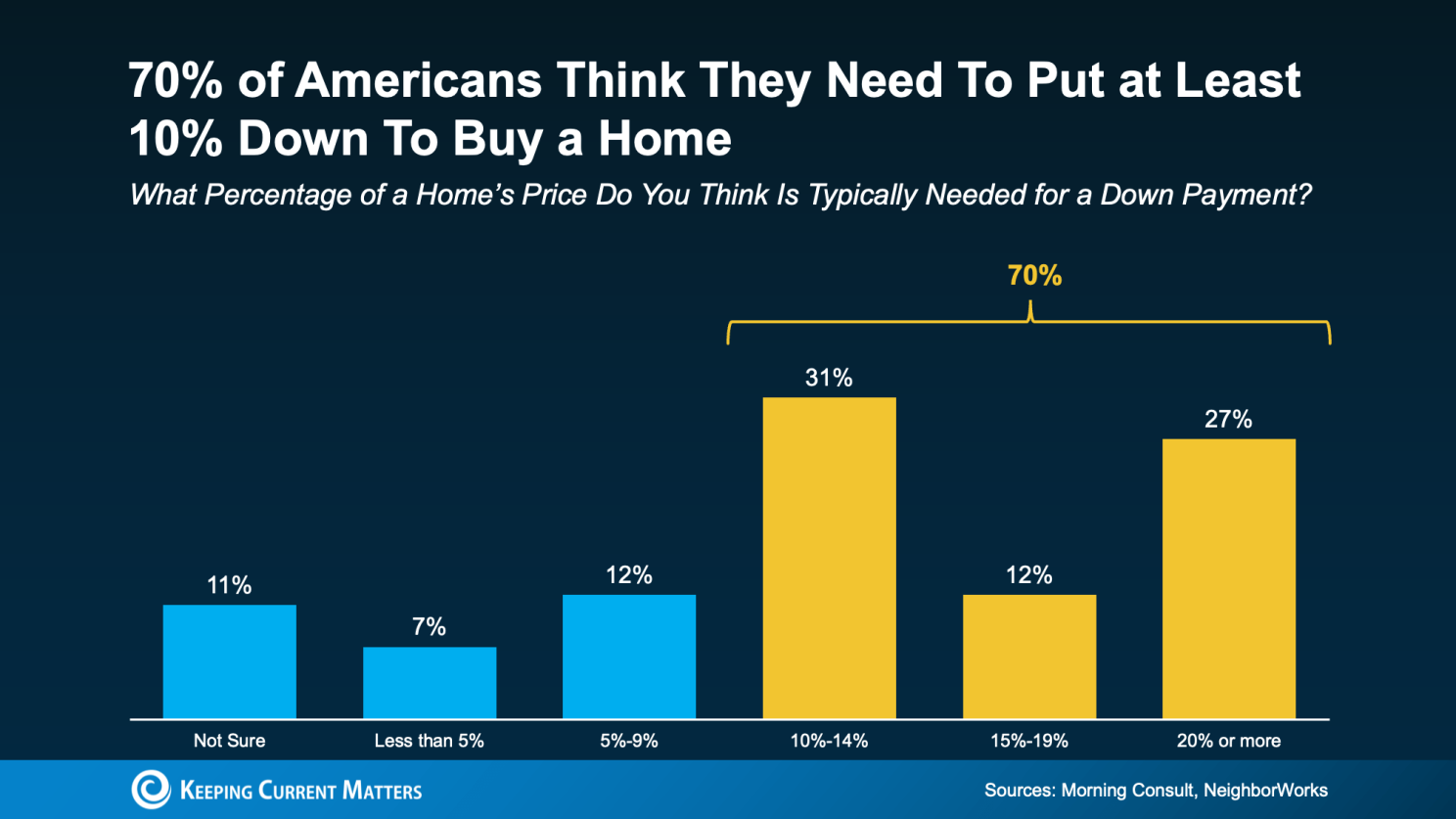

Let’s get this out of the way first. A staggering 70% of Americans still believe you need to put at least 10% down to buy a home. And 11% don’t even know what’s required.

But here’s the truth: According to the National Association of Realtors, the average down payment for first-time buyers has been between 6% and 9% for years. And depending on your loan type, it could be even less:

- FHA loan? Only 3.5% down.

- VA loan? Often $0 down.

Translation? That dream home may not be as far out of reach as you thought.

Myth #2: It Takes Forever to Save for a Down Payment

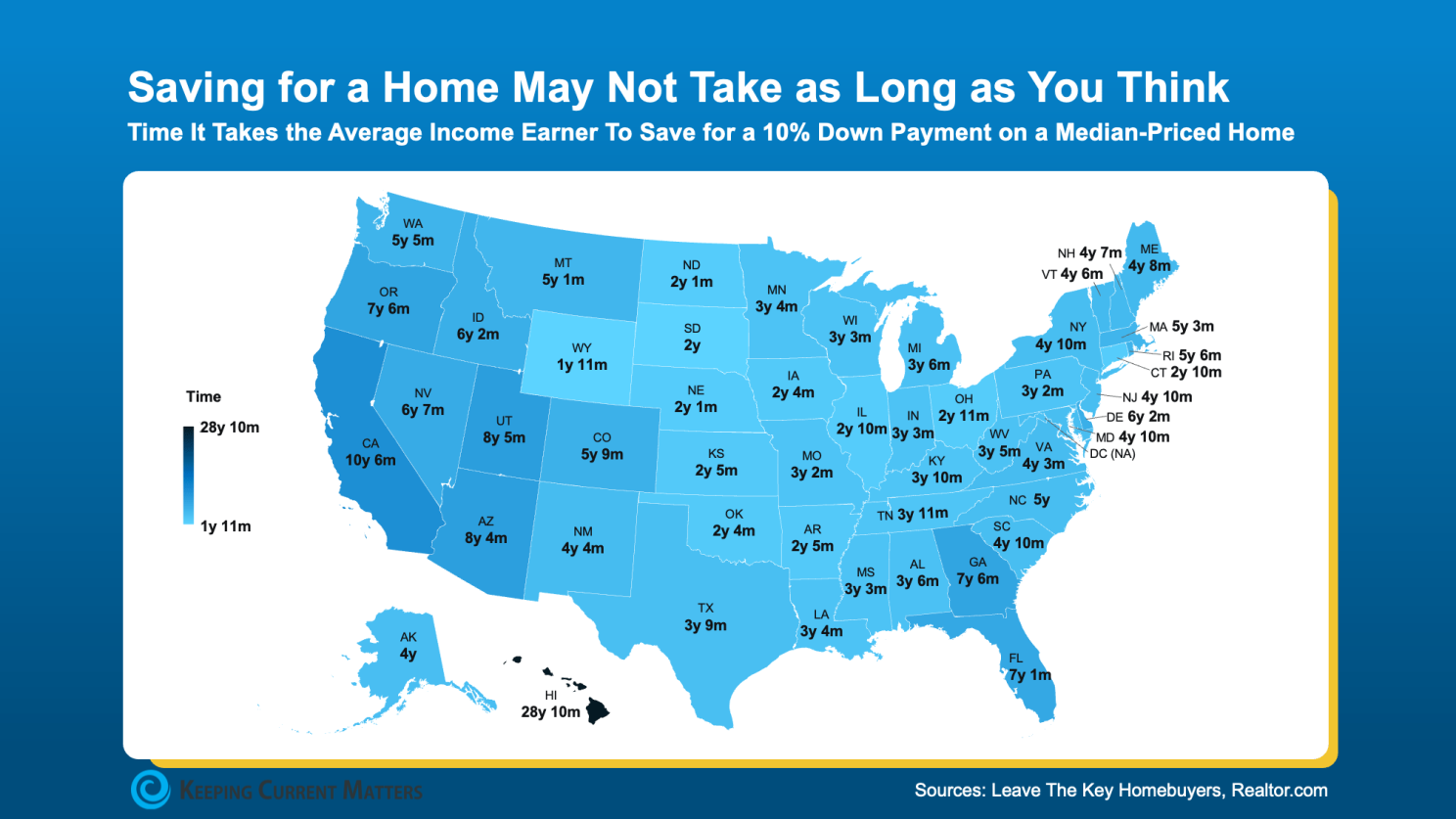

We get it—saving can feel like an uphill battle, especially with rising rent, gas, and grocery bills. But the time it takes to save up varies by state, and in many areas, it can happen quicker than expected.

Here’s another thing: you probably don’t need to save 10%. And depending on your income and budget, a realistic savings plan can move you into homeownership sooner than you imagined. It’s not about giant leaps—it’s about consistent steps in the right direction.

Myth #3: You Have To Do It All On Your Own

This one trips up more buyers than anything else. Think you need to fund your entire down payment solo? Think again.

There are thousands (yep, thousands) of down payment assistance programs across the country. These are designed for people just like you—ready to own, just needing a little help getting started.

Still not convinced? A recent study shows 39% of Americans don’t even know these programs exist. That means a lot of buyers are leaving free money on the table.

As Miki Adams from CBC Mortgage Agency puts it: “With high interest rates and soaring home prices, down payment assistance is more essential than ever.”

The Bottom Line

You don’t need to be rich, wait forever, or go it alone to buy a home. You just need the right game plan and someone to guide you.

Let’s chat about how close you really are to homeownership—and what programs could help get you there faster than you thought.