Don’t let outdated info or surprise costs hold you back from homeownership. Download the Made 4 More app for access to accurate listings, honest pricing, and no strings attached—so you can buy smart and move with confidence!

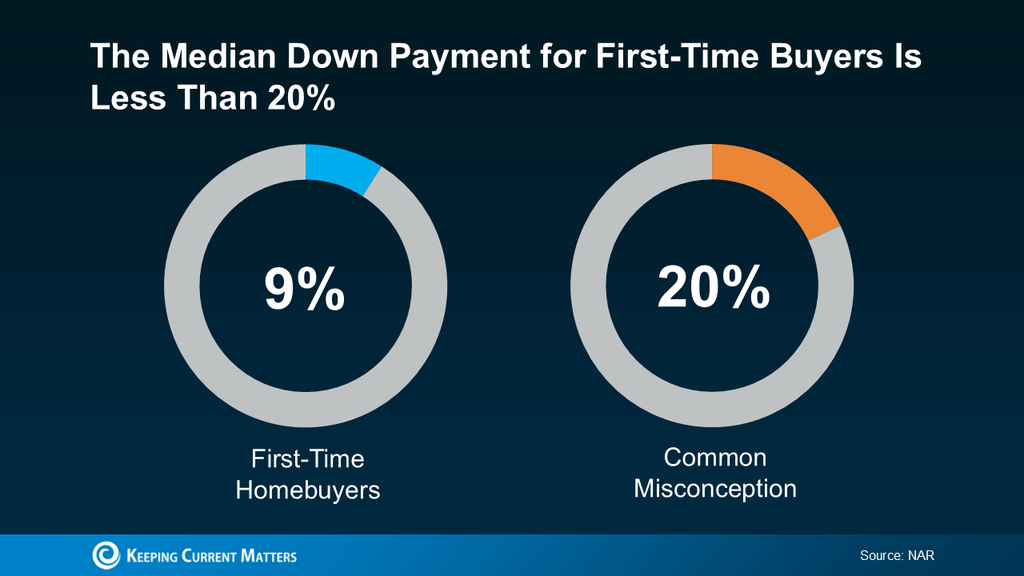

Think you need 20% down to buy a house? You're not alone—and you're also not right. For first-time homebuyers, that myth can feel like a financial mountain. But here’s the truth: you probably don’t need nearly that much.

You Don’t Need 20% – Here’s Why

Unless your lender or specific loan program says otherwise, there’s a good chance you can buy a home with a lot less down. FHA loans let you get in the door with as little as 3.5% down. If you're a Veteran or buying in a rural area, VA and USDA loans might even let you skip the down payment entirely. So that 20% "requirement"? It’s more of a rumor than a rule.

In fact, the National Association of Realtors says the median down payment for first-time buyers is just 9%. That’s a far cry from 20%. And if you're wondering whether that small of a down payment will hurt you—don't stress. Sure, more money down can mean lower monthly payments, but getting into a home sooner can help you start building equity and wealth right away.

Down Payment Assistance Is the Best-Kept Secret in Real Estate

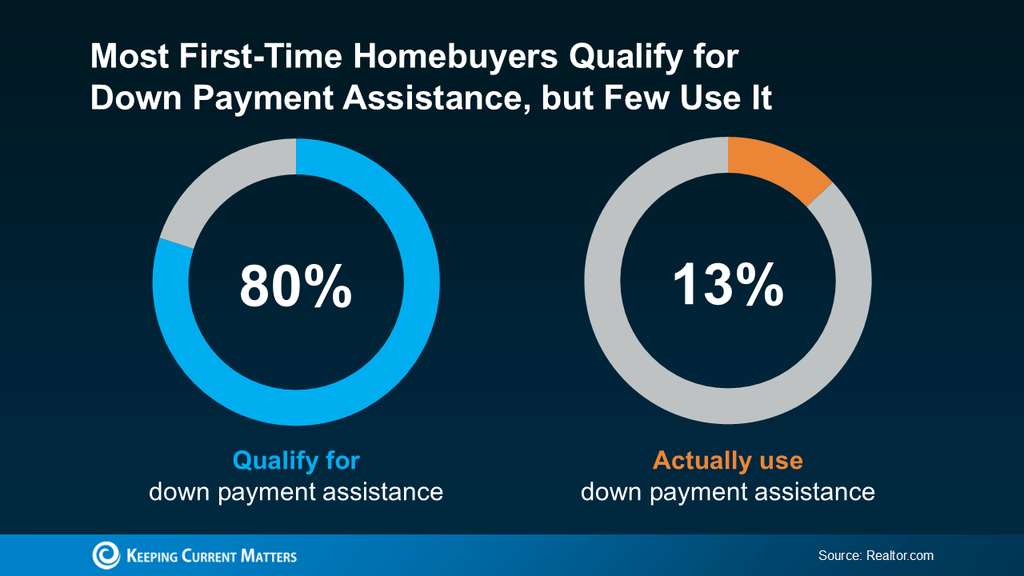

Here’s where things get even better: almost 80% of first-time buyers qualify for down payment assistance (DPA), but only about 13% actually use it. That’s a massive missed opportunity!

Some DPA programs offer thousands—yes, thousands-to—to help you cover your down payment or closing costs. The average benefit is around $17,000, according to Down Payment Resource. And in many cases, you can stack multiple programs together for even more help.

Think of DPA as a boost to your savings or a shortcut to get into a home faster. If you’ve been putting off buying because you think you need to save for years, it’s time to rethink your strategy.

You don’t need 20% down to become a homeowner. With the right loan program and help from down payment assistance, you could be closer than you think to holding the keys to your first home.

Want to know what you qualify for? Call or text us at 855-935-MORE and let’s talk through your options.