Stop overpaying because of outdated listings or sneaky fees. The Made 4 More app gives you the most accurate home data—without selling your personal info. Find real deals, fast. Download now and start your search with confidence!

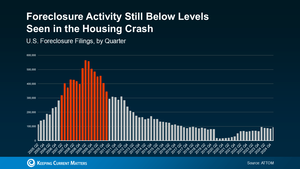

It’s easy to panic when headlines scream about rising foreclosure filings—especially when everything else in your budget is feeling tighter than ever. But before your 2008 flashbacks kick in, let’s set the record straight: today’s foreclosure numbers aren’t a warning sign—they’re a market correction, not a meltdown.

Facing the Foreclosure Hype: What’s Really Going On?

Yes, foreclosure filings are up compared to last year. But context matters. We’re still sitting well below historical averages and light-years away from the flood of foreclosures we saw during the Great Recession.

Why? Because the market we’re in today is nothing like 2008. Back then, loose lending standards handed out risky loans like candy. Homeowners were underwater with zero equity and no way out. It was a perfect storm—and it wrecked a lot of lives.

This Time? Totally Different Story.

✅ Lending is tighter.

Buyers now go through way more hoops to get approved. That means fewer people are in homes they can’t actually afford.

✅ Homeowners have equity.

Thanks to years of rising home prices, most homeowners are sitting on serious equity. That gives them options, like selling, before foreclosure ever becomes a reality.

✅ 2020-2021 data was distorted.

Let’s not forget: foreclosure bans were in place during the pandemic, which temporarily froze filings. So yes, numbers look “up” now—but only compared to that artificial low.

Here’s the Real Market Snapshot

When you stack up today’s data next to the mess from 2008, it’s not even close. We’re talking apples vs. rotting bananas. Even compared to more “normal” years like 2017-2019, foreclosure filings today are still lower. This isn’t the beginning of a crash—it’s a return to a more balanced market.

Homeowners Still Have the Upper Hand

Even those in foreclosure aren’t in the same boat as 2008. Many can sell and walk away with cash in hand. That’s thanks to strong equity positions built up over the last few years. As Rob Barber from ATTOM puts it, equity is the cushion keeping the market stable—even when times get tough.

This Isn’t a Crisis. It’s a Correction.

Rising foreclosures don’t equal a housing collapse. Most homeowners today are better protected, more financially sound, and sitting on assets that can help them pivot if life throws them a curveball.

So, if you’ve been spooked by headlines or sitting on the sidelines waiting for the sky to fall, it’s time to take a breath—and maybe even take a step forward.

Want the full picture—not just the panic?

Call or text us at 855-935-MORE to get expert insight on what today’s market really means for your homeownership goals.