Have you been watching mortgage rates lately? It’s like they’re channel surfing—one minute they dip, the next they spike again. And if you’re thinking about buying a home, this financial seesaw can feel like a total head game.

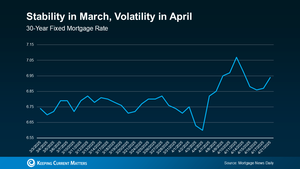

You’re not imagining it. After a pretty chill March, April’s rates have been all over the place. (Cue the roller coaster sound effects.)

But here’s the thing: trying to time the market is like trying to guess when gas prices will hit their lowest. You’ll drive yourself nuts—and probably miss out on a good opportunity.

So, what can you actually do when mortgage rates won’t sit still? More than you think.

You Can’t Control the Market, But You Can Control Your Moves

Rates may be out of your hands, but that doesn’t mean you’re powerless. You still have control over the three biggest levers that affect your rate: your credit score, loan type, and loan term. Think of it as adjusting your own sails while the wind does its thing.

-

Credit Score: Your Power Tool for Better Rates

Let’s keep it real—your credit score is like your financial reputation. And when it comes to mortgage rates, it can seriously work in your favor (or against you).

Even a small boost in your score could save you hundreds a month on your mortgage payment. That’s no joke. Lenders see a high score and offer better deals. A low score? Not so much.

👉 Pro tip: Not sure where your score stands? Talk to a solid loan officer. They’ll give you the lowdown—and tell you how to level up fast.

-

Loan Type: One Size Doesn’t Fit All

Conventional, FHA, USDA, VA… no, it’s not alphabet soup—it’s your menu of loan options. Each one comes with different perks and requirements.

For example, VA loans often have great rates and no down payment for qualified veterans. FHA loans? Great for first-timers. USDA loans? Yep, even better if you’re buying in rural areas.

👉 Moral of the story: Don’t just settle for the first loan you hear about. Shop around. Talk to a few lenders. Find out what’s really right for you.

-

Loan Term: 15, 20, or 30 Years? Choose Wisely

Here’s another secret sauce to your mortgage rate—the length of your loan. A shorter term usually means a lower rate, but a higher monthly payment. A longer term? Easier on your wallet each month, but you’ll pay more in interest over time.

It’s all about balance. Think of it like choosing between a sprint and a marathon. Do you want to be done sooner, or stretch it out and breathe a bit easier along the way?

👉 Your loan officer can help you weigh the pros and cons and pick the one that fits your life.

Focus On What You Can Control

You can’t change where the market’s going. But you can prepare yourself to score the best rate possible when the time is right. Get your credit in shape, explore your loan options, and choose a loan term that fits your budget and timeline.

And whatever you do—don’t go it alone. Reach out to a real estate pro and a trusted lender who can guide you through it all.

Want personalized help navigating the rate rollercoaster?

📞 Call or text us at 855-935-MORE and let’s talk strategy.

Don’t let bad data or hidden fees cost you your dream home!

Download the Made 4 More app for the most accurate listings—without your info being sold.

Find the best deals with confidence. Get started today!