If you’ve been holding off on buying a home, hoping mortgage rates will drop significantly, you might be waiting longer than expected. Experts predict that while rates may decline slightly, they won’t dip as low as many buyers hope. The good news? You don’t have to wait. There are smart financing options that can make homeownership affordable right now.

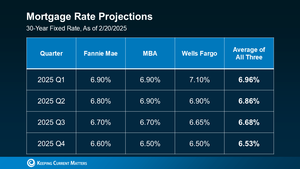

Will Mortgage Rates Drop Anytime Soon? A few months ago, forecasts suggested mortgage rates could fall below 6% by the end of the year. However, updated projections from Fannie Mae, the Mortgage Bankers Association (MBA), and Wells Fargo indicate that rates will likely settle between 6.5% and 7% instead.

So, if you’re delaying your home purchase in hopes of a dramatic drop, you might be in for a long wait. And if life changes—like a new job, a growing family, or a relocation—require you to move sooner rather than later, waiting might not be an option.

Instead of sitting on the sidelines, let’s explore creative ways to make buying a home more affordable in today’s market.

Alternative Financing Solutions to Buy a Home Now Since rates may not fall as much as anticipated, it’s time to get strategic. Here are three financing options to consider that could help you buy a home now instead of waiting.

-

Take Advantage of Mortgage Buydowns

A mortgage buydown lets you pay an upfront fee to temporarily reduce your mortgage rate. This means lower monthly payments in the early years of your loan, which can be a game-changer if you need a bit of breathing room in your budget.

In fact, 27% of real estate agents report that first-time homebuyers are requesting buydowns from sellers to make homeownership more attainable. If you’re serious about buying, this could be a great negotiation strategy.

-

Consider Adjustable-Rate Mortgages (ARMs)

Adjustable-rate mortgages typically start with lower interest rates than 30-year fixed loans, making them an attractive option in today’s higher-rate environment. If you plan to refinance in the future when rates drop or move before the rate adjusts, an ARM could save you money upfront.

Worried about risky loans from the past? Don’t be. Modern ARMs are different from the ones that contributed to the 2008 housing crisis. Today’s lenders verify your income, assets, and ability to pay beyond the initial rate period, making ARMs a safer and more structured option.

-

Explore Assumable Mortgages for Lower Rates

An assumable mortgage allows buyers to take over the seller’s existing loan—including their lower interest rate. This can be a huge advantage, especially considering that 11 million homes qualify for this option according to U.S. News. If you find a seller with a lower locked-in rate, assuming their mortgage could save you thousands over time.

Final Thoughts: Don’t Wait—Explore Your Options Today Waiting for mortgage rates to drop significantly may not be the best strategy. Instead, explore financing options like buydowns, ARMs, or assumable mortgages to make homeownership possible right now. Connect with a trusted lender to find out what works best for you.

📞 Call or text us at 855-935-MORE to get started on your homeownership journey today!

🔎 Looking for the most motivated sellers in your area? Get ahead in your home search—download the Motivated Seller Index today!

📲 Don’t let bad data or hidden fees cost your dream home! Download the Made 4 More app for the most accurate listings—without your info being sold. Find the best deals with confidence. Get started today!