📲 Don’t miss out on today’s lower rates because of outdated info or sneaky fees!

Download the Made 4 More app for the most accurate, up-to-date home listings—with zero spam and no strings attached.

Lock in the best deal with confidence. Start your home search today!

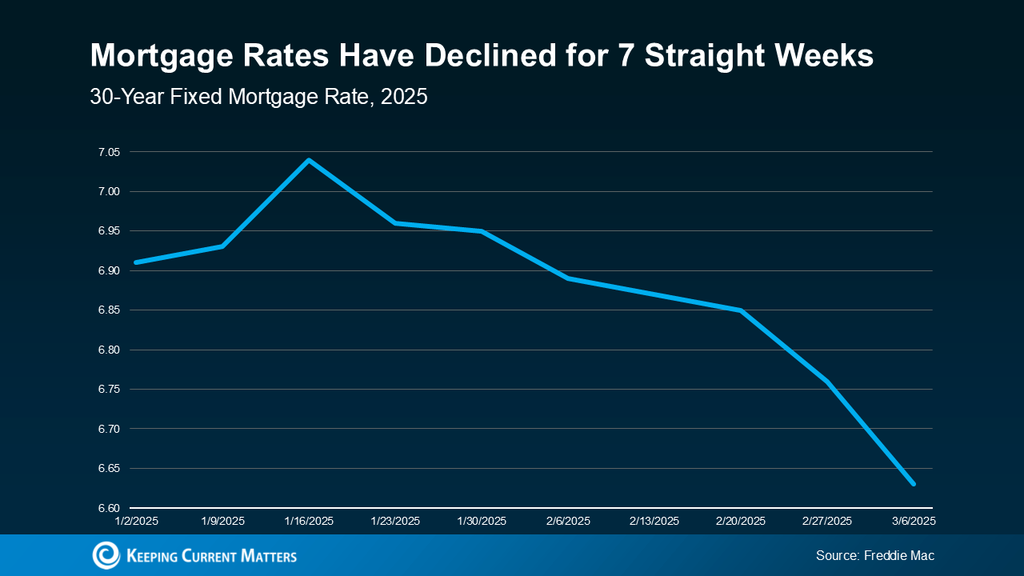

If high mortgage rates had you hitting pause on your home search, now’s the time to hit play. After seven straight weeks of decline, rates just hit their lowest point of the year—and that’s a big deal for your wallet and your future.

📉 Mortgage Rates Are Finally Trending Down

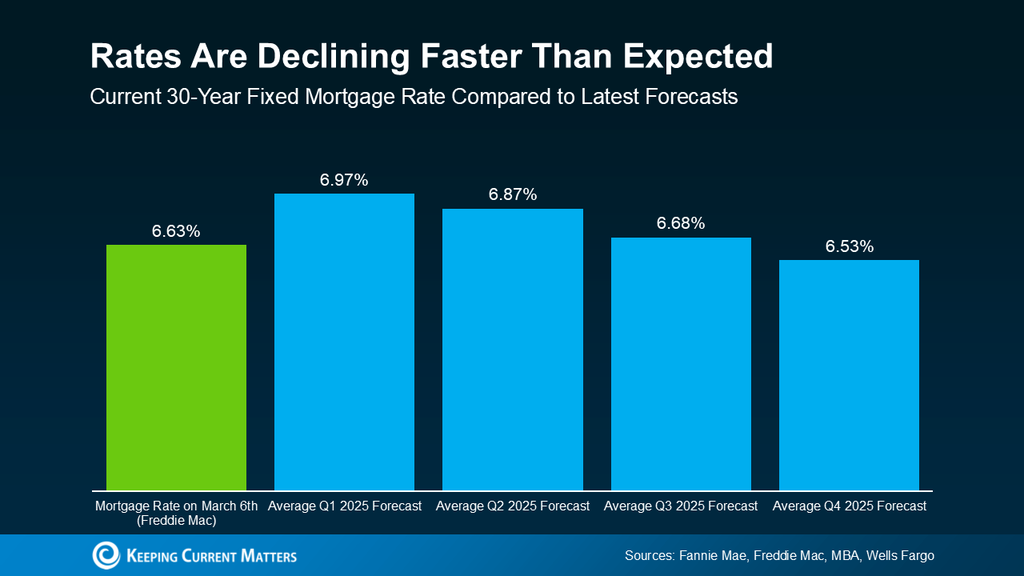

According to Freddie Mac, the average 30-year fixed mortgage rate has dropped from over 7% to the mid-6% range. That’s a major shift—and it’s happening earlier than experts expected. Most projections had this dip landing sometime in Q3, but here we are, mid-year, already seeing it.

Why the sudden slide? Uncertainty in the economy and the impact of new tariffs are contributing to the shift. Joel Kan of the Mortgage Bankers Association summed it up perfectly:

“Mortgage rates declined last week on souring consumer sentiment regarding the economy and increasing uncertainty over the impact of new tariffs. Those factors resulted in the largest weekly decline in the 30-year fixed rate since November 2024.”

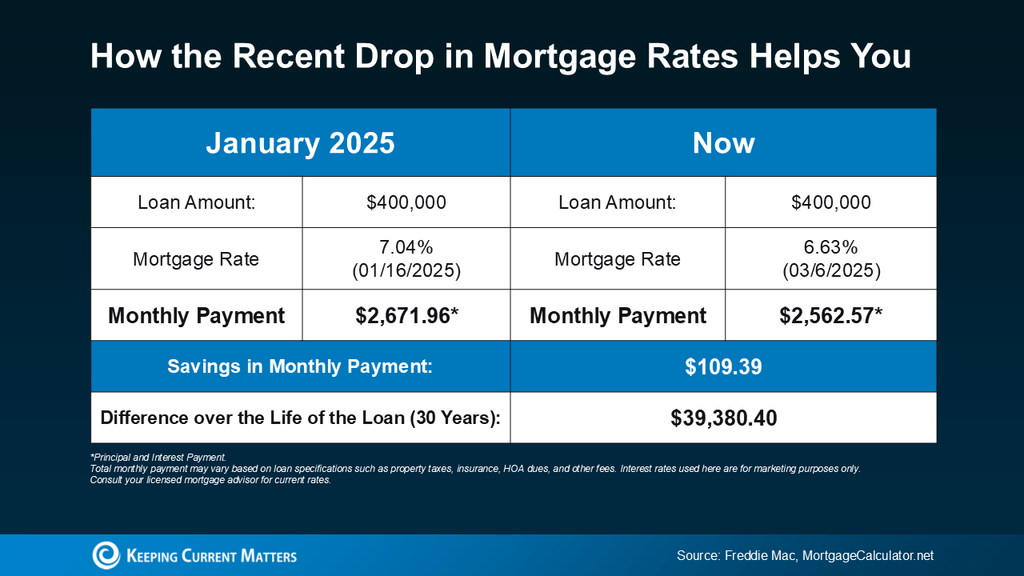

💡 Why This Rate Drop Matters to You

Let’s talk numbers. Say you’re looking at a $400,000 home loan. If you locked in a rate back in January at 7.04%, your monthly payment would have been a lot higher than it is today. Now that rates have dipped into the mid-6’s, your payment could be over $100 less every month.

That’s over $1,200 a year back in your pocket. For many, that savings could mean more breathing room—or the chance to qualify for a better home altogether.

⚠️ Rates Won’t Stay This Low Forever

Here’s the kicker: rates are volatile. They’ve come down fast, but that also means they could climb again just as quickly. If you’ve been sitting on the fence, waiting for a “better time” to buy, this could be your window. Don’t let it close before you make your move.

📦 Bottom Line

Mortgage rates just hit their lowest point of the year, giving buyers a rare break in an otherwise high-cost market. If you’ve been holding off, now may be the moment to jump back in and take advantage of lower monthly payments and increased buying power. The market won’t wait—neither should you.

📞 Ready to make your move? Call or text us at 855-935-MORE. We’ll help you lock in the best opportunity while it lasts.