🚫 Say Goodbye to Junk Data and Hidden FeesWith mortgage rates dipping, now’s your chance to find your dream home—and you need the best tools to do it. Download the Made 4 More app for the most accurate, up-to-date listings without the hassle of your personal info being sold. Search smart. Buy confidently. Start today!

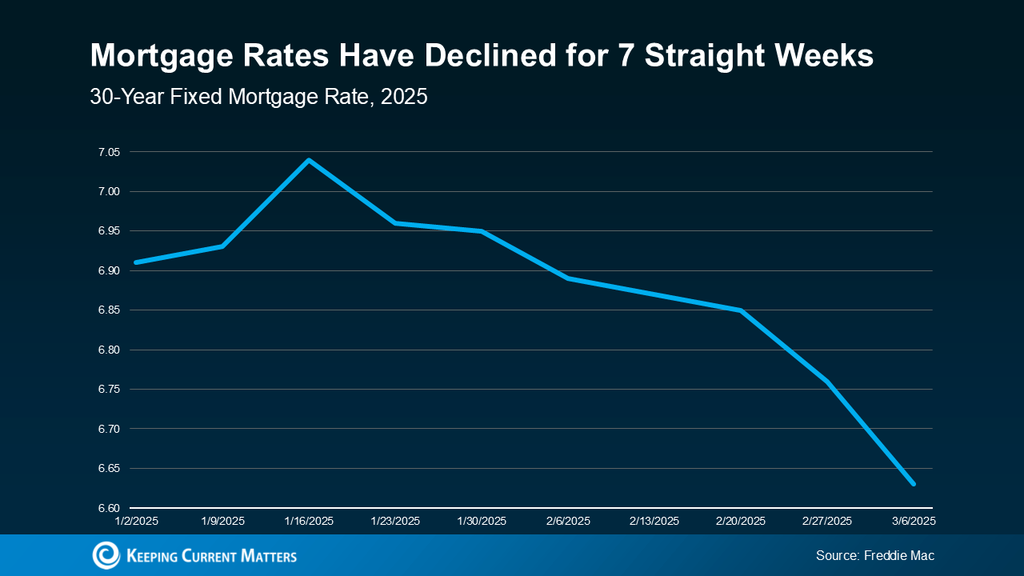

If you've been sitting on the sidelines waiting for mortgage rates to cool down, good news: they're finally starting to! After climbing over 7% earlier this year, rates have dropped for seven straight weeks, landing in the mid-6% range—the lowest point we've seen in 2025.

Why the Drop Matters (a Lot)

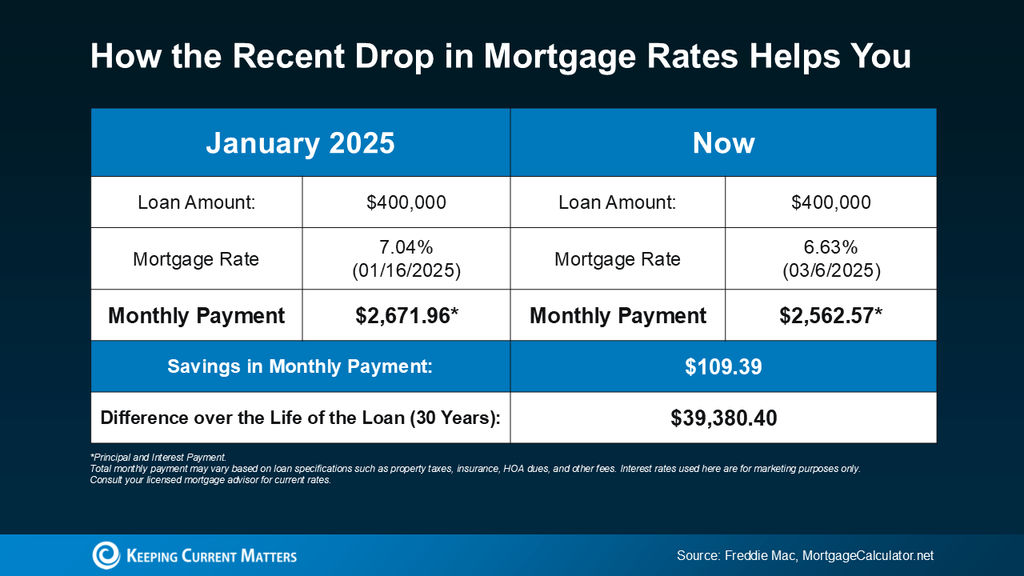

When mortgage rates drop, your buying power goes up—simple as that. Even a small rate dip can mean hundreds saved each month on your mortgage payment. Picture it like this: if you were looking at a $400K loan at 7.04%, you’d be paying about $100 more every single month than you would now. Over a year, that’s over $1,200 back in your pocket.

What’s Causing the Slide in Rates?

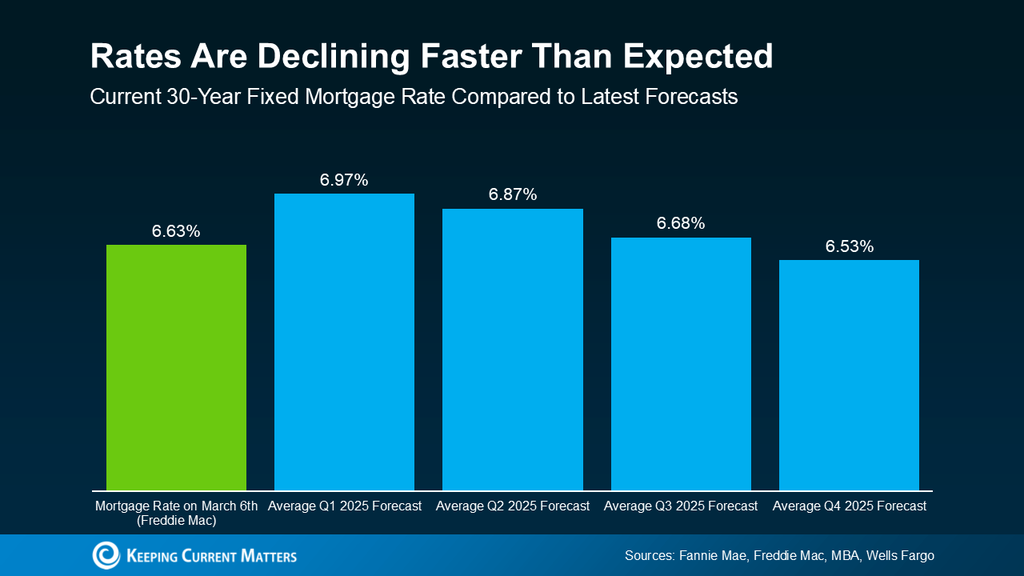

According to the Mortgage Bankers Association, it’s a mix of consumer concern about the economy and uncertainty surrounding new tariffs. Translation? Wobbly economic vibes are working in your favor—at least for now. Rates fell more quickly than experts predicted, and some thought we wouldn't see this kind of relief until late summer.

Why This Could Be Your Sweet Spot

Mortgage rates are notoriously jumpy. They can swing fast based on headlines, inflation, or even investor mood. So while today's rates are giving buyers some much-needed breathing room, there's no guarantee how long this window will stay open.

If you've been waiting for a sign, this might be it.

A Realtor’s Time to Shine

For agents, this is the kind of shift that creates real momentum. Buyers who were previously priced out are back in the game, and sellers are more willing to list knowing there’s fresh interest. If you’ve been working your pipeline, now’s the time to re-engage your leads and remind them that buying today could mean serious monthly savings.

Want to attract more buyers? Educate them on the math, show them what their new monthly payments could look like, and help them act before rates swing back up.

Mortgage rates are down—and that’s a rare and powerful opportunity. Whether you’re a buyer looking to get more for your money or an agent ready to boost your closings, this is the moment to move.

Call or text us at 855-935-MORE and let’s talk about how you can take advantage of today’s market momentum to get top dollar for your home. With the right strategy—and the right team—you can sell for more and stress less.